ATLANTA — Jason Nettles, managing director at Northmarq’s Atlanta office, is well-versed on the recent history of U.S. apartment deliveries, knowledge that came in handy for launching discussion among developers at the 16th annual InterFace Multifamily Southeast conference. Nettles moderated a panel of five regional developers, all of whom also share keen awareness of just how much new multifamily product U.S. markets — particularly those in the highly desirable Sun Belt regions — have added in recent years. In these areas, supply growth is both a dominant narrative on the surface of the multifamily development scene and an invisible hand that guides business decisions behind that scene. Massive blips in supply, whether positive or negative, impact key facets of underwriting, including rent growth assumptions and concessions, as well as financing terms on both the debt and equity sides of the capital markets. Those figures and assumptions must then be evaluated against hard costs of development, which as a rule do not decline over time, but rather grow at varying paces. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. All …

Features

By Cliff Booth, founder & chairman, Westmount Realty Capital Shallow bay industrial, often defined as product with suites between 2,000 and 30,000 square feet, has proven to be a resilient and attractive commercial real estate investment for the past four decades. Today, a combination of persistent tenant demand, flexible space configurations, favorable lease structures and limited new supply continues to drive investor interest in this subcategory of industrial product, including increased institutional capital flows. Shallow bay industrial remains a standout in commercial real estate portfolios — here’s why. Consistent Tenant Demand, Diversification Shallow bay industrial properties cater to a broad spectrum of users, ranging from local contractors and logistics providers to regional distributors and e-commerce firms. These tenants are drawn to highly functional suites that support frequent changes in business operations, from manufacturing to last-mile delivery. Research from JLL shows that over the past decade, the annual average leasing volume in the shallow bay category has been about 250 million square feet, evidencing stable demand through multiple economic cycles. The multi-tenant structure of shallow bay buildings reduces single-tenant risk and enhances asset stability. A project might host five to 50 tenants, with no single occupant accounting for more than 10 percent …

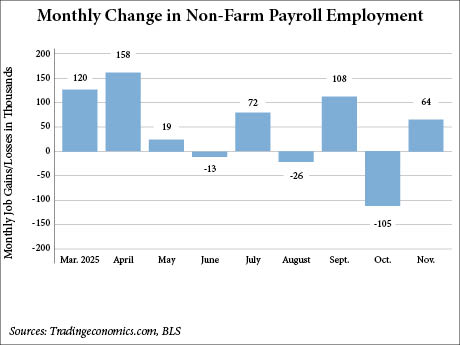

WASHINGTON, D.C. — The U.S. economy has added 64,000 non-farm payroll jobs in November and lost 105,000 jobs in October, according to the U.S. Bureau of Labor Statistics (BLS). The BLS included the October figures into the November report due to complications with the federal government shutdown, which lasted for 44 days in October and early November. The bureau, which also delayed the release of the consumer price index and producer price index in October, plans to release the December jobs report on Jan. 9, 2026. The November figure was higher than the 45,000 estimate from Dow Jones economists, according to CNBC. The news outlet also reported that the economists didn’t make an official estimate for the October report but were largely anticipating a drop in employment. In addition to the delayed report, the BLS also revised downward the employment figures for August, from a loss of 4,000 jobs to -26,000, and September, from 119,000 jobs to 108,000. The U.S. unemployment rate also ticked up 20 basis points from September to 4.6 percent in November, its highest level since September 2021. Federal government employment continued to decrease in November with a loss of 6,000 jobs. This follows a decline of …

By Taylor Williams DALLAS — Technological innovation has long been a cornerstone of managing and leasing multifamily properties, and that feature of the business has only been augmented in the era of artificial intelligence (AI). But for all the operational conveniences and efficiencies that AI potentially brings to the table, multifamily management has not yet reached the point of phasing out the human element. Almost immediately after the members of the leasing and management panel at the annual InterFace Multifamily Texas conference had introduced themselves, this fundamental premise of multifamily management was put forth to a crowd of several hundred real estate professionals — men and women who have built careers based on human relationships. The message to those at the conference, which took place in late September at the Westin Galleria Hotel in Dallas, seemed to be one of reassurance, that even as AI seemingly infiltrates every aspect of human life and threatens to void millions of jobs, the human principles that have long governed real estate transactions remain intact. At least for now. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements …

InterFace Panel: Multifamily Operators Are Charting a Path from Oversupply to Opportunity in 2026

by Abby Cox

ATLANTA — The multifamily market in the Southeast still prevails as one of the nation’s most dynamic real estate ventures, but one aspect in particular is casting a dark shadow — the cultivation of oversupply in the region. When the demand for housing during and after the COVID pandemic increased, developers energetically responded with an aggressive building boom. However, when new supply began to outpace demand, vacancy crept up and concern for the market became more prominent. “We put shovels in the ground and started developing — and now we’re paying for that sin,” said Greg Mark, executive managing director at Cushman & Wakefield. “Across the board, we’re just not seeing the same kind of returns.” Mark’s comments came at the operations panel during the 2025 InterFace Multifamily Southeast conference, which was held at the InterContinental Buckhead in Atlanta. Co-hosted by France Media’s InterFace Conference Group and Multifamily & Affordable Housing Business magazine, the two-day event attracted a little more than 300 attendees. Ed Wolff, CEO of Dallas-based Aerwave, moderated the panel. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Karen Key, Southeast …

