WASHINGTON, D.C. — A partnership between Carr Properties and Barings has purchased a 12-story office building located at 1401 New York Ave. NW in downtown Washington, D.C. Eastdil Secured represented the undisclosed seller in the transaction. The sales price was also not disclosed. The new ownership plans to fully renovate the 211,500-square-foot building with a new enclosed amenity space on the rooftop, as well as upgrades to the office building’s lobby, fitness center and conference facilities. Current tenants at the LEED Gold-certified building include Boies Schiller Flexner, Capstone, Vedder Price and Nossaman.

District of Columbia

Fundamental macroeconomic changes in the U.S. office market, combined with the enduring resilience of Washington, D.C., make this a unique moment for investment in the region’s office sector. Forward-thinking, data-driven analysis will uncover unprecedented opportunities. Persistent flight-to-quality trends continue to drive a polarization of the D.C. office market more severely than the national average, with trophy vacancy lower and commodity vacancy higher than the overall U.S. office market. Recent sharp federal government cutbacks have caused uncertainty throughout 2025, driving additional occupancy loss in the commodity segment of the market, while a resilient private sector shows seemingly endless demand for top-quality space. Overall, midsized and large private sector tenants in the market plan to grow by an aggregate 350,000 square feet. Expected growth will be driven by law firms, higher education institutions, business and financial services firms and trade associations, including several new-to-market tenants. As a result, standard Class A and B/C vacancy rates are hovering at historic highs of 24 percent and 26 percent, respectively, while trophy vacancy sits at a historic low of 10.2 percent. The overwhelming majority of large and mid-sized blocks of top-quality space are also encumbered. If trophy space continues to be absorbed at the same …

WASHINGTON, D.C. — The U.S. economy has added 50,000 non-farm payroll jobs in December, according to a report from the U.S. Bureau of Labor Statistics (BLS). The December figure fell short of the downwardly revised 56,000 in November and short of the Dow Jones estimate for 73,000, according to CNBC. The BLS also revised downward the employment figures for October, from a loss of 68,000 jobs to -173,000. Over the course of 2025, payroll gains averaged 49,000 per month, compared with 168,000 in 2024. Meanwhile, the unemployment rate edged down slightly to 4.4 percent, which reflected small shifts in the household survey rather than a surge in hiring. Federal government employment changed little in December (+2,000), but since reaching a peak in January, employment is down by 277,000 jobs. Additionally, retail trade lost 25,000 jobs in December. Over the month, employment declined in warehouse clubs, supercenters and other general merchandise retailers (-19,000) and food-and-beverage retailers (-9,000). However, electronics and appliance retailers added 5,000 jobs. Jobs gains in December were primarily concentrated in service-oriented sectors, such as food services and drinking places (+27,000), healthcare (21,000) and social assistance (17,000). Employment showed little or no change over the month in other major industries, …

WASHINGTON, D.C. — Nuveen Green Capital (NGC) has provided $465 million in C-PACE financing for The Geneva, an office-to-residential conversion project in Washington, D.C. The transaction represents the largest Commercial Property Assessed Clean Energy (C-PACE) financing in history as well as D.C.’s largest office-to-residential conversion to date, according to NGC. The borrower, Philadelphia-based developer Post Brothers, also received a $110 million senior loan from investment firm Mavik, bringing total financing to $575 million. The project’s overall price tag is $750 million, according to The Wall Street Journal. Located at 1825-1875 Connecticut Ave. NW, the 604,000-square-foot office property is comprised of two nine-story towers at the confluence of D.C.’s upscale Kalorama, Dupont Circle and Adams Morgan neighborhoods. The property will be converted into a 15-story luxury apartment building with 429 market-rate units, 42 extended-stay rentals, 61 affordable housing units and 57,000 square feet of commercial space. A timeline for construction was not provided. The $465 million in C-PACE financing was administered through DC Green Bank, which serves as the administrator of the DC PACE program on behalf of the District of Columbia. The DC PACE program is a special financing option for renewable energy projects such as solar, energy efficiency upgrades …

As 2025 closes, data suggests that the greater metropolitan Washington, D.C., area is stable but, like most markets nationally, remains below the industrial peak values achieved post-pandemic when vacancy rates hovered below 5 percent. That is no surprise, as we may never experience another “perfect storm” scenario in our lifetimes. The overall market for industrial buildings 100,000 square feet and larger is a healthy 6.3 percent, inclusive of data centers. A significant percentage of vacancy is masked by the build-out of data centers in Northern Virginia because, removing this asset class, the vacancy increases to approximately 9.1 percent. The number increases closer to 10 percent when we focus more specifically on logistics spaces, according to data from CoStar Group. Confidence remains strong for leasing activity in larger Class A industrial buildings, but the underlying economic fundamentals, uncertainty in tariff policy and geopolitical instability could lead to a continued trend of higher vacancy rates in the future. Consumer spending underpins the economy and is increasingly dependent on wealthier households who account for the majority of spending. Low- and middle-income households have continued to be squeezed by the rising costs of food, fuel and housing, which impacts the demand for shipped, manufactured …

The Washington, D.C., commercial real estate market is intricate, shaped by broad economic trends and local dynamics. The recent federal government shutdown underscored ongoing challenges, intensifying uncertainty and slowing local transactions. Continued ambiguity around trade and tariff policies further complicates business planning, adding to the region’s cautious dealmaking environment. Anxiety affects the region’s key economic source: federal workers and contractors, who make up 40 percent of its economy. Since January 2025, federal job losses here have outpaced the national average, increasing the risk of a local slowdown. Despite the area’s wealth, ongoing job uncertainty should guide all investment and operational choices. The interplay between federal employment trends and local business activity means that investors and operators must remain vigilant, adapting strategies to respond to shifting workforce dynamics and consumer sentiment. Tale of two marketsThe D.C. retail market is split: downtown faces challenges due to office vacancies and low weekday traffic, while suburban and residential-heavy urban areas are thriving. Affluent spots in Northern Virginia and Suburban Maryland have the lowest vacancy rates thanks to stable local shoppers. These areas benefit from consistent foot traffic and resilient spending patterns, which help insulate them from broader economic volatility. From a capital markets perspective, …

