SAN DIEGO — Marcus & Millichap has arranged the sale of Prospect Square at La Jolla Village, a mixed-use property located in San Diego’s La Jolla submarket. 1025 Prospect LLC sold the asset to 1025 Associates LLC & Wedge 3.0 LLC for $10.3 million. Nick Totah of Marcus & Millichap represented the seller, while Ross Sanchez of Marcus & Millichap represented the buyers in the deal. Located at 1025 Prospect St., Prospect Square at La Jolla Village features 33,055 square feet of ground-floor and second-floor retail and restaurant space, third-floor office space and a three-story subterranean parking garage. Current tenants include Cody’s Restaurant, Beeside Balcony, The Agency, Arjang Fine Art, Blueprint Equity and Patient Partner. Originally built in 1984, the property was renovated in 2022 and 2024.

Restaurant

Morgan, Casto Net Lease Buy Land in Southeast Florida, Plan Aldi-Anchored Shopping Center

by John Nelson

PORT ST. LUCIE, FLA. — A partnership between Morgan Co. and Casto Net Lease has acquired 15 acres in Port St. Lucie, a city in southeast Florida’s St. Lucie County. The duo plans to develop a new shopping center anchored by Aldi on the site. The center will also include outparcels designated for McDonald’s, Circle K and AutoZone, as well as outparcels that are currently available for sale or lease. Scott Copeland of On Course Development represented Morgan and Casto Net Lease in the land deal. The seller and sales price were not disclosed. The buyers plan to break ground on the shopping center before the end of the year and deliver the property in 2027.

FLOWERY BRANCH, GA. — The Taylor McMinn Retail Group of Marcus & Millichap has brokered the sale of a restaurant in Flowery Branch leased to Whataburger. The restaurant was built in 2024 and sold to a local buyer that purchased the property all-cash in a 1031 exchange. Don McMinn and Andrew Koriwchak of Taylor McMinn Retail Group represented the seller, a repeat developer for the Whataburger brand, in the deal. Both parties requested anonymity. Whataburger has 14 years remaining on its ground lease, which features rent increases in the initial term as well as extension options. “This marks our fourth new Whataburger closing in the Atlanta MSA over the past 12 months, and we are currently marketing an additional location in Buford, Ga.,” says McMinn. “Demand for well-located QSR [quick-service restaurant] assets remains strong as 1031 exchange and private capital continue to re-enter the net lease market. Capital targeting the QSR sector is driven by long-term leases, rent escalations and attractive drive-thru locations.”

CHICAGO — Fine dining restaurant and bar concept Espiritu has signed a lease to open a roughly 10,000-square-foot ground-floor space at One East Wacker, a Chicago office building owned by AmTrustRE. Espiritu comes from the restaurateurs behind Chicago Cut Steakhouse and Cerdito Muerto, Matt Moore and Emidio Oceguera. The dining concept blends classic Chicago dishes with a modern Mexican flair. In addition to 10,000 square feet of indoor space, the restaurant will include 2,200 square feet of adjoining outdoor patio area along Wacker Drive. Dana Moyles of Dana Moyles Real Estate Services represented Espiritu in the lease, while John Vance and Will Winter of Stone Real Estate represented the landlord. AmTrustRE has also secured three new office leases at the property, including Flight Centre Travel Group (USA) Inc., the Trade Commission of Spain in Chicago and the Consulate General of Bosnia and Herzegovina in Chicago. Signed to 7,216 square feet of office space on the 13th floor, Flight Centre Travel Group is one of the world’s largest global travel agencies. JLL’s Sarah Silva and Bess Cooney represented the tenant. The Trade Commission Office of Spain, of the Government of the Kingdom of Spain, will occupy 4,326 square feet on the …

JOHNS CREEK, GA. — A new wave of retailers has joined the tenant roster at Medley, a new 43-acre mixed-use redevelopment underway in Johns Creek, about 27 miles north of Atlanta. Locally based Toro Development Co. recently announced the newcomers, which will include Shake Shack, Trader Joe’s, Kontour Medical Spa, Moop’s Boutique and Northern China Eatery. Previously announced concepts include Sephora, High Country Outfitters, BODYROK, Petfolk, CRÚ Food & Wine Bar, Fadó Irish Pub, Summit Coffee, Five Daughters Bakery, Drybar Shops, Minnie Olivia Pizzeria and Clean Your Dirty Face, among others. Set to debut officially around Halloween, Medley will offer 164,000 square feet of retail, restaurant and entertainment space; 833 luxury townhomes and apartments; The Hotel at Medley, a 150-room boutique hotel set to open in 2028; 110,000 square feet of lifestyle office space; and a 25,000-square-foot plaza. The project is located at the intersection of Johns Creek Parkway and McGinnis Ferry Road and was once a suburban office hub for State Farm Insurance.

