WASHINGTON, D.C. — The volume for commercial and multifamily mortgage loan originations closed in the third quarter of 2025 was 36 percent higher compared to a year earlier, according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations report. The third-quarter production also represents an 18 percent increase from the previous quarter. The MBA reports that loan originations have now risen for five consecutive quarters on both a quarterly and annual basis. Among property types, there was an 181 percent year-over-year increase in the dollar volume of loans for office properties, 100 percent increase for retail properties, 66 percent increase for hotels, 27 percent increase for multifamily properties and a 5 percent increase for industrial properties. Originations for healthcare properties decreased 43 percent compared to the third quarter of 2024. “While some sectors, such as healthcare and industrial, saw slower activity, overall volumes reflected improving sentiment as property values stabilized and loans reaching maturity were refinanced,” says Reggie Booker, MBA’s associate vice president of commercial/multifamily research. Among capital sources, there was a 52 percent year-over-year increase in loans by depositories lenders (i.e. banks), 40 percent increase in loans by government sponsored enterprises (Fannie Mae and Freddie Mac) …

District of Columbia

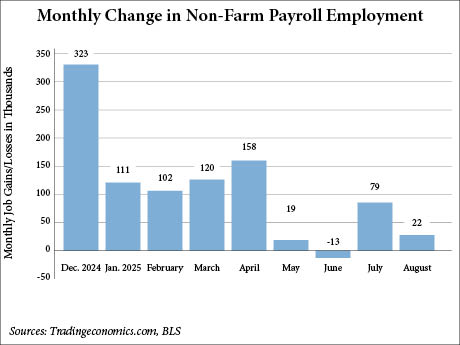

WASHINGTON, D.C. — The U.S. economy added a meek 22,000 jobs in August, falling short of the 75,000 figure projected by Dow Jones economists, according to CNBC. According to the U.S. Bureau of Labor Statistics (BLS), the report showed a marked slowdown from the July increase of 79,000, which was revised up by 6,000. Revisions also showed a net loss of 13,000 jobs in June, after the former estimate was lowered by 27,000. June is now the first month of recorded negative job growth since December 2020. Both the unemployment rate, which sits at 4.3 percent, and the number of unemployed people, which sits at 7.4 million, demonstrated a slight increase per August’s report. August’s payroll count was the first since President Donald Trump fired former BLS Commissioner, Erika McEntarfer, following the release of the July jobs report. Although total nonfarm payroll employment has shown little change since April, a job gain in healthcare was partially offset by losses in federal government, as well as mining, quarrying and oil-and-gas extraction. Federal government employment declined in August by 15,000 jobs and is down by 97,000 since reaching a peak in January. Additionally, employment in mining, quarrying and oil-and-gas extraction fell by 6,000, …

Elme Communities Agrees to Sell Multifamily Portfolio to Cortland for $1.6B as Part of Liquidation Plan

by John Nelson

BETHESDA, MD. AND ATLANTA — Elme Communities (NYSE: ELME), a Maryland-based multifamily owner-operator that previously operated as WashREIT, has entered into a purchase and sale agreement with an affiliate of Cortland Partners, an Atlanta-based multifamily investment and management firm. Under the terms of the transaction, Elme would sell 19 apartment communities to Cortland for $1.6 billion in an all-cash deal. “We are pleased to have reached an agreement with Cortland that recognizes the greater value of these 19 Elme communities and their long-term potential when coupled with Cortland’s economies of scale,” says Paul McDermott, president and CEO of Elme. “We believe Cortland will be an excellent steward of the properties and that this sale will facilitate a seamless transition of ownership, enabling continuity of operations for our residents and community teams.” Steven DeFrancis, CEO of Cortland, said that the portfolio will grow the company’s presence in the Washington, D.C., region and in its home state of Georgia. “We’re excited to welcome these communities into the Cortland family and deliver the exceptional living experience residents have come to expect from our brand,” says DeFrancis. The properties include: Goldman Sachs & Co. LLC and Jones Lang LaSalle Securities LLC are acting as …

