By Taylor Williams DALLAS — As is the case for many commercial asset classes and markets in 2025, there is an expectation of elevated deal volume for investment sales of affordable housing properties in Texas. But brokers in that space caution that the rebound will likely be marginal and is not necessarily indicative of ideal market conditions taking hold. A quintet of panelists broke down this notion and others at the InterFace Texas Affordable & Workforce Housing conference on Feb. 13 at the Westin Galleria Dallas hotel. Mary Ann Bennett, senior managing director at BBG Real Estate Services, moderated the discussion on investment sales activity. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Panelist Michael Furrow, senior vice president of affordable housing at commercial finance firm BWE, took the audience of 200-plus back in time to illustrate just how quiet the past two years had been. He did so by providing statistics on affordable housing sales for Dallas-Fort Worth (DFW) between 2021 — when multifamily rents and sales prices were peaking across the board — and 2024, when they …

Texas Market Reports

By Joe Lutz, managing director at Leon Multifamily Group Market uncertainty has many real estate investors hesitating. Rising costs, high interest rates and shifting supply-demand dynamics add to the caution. Yet Dallas-Fort Worth (DFW) remains a powerhouse in multifamily development, driven by strong demand and solid market fundamentals. For those willing to act, the opportunities are hard to ignore. Investor caution is evident, with a “stay alive through ’25” mentality reflecting economic pressures. Transaction volumes have dropped to historic lows. Newmark Capital Research (NCR) reports that 2023 and 2024 saw the weakest activity since 2013, with sales down 30 percent compared to the pre-COVID era. For the first time since 2008, 2023 ended without the usual year-end sales uptick, and 2024 data suggests a similar trend. While some feared a market collapse, conditions haven’t reached Great Financial Crisis levels. The multifamily sector faces supply imbalances and growing debt pressures. Construction starts hit their lowest levels since 2013, while completions exceeded new starts by over 200,000 units — a gap unseen since the 1970s, according to data from NCR. The surge in 2023 completions resulted from post-COVID, low-interest-rate incentives, but now concerns over vacancies, concessions and stagnant rent growth linger. Debt …

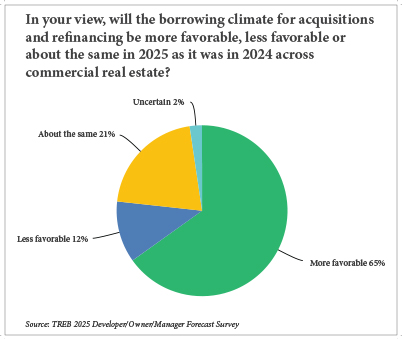

By Taylor Williams According to the results of Texas Real Estate Business’ annual reader forecast survey, to many commercial brokers and owners in Texas, the change of power in the White House is very much a good thing. In the survey, respondents across a wide range of commercial jobs, practices and asset classes shared expectations for 2025 across an even wider range of topics. But as is usually the case every fourth December, it was the results of the presidential election that generated the most insight and feedback from participants. Like the man himself, the commentary on Donald Trump was often polarizing, but it’s a welcome respite from years of focusing on inflation and interest rates. Across two separate surveys, 45 brokers and owners/developers answered, via free-response format, the same question of how Trump’s re-election would impact the industry in the short run. Though in their entirety, responses ran the gamut from effusive to disheartened and everything in between — with many respondents unsurprisingly opting to remain anonymous — the overall resulting feeling is clearly one of optimism. During his first term as president, Trump, a major commercial developer himself, routinely pressured the Federal Reserve to lower interest rates, which …

By William McDonough, vice president, Weitzman San Antonio’s retail market is reporting record-high occupancy as it continues its longest-ever streak of balanced supply and demand. With a new high of 95.2 percent, the Alamo City retail market has now posted healthy occupancy rates of 90 percent or higher for 14 years straight. The occupancy rate is based on Weitzman’s review of a total San Antonio retail inventory of approximately 49 million square feet of retail space in multi-tenant shopping centers with 25,000 square feet or more. Occupancy remains high due to stable tenant retention and strong demand for well-located vacancies. For example, shortly after Conn’s announced in mid-2024 that it planned to close its area stores, discount apparel retailer Burlington announced its plans to backfill three of the nine stores slated for closure. The market is also reporting an increase in new construction, but the deliveries overall have actually increased occupancy due to the fact that they are primarily for anchor stores and largely preleased shop space. Last year, the market did see new vacancies created due to the chain-wide failures of Conn’s, Big Lots, American Freight Furniture and 99 Cents Only. But in a tight market like San Antonio’s, …

By Lee Winston, partner at Gray, Winston & Hart PLLC No income tax in Texas. The Texas Constitution prohibits it, so local funding depends primarily on property taxes. But to many Texas businesses, this “necessary evil” has become just plain evil. Over the last several years, property taxes in Texas have exploded. State politicians have taken notice and are ramping up demands to reduce or eliminate property taxes, but the alternatives are more than unpopular. For instance, nobody wants to pay — and no politician wants to stand for election on — instituting a near 20 percent sales tax. And everyone knows this. To avoid this reality, lawmakers have pivoted to find a villain, and the appraisal districts that place the taxable value on property are a ready target. The popular solutions to rein in this villain are appraisal caps, increased exemptions and value limitations, all of which offer relief to residential property owners but do little for commercial owners. And these “fixes” result in a system that is neither equal nor uniform, undermining the constitutional foundation of taxation in Texas. Our elected officials have yet to address the fundamental issue driving the over-valuation of most commercial properties, which is …

