By Sandy Schmid, director of acquisitions and development, StarPoint Properties In the fast-paced world of commercial real estate, foresight is as valuable as bricks and mortar. Despite whispers of distress on the horizon for the Lone Star State in 2024, the multifamily real estate market is ablaze with potential. Texas is one of the hottest destinations for developers and investors, and the strategic play is to not just weather the storm, but rather to ride it to success. Recent predictions of multifamily distress starting in the latter half of 2023 have certainly raised eyebrows and fueled speculation. However, predicting the Texas real estate market is akin to forecasting a Wild West shootout — a challenging task given the state’s history of resilience and its ongoing growth. Texas has consistently proven its ability to rebound from economic challenges, and current indicators suggest that the multifamily sector is poised for sustained growth. A Growth Powerhouse One factor supporting the optimistic outlook is the impressive trajectory of Texas’ GDP growth. The state saw a notable increase in its GDP over recent years: 5.7 percent growth in 2021, 2.7 percent in 2022 and 3 percent in the first quarter of 2023 alone. This data compares …

Multifamily

By Taylor Williams HOUSTON — Industry professionals say that while the fundamentals that underlie multifamily properties in major Sun Belt markets are quite healthy, the broader conditions of the U.S. capital markets are so choppy and disruptive that lending volumes are depleted across the board. The dearth of deals isn’t exclusively attributable to the Federal Reserve raising interest rates, which has now happened 11 times in 17 months. The nation’s central bank is now targeting a short-term benchmark range from roughly 5.25 to 5.5 percent, the highest level since 2001. Underwriting standards are tightening as owners reckon with serious increases in property taxes and insurance, among other items. Major banks are scaling back their originations in favor of keeping more reserves on hand in anticipation of exposure to defaults on office loans that are coming due within the next 12 to 18 months. The wounds of the collapses of regional lenders Silicon Valley Bank and Signature Bank in March are still fresh, and the country is scarcely a year removed from what will assuredly be a heated and divisive presidential election. For debt providers, the combined effect of those factors is major reluctance to transact. Lenders and investors have largely shifted …

By Taylor Williams Multifamily investment sales activity has been muted across major Texas markets during the first half of 2023, underscoring the unfortunate reality that even the most coveted asset classes are not immune to severe macroeconomic headwinds. Much like a year ago, the combined effects of stubborn inflation and corresponding interest rate hikes have wrought visibly negative changes to the world of multifamily investment sales. But in summer 2022, deals were still getting done at a decent clip; price disparities and depreciation were the most significant and obvious impediments to deal velocity. Today, buyers and sellers are more closely aligned on market realities as relates to price points, but many are simply not motivated to transact — at least in the short term. According to data from RealPage, in the first quarter of 2023, there were 337 multifamily transactions within the Dallas-Plano-Irving triangle, down from 510 in the first quarter of 2022. The greater Houston area saw 266 deals executed in the first quarter this year, a decline from 410 during that period in 2022, while the Austin market’s total number of transaction fell from 191 to 123 quarter-over-quarter. Multifamily sales prices responded differently to reduced deal volume from …

By Steve LaMotte Jr., CBRE With 2021, a record year for asset appreciation and fundamentals, 2022 marked a turning point in the apartment space across the nation. Multifamily leasing velocity, rent growth and occupancy levels have seemingly reached their current peak levels and begun to cool. Instability in the capital markets throughout much of 2022 encouraged many on both the buy and sell sides to wait it out, looking for signs of stability. However, despite the turbulence and the pause, the multifamily sector has remained resilient and is expected to maintain its claim as the preferred asset classification in 2023. Further, metro Indianapolis has been a standout performer in every meaningful measurement. Now widely regarded as an emerging star of the Midwest, metro Indianapolis has earned its place as the nation’s rent growth leader in the back-to-back months of October and November of 2022, according to Yardi Matrix. The metro has outperformed many major markets while maintaining its characteristic affordability. According to research from CBRE Econometric Advisors, the average metro rent of $1,200 per unit ($1.30 per square foot) shows that metro Indianapolis will deliver outsized rent growth in times of distress while remaining one of the most affordable metro’s …

By Cody Roskelley, senior developer at Pennrose Texas has experienced tremendous residential growth over the last few years. Families are leaving high-cost, high-tax areas like New York and California for more affordable alternatives. According to The Tax Foundation, Texas was one of the Top 10 U.S. states for inbound migration in 2021, posting population growth around 1.3 percent on a year-over-year basis. With population increase also comes opportunities for economic growth and regional investment. However, having high-quality, affordable and workforce housing stock is key to the state successfully capitalizing on this moment. Between historically high rates of inflation and single-family home prices, as well as aggressive interest rate hikes, having the affordable housing infrastructure in place to attract new residents is critical. While most people generally agree that there is a need for more affordable housing, there is often local pushback once such communities are proposed in their neighborhoods. Much of the opposition stems from a lack of understanding of what affordable housing is — and isn’t. For example, individuals making anywhere between 30 to 80 percent of the area median income (AMI) can qualify for affordable housing. There are also several different subcategories of affordable housing: Low-Income Public Housing: …