U.S. Economy Adds 73,000 Jobs in July, Previous Months’ Numbers Revised Down Significantly

by Abby Cox

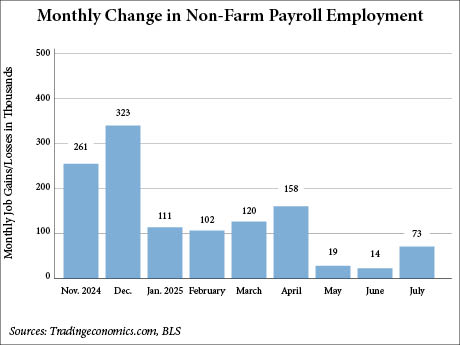

WASHINGTON, D.C. — The U.S. Bureau of Labor Statistics (BLS) has reported that U.S. employment growth totaled 73,000 in July, falling below the 100,000 figure projected by Dow Jones economists, according to CNBC. May and June totals were also significantly revised downwards by a combined 258,000 from previous months’ totals. The BLS revised May job growth down from +144,000 to +19,000, and June from +147,000 to +14,000. The unemployment rate rose slightly to 4.2 percent, and the number of unemployed people — at 7.2 million — also showed little change from June. Nearly all job growth in July came from the healthcare and social assistance sectors, accounting for roughly 94 percent of the gains. Healthcare contributed 55,000 jobs, including increases in ambulatory healthcare services (+34,000) and hospitals (+16,000). Social assistance employment provided 18,000 jobs, reflecting continued growth in individuals and family services (+21,000). Retail added nearly 16,000 jobs, while the financial sector was increase by 15,000 jobs. Meanwhile, federal government employment continued to decline in July (-12,000) and is down by 84,000 since reaching a peak in January before Elon Musk’s Department of Government Efficiency (DOGE) began reallocating job scopes and duties. There was little change in employment over the …

WASHINGTON, D.C. — In-Rel Properties, a real estate investment and management firm based in Lake Worth Beach, Fla., has purchased a nearly 130,000-square-foot office building located at 2033 K St. NW in Washington, D.C.’s Golden Triangle district. The seller and sales price were not disclosed. In-Rel has tapped Carroll Cavanagh, Dimitri Hajimihalis and Emily Eppolito of CBRE to spearhead the leasing campaign at 2033 K Street. Renovated in 2019, the eight-story office building features a new lobby, fitness facility and conference center. In-Rel plans to install “town hall” speculative suites on the second and third floors to boost occupancy at the office building, which has a block of up to 60,000 square feet of contiguous space available for lease.

WASHINGTON, D.C. — Affiliates of Harbor Group International LLC (HGI) have provided a $38.3 million loan for the refinancing of a 12-story office building located at 1250 Eye St. in Washington, D.C.’s East End district. The borrower is Kairos Investment Management Co., which purchased the 180,000-square-foot property in 2023. Kairos plans to use the loan proceeds to refinance existing debt and fund ongoing renovations and enhancements of the property, while also supporting leasing activity. These enhancements will include a new amenity suite on the 12th floor that Gensler designed that will feature an elevated hospitality lounge, conference center, bar/kitchen and terrace. Renovations include move-in ready office spaces and upgrades to commons areas including the lobby, fitness center, bike room and parking/valet services.

Affordable HousingDistrict of ColumbiaFeaturesHeartland Feature ArchiveMultifamilyMultifamily & Affordable Housing Feature ArchiveNortheast Feature ArchiveSoutheastSoutheast Feature ArchiveTexas & Oklahoma Feature ArchiveWestern Feature Archive