By Jason Baker, principal at Baker Katz If you look back about 150 years or so, drugstores have played a big role in communities nationally and across Texas. From the beginning with small corner pharmacies to today’s large retail chains with 24-hour service, drive-thrus and a wide range of products, drugstores have filled retail and service needs in the communities they serve. However, in the past few decades, there has been a noticeable shift. In the 1980s and 1990s, national chains such as Walgreens and CVS expanded rapidly, often setting up stores at the exact same intersection. These stores became go-to spots for everything from prescriptions to film processing to everyday essentials and necessities. However, their fast-paced growth also came with its own set of challenges, such as high costs of real estate and operational expenses that left the underlying real estate of many of the drugstores vulnerable when market conditions changed. Shifting Consumer Behaviors Force Adaptation Over the past two decades, consumer behavior has changed significantly. With the rise of telehealth, people can now see a doctor on Zoom and get a prescription without ever leaving their home. At the same time, online giants and big-box retailers have also …

By Taylor Williams “The greatest victory is one that doesn’t require a battle.” Ancient Chinese military strategist Sun Tzu penned that line as part of The Art of War, but in applying the expression to the (almost) equally cutthroat business of developing and investing in retail real estate, there is some wisdom to be gleaned. In simple terms, sometimes the best decision, at least temporarily, is to do nothing. Passivity does not come easily to commercial builders and buyers. Where their investors are concerned, these companies often have strict timelines for deployment of funds and even stricter benchmarks for guaranteed returns. When market conditions are favorable, these groups are pressured to maximize growth, in terms of both direct mandates from shareholders and indirect obligations via competitors being aggressive in the market. For better or worse, the market sentiments surrounding real estate development and investment embody classic principles of capitalism, and that’s unlikely to ever change. But if there is one thing developers, investors, lenders and operators across all asset classes can likely agree on, it’s that market conditions in 2024 have not been favorable. Yet the push for growth has merely slowed, not disappeared. New product must get developed to …

Interviews by Jessica Johnson and Abby Lestin Big deal, little deal or no deal? In a hypothetical survey among several dozen women who work in commercial real estate that examines the significance of their growing segment of industry leadership, answers would likely run the gamut of those three options. The answer is subjective, of course. But regardless of individual sentiments, there can be no denying that commercial real estate does currently have a strong cast of experienced, capable women in leadership positions, and there is little reason to think that trend will slow or backtrack in the future. At France Media, the Atlanta-based parent company of Texas Real Estate Business, we see this pattern manifest in multiple forms. Our conference division, InterFace Conference Group, hosts dozens of industry events every year with panel discussions that routinely feature women in prominent speaking roles. We see more announcements about advocacy groups within the industry that are largely devoted to women and their occupational advancement and achievements, as well as launches of companies owned and led by women. And we count a growing contingent of women among our regular editorial sources and contributors. This isn’t just some initiative driven by diversity, equity and …

By Ben Reinberg, CEO, Alliance Consolidated Group of Cos. In late September, Texas-based software company Dell became one of the latest major companies to announce a full return-to-office (RTO) mandate. In a leaked memo to employees, Bill Scannell, the company president, wrote, “As we enter a new AI world, in-person human interaction will be more important than ever.” Just a few weeks later, Amazon announced a full RTO policy. And over the summer, Meta, the parent company of Facebook, informed employees that remote team members would not be eligible for promotions. These RTO announcements from major organizations have dotted the web for years following the pandemic, leading many investors to hope for a slow-but-steady march back to busy office buildings and revitalized downtowns throughout the Lone Star State. The actual data, however, tells a much different story. Reports on Texas’ commercial real estate markets indicate that nearly a quarter of all office space is vacant nearly four years after the pandemic. According to CommercialEdge, Dallas’ office vacancy rate is 22.9 percent, and Austin’s is 27.8 percent. Workforce trends reflect a similar situation. Austin was named the No. 1 metro for remote workers in 2023 by Coworking Mag, with nearly a …

By Josh Wheeler, senior vice president of development & acquisitions, Stonemont Financial Group The Dallas-Fort Worth (DFW) metroplex remains at the forefront of industrial growth in the United States. According to CommercialEdge, the market boasts a pipeline of 15.7 million square feet under construction as of June 2024 after several large deliveries were completed in the first half of the year. Following several years of explosive growth caused largely by the rise in e-commerce during the pandemic, the market has cooled due to economic headwinds. Tenants are taking longer to make decisions about their spatial needs. Construction has slowed after almost 18 million square feet of space was delivered in the first half of the year, including Stonemont’s 565,000-square-foot industrial park in Wilmer, just outside the metro area. As a result, vacancy rose to 11 percent in the third quarter of 2024. The market has continued its 14-year-long trend of positive absorption, though 2024’s year-to-date absorption is 6.5 million square feet below last year’s number. However, there is ample reason to remain bullish on DFW and to view the market as well-positioned to maintain its status as one of the country’s leading industrial powerhouses. Trends remain favorable for the market, …