BXP Buys D.C. Office Building for $55M, Plans Redevelopment Following Sidley Austin Anchor Lease

by Abby Cox

WASHINGTON, D.C. — BXP has acquired 2100 M Street, a 300,000-square-foot office building located in the West End of Washington, D.C., for $55 million. The publicly traded, Boston-based office REIT plans to demolish the existing building and develop a new 320,000-square-foot office tower. BXP expects to commence construction of the project in 2028. Eastdil Secured represented the undisclosed seller in the transaction. Additionally, Sidley Austin LLP has signed a 240,000-square-foot lease to anchor the future trophy property, occupying 75 percent of the building. The global law firm will be situated on the fourth through 10th floors and is scheduled to move into its new space in 2031. Lou Christopher and Jordan Brainard of CBRE represented Sidley Austin in the lease transaction.

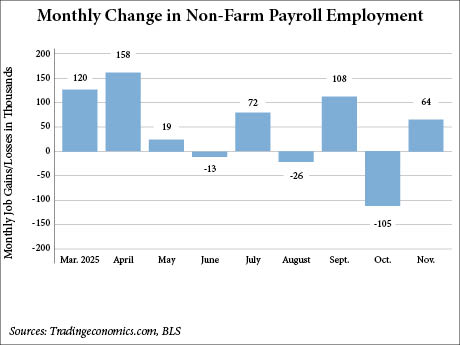

WASHINGTON, D.C. — The U.S. economy has added 64,000 non-farm payroll jobs in November and lost 105,000 jobs in October, according to the U.S. Bureau of Labor Statistics (BLS). The BLS included the October figures into the November report due to complications with the federal government shutdown, which lasted for 44 days in October and early November. The bureau, which also delayed the release of the consumer price index and producer price index in October, plans to release the December jobs report on Jan. 9, 2026. The November figure was higher than the 45,000 estimate from Dow Jones economists, according to CNBC. The news outlet also reported that the economists didn’t make an official estimate for the October report but were largely anticipating a drop in employment. In addition to the delayed report, the BLS also revised downward the employment figures for August, from a loss of 4,000 jobs to -26,000, and September, from 119,000 jobs to 108,000. The U.S. unemployment rate also ticked up 20 basis points from September to 4.6 percent in November, its highest level since September 2021. Federal government employment continued to decrease in November with a loss of 6,000 jobs. This follows a decline of …

Affordable HousingCompany NewsDistrict of ColumbiaLeasing ActivityMultifamilySeniors HousingSoutheastStudent Housing

Justice Department, RealPage Settle Lawsuit Over Use of Revenue Management Software in Apartment Rental Pricing

by John Nelson

RICHARDSON, TEXAS AND WASHINGTON, D.C. — The U.S. Justice Department’s Antitrust Division has reached a settlement with RealPage Inc. as part of its ongoing enforcement against algorithmic coordination, information sharing and other anticompetitive practices in rental housing markets across the country, according to details disclosed in a North Carolina federal court on Monday. The proposed consent judgment, which still requires court approval before it can be implemented, would help restore free market competition in rental markets for millions of American renters, the Justice Department stated in a press release. “Competing companies must make independent pricing decisions, and with the rise of algorithmic and artificial intelligence tools, we will remain at the forefront of vigorous antitrust enforcement,” said Assistant Attorney General Abigail Slater of the Justice Department’s Antitrust Division. Headquartered in Richardson, Texas, RealPage is a provider of revenue management software and services for the conventional multifamily rental housing industry. In a civil antitrust claim filed in North Carolina in August 2024, the Justice Department and the attorneys general of eight states alleged that RealPage’s revenue management software relied on nonpublic, competitively sensitive information shared by landlords to set rental prices. The plaintiffs also alleged that RealPage’s software included features designed …

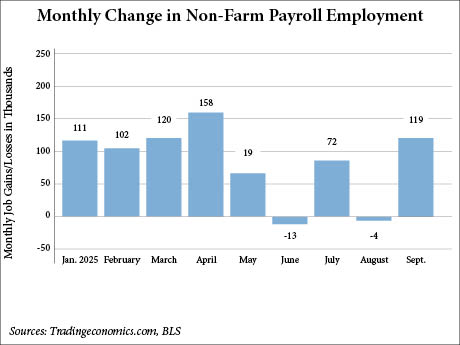

WASHINGTON, D.C. — The U.S. economy has added 119,000 jobs in September, according to a report from the U.S. Bureau of Labor Statistics (BLS). The latest jobs data was delayed by more than six weeks due to the recently concluded shutdown of the federal government, which lasted 44 days. The September figure exceeded forecasts of 50,000 new jobs by Dow Jones economists, according to CNBC. The BLS will postpone the jobs report data for both October and November, with plans to release the two reports simultaneously on Dec. 16. The September jobs report was originally scheduled to release on Oct. 3; the October jobs report was scheduled for Nov. 7; and the November jobs data was set to debut on Dec. 5. In addition to the delays, the BLS has revised down the jobs data for July and August by a combined 33,000 jobs. The July jobs report was revised from 79,000 to 72,000 jobs, and the August report was downwardly revised from 22,000 jobs to -4,000 jobs. The unemployment rate also increased to 4.4 percent, which is the highest level for the rate since October 2021. For September, employment was led by the healthcare sector (+43,000), bars and restaurants …

Newer Posts