LANSING, MICH. — Pita Way has signed a 1,400-square-foot lease to open at The Marketplace at Delta Township in Lansing. Michael Murphy of Gerdom Realty & Investment represented the tenant. The transaction marks the sixth Pita Way location that Gerdom helped the tenant secure in the past year. Eric Unatin of Mid-America Real Estate Group represented the undisclosed landlord.

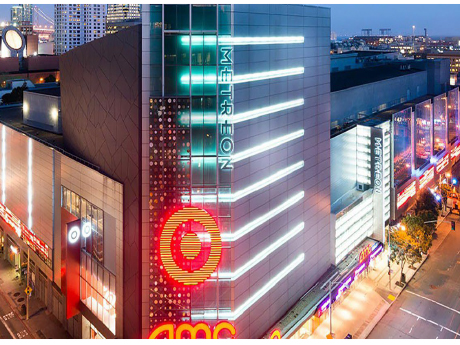

TMG, Bridges Capital Acquire 320,000 SF Metreon Shopping Center in Downtown San Francisco

by John Nelson

SAN FRANCISCO —TMG Partners and equity partner Bridges Capital LLC have acquired Metreon, a 320,000-square-foot, vertically oriented shopping center in downtown San Francisco. Built in 1999, the retail and entertainment destination is anchored by Target and a 16-screen AMC Theatres that features the tallest IMAX screen in North America. Locally based TMG and Bridges Capital purchased the four-story property from Acore Capital in a deed-in-lieu transaction. The sales price was not disclosed. The City and County of San Francisco will continue to retain ownership of Metreon’s ground lease through at least 2082, according to the San Francisco Business Times. The news outlet also reported Acore Capital was the mortgage lender for Metreon on behalf of the previous owner, Starwood Capital Group. “This investment in Metreon is a powerful vote of confidence in our downtown recovery,” says San Francisco Mayor Daniel Lurie. “We’re grateful for [TMG’s] partnership as we work to accelerate San Francisco’s comeback.” Metreon is located at 135 4th St. at Mission in the city’s Yerba Buena neighborhood. The property includes City View at Metreon, a 31,000-square-foot events venue with floor-to-ceiling windows offering views of the San Franisco skyline. TMG will rebrand the venue and partner with Skylight, a …

SRS Negotiates Sales of Three New Central Florida Retail Properties Leased to 7-Eleven

by John Nelson

TAMPA, FLA. — SRS Real Estate Partners has negotiated the sales of three new retail properties in Central Florida leased to 7-Eleven totaling $28.8 million. Built in late 2025, the three properties are located in Winter Haven, Daytona Beach and Ocoee and comprise modern convenience stores and fueling stations. 7-Eleven occupies all three properties on 15-year, triple-net leases. Patrick Nutt and William Wamble of SRS represented the sellers, Florida-based developers, in the transactions. The Winter Haven and Ocoee properties were sold as a portfolio to a Florida-based family office for a combined $19.2 million. A locally based, private investor purchased the Daytona Beach location, which is situated across from Latitude Landings and Latitude Margaritaville, in a 1031 exchange for approximately $9.5 million.

ATLANTIC CITY, N.J. — PACE Loan Group (PLG) has provided a $45.5 million C-PACE (Commercial Property Assessed Clean Energy) loan for Island Waterpark at Showboat, a 120,000-square-foot entertainment venue in Atlantic City. The venue opened in summer 2023 via conversion of a surface parking lot at the adjacent Showboat Resort and includes 10 waterslides, a multi-level children’s play structure, lazy river, four restaurants and three bars. The borrower, Bart Blatstein of Philadelphia-based Tower Investments Inc., will use a portion of the proceeds to pay down existing construction debt on the property.

PIQUA, OHIO — The Cooper Commercial Investment Group has brokered the sale of a newly constructed restaurant property occupied by Chipotle Mexican Grill in Piqua, a suburb of Dayton. The 15-year lease features 10 percent rental increases in years six and 11. The property includes the restaurant’s namesake drive-thru, Chipotlane, as well as patio seating. Dan Cooper of Cooper Group represented the seller, a longtime client. The asset sold to an all-cash 1031 exchange buyer from California at a 5.5 percent cap rate.

Newer Posts