Why Fannie Mae, Freddie Mac Believe the Wind Is at Their Back

by John Nelson

Fannie Mae and Freddie Mac are adopting a more pro-business approach when it comes to closing multifamily loans in 2025 than in recent years, when sources say they were more selective. The two government-sponsored enterprises (GSEs) combined to produce 33 percent more multifamily loans in first-quarter 2025 compared with first-quarter 2024. “There is definitely a ‘volume on’ mindset at both shops,” says Landon Litty, director of agency sales at BWE. “This is a real positive for borrowers.” For Fannie Mae, the volume of multifamily loans totaled $11.8 billion in the first quarter of 2025, compared with $10.1 billion in the first quarter of 2024. Meanwhile, Freddie Mac produced approximately $15 billion in multifamily loans in the first quarter, financing around 144,000 rental units, well above the approximately $10 billion produced in first-quarter 2024. “The first quarter of 2025 has been dynamic, with real-time adjustments to meet market needs while maintaining a focus on soundness,” says a spokesperson at Freddie Mac Multifamily. Other sources attest that the GSEs are focusing on their sponsors more so than in previous years. T.J. Edwards, chief production officer for the multifamily finance division at Walker & Dunlop, says the agencies are proactively vetting first-time borrowers …

CPC Arranges $26.7M in Construction Financing for Affordable Housing Rehabilitation Project in D.C.

by Abby Cox

WASHINGTON, D.C. — The Community Preservation Corp. (CPC) has arranged $26.7 million in construction financing for the rehabilitation and expansion of Townley Court, a 45-unit affordable housing community located in the Glover Park neighborhood of Washington, D.C. DC Green Bank and J.P. Morgan provided $15.7 million in combined financing for the project, while additional financing included $5.2 million from Amazon and $5.8 million from American Housing. Additionally, CPC Mortgage Co. originated a $15.7 million Freddie Mac loan under a Targeted Affordable Housing (TAH) forward commitment. The financing will fund renovations to the apartment’s 45 existing units, with plans to build an additional seven units, as well as solar panels, electric vehicle charging stations and energy-efficient building upgrades. The eco-friendly improvements are estimated to cut both the building’s utility costs and greenhouse gas emissions by nearly 10 percent, while also meeting the Enterprise Green Communities certification upon completion of the renovation. Completion is targeted for September 2026.

WASHINGTON, D.C. — SRS Real Estate Partners has brokered the nearly $3 million sale of a restaurant property located at 301 Massachusetts Ave. in Washington, D.C.’s Capitol Hill neighborhood. Pupatella Neapolitan Pizza has occupied the 4,154-square-foot restaurant since fall 2024 on a triple-net lease. Rick Fernandez and Andrew Fallon of SRS represented the seller, a private owner based in New York City, in the transaction. The buyer was a local private investor. Both parties requested anonymity. Sandy Spring Bank provided an undisclosed amount of acquisition financing to the buyer. The restaurant was recently renovated and features 1,500 square feet of outdoor patio space.

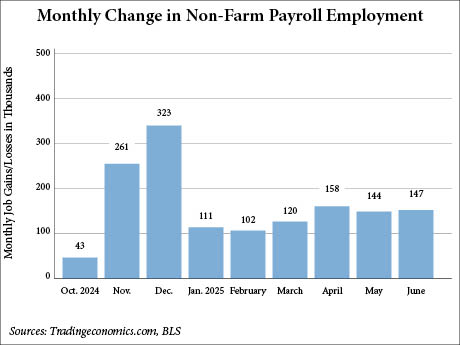

WASHINGTON, D.C. — The U.S. economy added 147,000 jobs in June, according to the U.S. Bureau of Labor Statistics (BLS). The monthly figure surpasses the estimated 110,000 jobs by Dow Jones economists, according to CNBC. The total also contrasts ADP’s report yesterday that the private sector lost 33,000 jobs in June, which CNBC reported was a surprise to economists who were forecasting an increase of 100,000 jobs. While surpassing expectations, the June total is on target with the average 146,000 jobs added over the prior 12 months, according to the BLS. The leading employment sector this past month was government, which added 73,000 jobs. State governments added 47,000 jobs, mostly in education (+40,000), and local governments added 23,000 jobs. Job losses continued at the federal level as 7,000 jobs were lost in June. Other sectors that saw job gains in June included healthcare (+39,000) and social assistance (+19,000). Employment changed little in most other fields, including construction, manufacturing, retail trade, transportation and warehousing, professional and business services and leisure and hospitality. The BLS also reported that the unemployment rate changed little at 4.1 percent, which marks 13 consecutive months where the unemployment rate has landed between 4 and 4.2 percent. …