ATLANTA — For many multifamily professionals, 2025 is a year to forget. Paul Berry, president and chief operating officer of Mesa Capital Partners, said that U.S. multifamily investment sales are on track to close out the year at $125 billion, which represents a 25 percent decline from an average pre-COVID year and a little more than a third of 2021’s total (a torrid $354 billion). Andrew Zelman, senior vice president of Southeast investments at Boston-based GID Multifamily, said that owners are doing “everything they can to hold out for a profit.” Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. “As simplistic as this is, sellers will avoid transacting at less than peak values at any cost,” said Zelman, who added that owners are essentially kicking the can down the road by recapitalizing their assets or stopping and starting the marketing process if their pricing expectations aren’t being met. Zelman’s comments came during the opening panel on Tuesday, Dec. 2, at the 2025 InterFace Multifamily Southeast conference, which was held at the InterContinental Buckhead in Atlanta. Co-hosted …

By Aron Schreier of Cresa and Gabe Hernandez of Design Republic Leaders often obsess over KPIs (key performance indicators) and will spend six figures on Salesforce licenses and sales training boot camps. But walk into most offices in 2025, and you’ll find sales teams working in spaces that actively undermine everything those investments are meant to achieve. Having spent careers straddling both worlds — commercial real estate and sales training — it’s easy to see how the right environments can create positive energy and how the wrong ones quietly drain it. Let’s review why space is perhaps the most strategic asset in all of sales. Space Drives Mindset Sales is a game of psychology as much as skill. Top performers need natural light that regulates energy throughout the day, sight lines that create productive visibility without surveillance and collision spaces where quick wins get celebrated spontaneously. These aren’t luxury amenities; they’re pieces of performance infrastructure. Contrast that with fluorescent-lit cubicle farms with tall, opaque barriers. These spaces don’t just fail to inspire — they actively communicate that energy should be contained. They set a tone that seeps into calls and meetings and ultimately erodes confidence over time. Your office layout either …

ATLANTA — Andrew Layton, chief acquisition officer for Atlanta-based Student Quarters, knows that from a commercial real estate investment standpoint, the student housing sector possesses a key advantage: the relative permanence of many flagship universities nationally. “There is no risk of the University of Kentucky uprooting itself from Lexington and moving to Frankfort anytime soon. In the conventional multifamily world, neighborhoods come, neighborhoods go. What was hot yesterday may not be so hot today. What was cold yesterday may be the flaming new market tomorrow. That’s just not the case in what we do,” emphasized Layton, who leads the origination and underwriting efforts involving both the acquisition and development of student housing assets for the Student Quarters’ investors. “There’s a sense of permanence [surrounding these academic institutions], and if you can get on the ground and do your due diligence, you can figure out relatively easily where things work and where things don’t work in a student housing market.” Student Quarters owns and operates over 13,000 beds nationally, stretching east to west from Clemson, South Carolina, to Tempe, Arizona; and north to south from East Lansing, Michigan, to Tallahassee, Florida. The insights from Layton, who’s worked in the student housing …

Higher rents and lower turnover are a few of the key advantages build-to-rent (BTR) properties have over traditional multifamily product, according to investors. Meanwhile, the sector continues to experience strong demand from tenants priced out of the housing market as well as renters by choice who prefer flexible, maintenance-free living. BTR units typically have all the perks of a single-family home — privacy, garages and yards — without the hassles of landscaping or property maintenance. “The BTR sector is experiencing significant growth because it addresses a genuine need in today’s housing market,” says Khrista Villegas, managing director of Material Capital Partners (MCP), a Charleston, South Carolina-based development and investment firm focused on BTR communities in the Southeast and Midwest. “Many prospective residents are moving away from traditional apartments, seeking the space, privacy and community feel of a single-family home without the commitment and burden of ownership. This trend is especially pronounced among millennials and Gen Z renters who value lifestyle flexibility, outdoor space and neighborhood connectivity — features that traditional apartments often lack,” explains Villegas. (Gen Z, the demographic cohort succeeding millennials, includes persons born between approximately 1997 and 2012.) Many millennials and Gen Zers are postponing family formation, but …

AcquisitionsFeaturesIndustrialLeasing ActivityLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasVideoWebinarWestern

Webinar: From Hype to Readiness — How Commercial Real Estate Firms Are Preparing for AI

The November 18 France Media webinar “From Hype to Readiness — How Commercial Real Estate Firms Are Preparing for AI,” hosted by France Media and sponsored by Defease With Ease | Thirty Capital, offered a look at the realities of artificial intelligence (AI) within the industry. What can a year of AI use in commercial real estate tell us about implementation and tactics? Panelists touched on the limitations of general-purpose tools, as well as trending topics including safeguards, data privacy, accuracy and institutional control. For professionals engaged in commercial real estate, the session highlighted practical ways AI can elevate both day-to-day efficiency and organizational sophistication (especially if efforts are backed up by a unified library of proprietary portfolio data). Panelists discussed how purpose-built platforms can support underwriting, refinancing, internal reporting and ongoing asset optimization by using secure, updated data. The expert presenters gave concrete examples on how AI can act as an effort multiplier: it can strengthen accuracy, surface risks earlier and broaden the capabilities of team members. The included case study underscored real-world advantages, including improved reporting integrity, stronger oversight and better workflow automation. Register here to watch this brief webinar to gain helpful insights on integrating new technology …