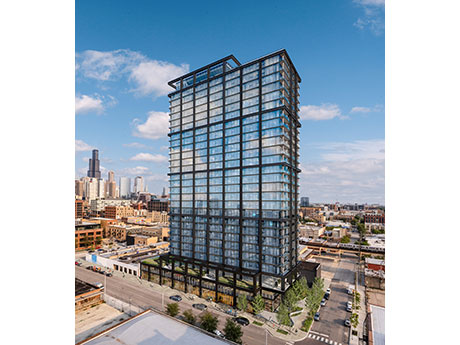

By Tyler Hague, Colliers A colleague of mine recently had to move out of her West Loop apartment quickly and she faced a conundrum: how much am I willing to pay for a one-bedroom apartment in Chicago? The unfortunate answer: not even close to the $2,700 per month rent she was continually being asked to pay. She ended up renting a studio. The average price for a one-bedroom apartment in the central business district is $2,478 per month, a figure that has grown 9.5 percent in the last year alone and equates to a $235.41 year-over-year rental increase, according to Yardi Matrix. It also translates to a national housing insecurity crisis, not just a local and presumed urbanized problem, and one that has been exacerbated by many of the detrimental housing laws and zoning regulations that exist in Chicago today. Whether it is aldermanic privilege, the Affordable Requirements Ordinance (ARO) or general NIMBYism, it is clear rent is too darn high — and it isn’t the entrepreneurial real estate professional’s doing but rather a major (and obvious) supply dilemma. This summer, for the first time in U.S. history, median rent costs in major cities surpassed $2,000 per month, according to …

By Kevin Leamy, senior vice president, debt & equity, Northmarq Dallas-Fort Worth (DFW) has been one of the hottest multifamily markets in the country over the past five years. And as the area’s growth pushes further north, developers and investors are finding plenty of liquidity to support transactions. The northern DFW suburbs experienced a huge inflow of people over the past several years. The growth to suburbs such as Addison, Richardson, Plano, Frisco and McKinney gained even more traction during the pandemic. An increasingly diverse employer base and corresponding job growth are attracting people and driving demand for both for-sale homes and multifamily units. Instead of making a long commute into downtown Dallas or Fort Worth, there are now several big employers in North Dallas that offer high-quality jobs. One key catalyst for expansion was the opening of Toyota’s North American headquarters in Plano five years ago. The 100-acre campus is home to more than 4,000 employees. Other major corporations have followed, including the newly opened regional headquarters for J.P. Morgan Chase. Another factor drawing new residents to the area is strong schools, including a reputation for some of the best elementary and high schools in the country. Multifamily developers …

By Dan Thies, Sansone Group We are more than halfway through the year and the multifamily market in the St. Louis metropolitan area continues to grow. As of the first quarter, there were 5,112 multifamily units under construction in the metropolitan area. So far, the rise in interest rates and the increase in construction costs has not dampened the enthusiasm of investors and developers for constructing new units in this market. Vacancy rates continue to stay low and lease rates continue to increase. As long as these market conditions continue, developers are going to bring new units to market. The new units being built will reflect new design features, which many developers are implementing in their communities. One of the many design trends taking place across the country and in the St. Louis area addresses the rise in the older population becoming renters. Many members of the baby boomer generation are looking to sell their suburban homes to downsize into smaller, more practical spaces. Their children have moved out of the home, and they no longer need all the space or maintenance of a home. They want to pull the equity out of their home and place it in a …

By Chris Armer, Hoefer Welker People who call the Kansas City metropolitan area home know it’s a desirable place to live. From the robust job market and vibrant arts scene to its rich history and, of course, stellar sports teams, the Kansas City metro area attracts a diverse group of people. Kansas City is evolving and so are its housing needs. In recent years, the demand for multifamily development in Kansas City has grown, driven by a range of factors. Mass retirements and flexible work arrangements are shifting priorities, while the housing shortage and rising interest rates are sending prospective homeowners on the search for attractive alternatives. The multifamily housing trend stands to gain momentum, creating a space for discerning real estate and architecture firms with development expertise to pave the way in an evolving housing market. The great shuffle Much has been said about the Great Resignation, but the COVID-19 pandemic didn’t only affect young and midlife workers who left their jobs to pursue higher-paying and more meaningful employment. It also hastened the Great Retirement, a massive wave of baby boomers leaving the workforce, many of them earlier than planned. Now those homeowners are selling their suburban single-family …

By Taylor Williams First things first: By most objective metrics and standards, multifamily assets in major Texas markets still represent strong investment propositions relative to certain other commercial sectors, as well as to the stock market, the other long-term vehicle to which real estate investments are most commonly compared. But as we cross the midpoint of 2022, the U.S. economy finds itself awash in a unique combination of challenging and extreme circumstances. Mainstream news coverage increasingly includes the word “record” in reports on inflation, one-off interest rate hikes and movement in the 10-Year Treasury yield. The yield on two-year Treasury notes recently eclipsed that of the 10-year, creating the “inverted curve” that has historically been an indicator of an upcoming downturn. Rumblings of an imminent recession grow louder by the day. Fear is contagious, and some markets are already showing signs of hunkering down in anticipation of a downturn. The expectation of recession, let alone the materialization of it, impacts even the strongest of markets, including multifamily assets in Texas. Investors and brokers who specialize in the property type recognize that certain factors — net in-migration of hundreds of thousands of people per year, exceptional corporate relocation activity, and supply …

Newer Posts