The more things change, the more they stay the same. More than 150 years after the old French proverb was coined, industrial real estate professionals in Texas who have a penchant for philosophy may well be seeing its application play out in real time. While the industrial market has cooled from 2021 and early 2022, when insatiable demand drove record rent growth, there are still enough positive fundamentals within the space to counteract the likes of inflation, interest rate hikes and geopolitical uncertainty during an election year. Against that backdrop, owners and brokers are frequently reminded of how fortunate they are to be doing business in the Lone Star State. Muchos Gracias Job and population growth are the Letterman guests who need no introduction, as they have always driven expansion and value creation in Texas across all sects of commercial real estate. But as powerful as those drivers are, they’ve been there all along. In recent years, as disruption in debt markets has slowed industrial supply growth and inflation has put pressure on tenants’ costs of occupancy, other macro-level forces have also emerged to buoy the market. Specifically, the impacts of a growing concentration of manufacturing operations in Mexico have …

Texas

Historically, the fortunes of many commercial real estate endeavors in Houston have been tied to the energy sector. But as developers and leasing agents across all major property types know, the market now boasts a much more diverse set of growth drivers, including regional distribution, healthcare, aerospace/defense and financial services. Each of these industries fuels growth in development and absorption of commercial space, not to mention housing. Yet even to the layman, these industries are as different as the commercial structures that house their operations. And taken collectively, the performances of Houston’s commercial properties do not always paint a wholistic picture of the larger economy. That holds especially true in times of larger macroeconomic disruption like the present. Texas Real Estate Business recently reached out to developers/owners, as well as leasing agents/managers who are deeply immersed in the Houston multifamily, industrial, retail, office and mixed-use sectors. By posing a quintet of questions that are — almost — equally applicable to each of these asset classes, we uncover insights on how the five major food groups are performing on a relative basis. Participating in the Q&A are Matt Bronstein, vice president at BHW Capital (multifamily); Robert Clay, president and co-founder of …

Economic development is, in many ways, the business of facilitating growth. Yet in Texas, thanks to an array of business- and development-friendly policies and laws, influxes of jobs, people and new real estate projects to support them sometimes seem to just happen naturally. When this kind of heavy growth is sustained over time, it can lead to less-affordable housing, more cookie-cutter retail scenes and heavier congestion and pressure on local infrastructure. But it is possible for smaller municipalities to embrace job and population growth with new real estate uses and projects in ways that don’t entirely compromise the historic charm or tranquility that many residents of these cities value. Revitalizing a downtown area — bringing in new businesses, adaptively reusing older buildings, creating pedestrian-friendly networks — is a primary means of marrying those objectives. When a successful downtown revitalization program is executed, the benefits tend to have a domino effect. Elevated foot traffic boosts sales at local businesses, increasing asset values over time and stimulating sales of properties. Other investors take note of the viable business plan, and the rest becomes history. But the whole process often starts with the visions of local business owners and the willingness of local …

By J. Wickam Zimmerman, CEO, Outside The Lines Inc. The use of artificial intelligence (AI) technology is growing in retail commerce, where it’s already helping businesses track inventory, forecast demand and suggest new products to consumers. But how does AI figure into retail real estate? Can it be used to enhance engagement and drive success at the properties themselves? Could it help entice shoppers to step away from their online shopping carts and venture out into the real world? The answer is a resounding yes, and we’re already seeing this play out in the Lone Star State. Creating Spaces That Attract & Retain With major Texas markets like Dallas-Fort Worth and San Antonio seeing record-high retail occupancy rates, many property owners are focused on capitalizing on this momentum. To keep foot traffic high and remain competitive with other local developments and online shopping, it’s more important than ever to create unique draws to centers. A key strategy involves creative placemaking and offering experiential destinations that are increasingly bolstered by technology, including AI. To stay ahead, retail centers today must offer an experience that can’t be replicated virtually. This requires having dynamic, interactive onsite features and leveraging technologies that are just …

By Taylor Williams When it comes to industrial supply growth in Central Texas, the usual suspects — land availability, interest rate movement, time-consuming permitting and approval processes — are all secondary to the need for more infrastructural development to support these projects. Roadways, public transit systems, electrical capacity, sewerage and water services — these are the key ingredients in the recipe for successful industrial development in Central Texas that can sometimes be overlooked or understated in importance. As such, economic development corporations (EDCs) in the area are prioritizing infrastructure development in their work as they help developers add much-needed industrial space to support the area’s burgeoning population. While underlying, efficient infrastructure is critical to all real estate developments and human occupation, it is especially crucial to industrial projects. Large-scale manufacturing facilities — think Tesla in East Austin and Samsung in its northern suburb of Taylor — employ thousands of people. Housing hasn’t caught up to population growth in many of the surrounding communities, necessitating alternate means of commuting. In addition, manufacturing and e-commerce facilities tend to have above-average electrical capacity requirements. Financially, meeting that demand might be made somewhat easier in a state that has a deregulated power grid, but logistically, …

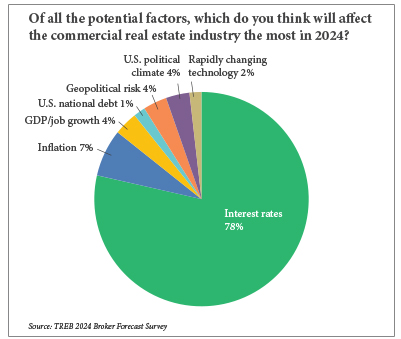

By Taylor Williams For the last several years, as COVID-19, inflation and interest rate hikes have chronologically rocked the commercial real estate industry, the term “dry powder” has increasingly factored into investment discussions. While the term generally refers to cash or capital that is parked on the sidelines, 2024 could well be the year for its deployment. There are several basic reasons for endorsing this notion. First, at its December meeting, the Federal Reserve signaled that it would cut rates three times this year, which should theoretically make debt financing more accessible and less expensive — though the extent of that depends on the magnitude of the reductions. Second, as evidenced by the stock market tear following that announcement, investors are itching to deploy capital and will rally around just about any reason to do so, proven or not. Third, there is roughly $537 billion in commercial real estate loans that will mature next year, according to New York City-based Trepp. This staggering volume of impending maturities in a high-interest-rate environment all but assures that some assets will be forced into sales, whether by owners pre-default or lenders post-default. And finally, the 10-year Treasury yield — the benchmark rate against …

By Taylor Williams The Houston industrial market has generally performed quite well over the past few years, even as a global pandemic, record inflation and hard-hitting interest rate hikes have rocked the commercial real estate industry as a whole. Demand for industrial space has held firm due to rebounding energy prices and expansions in infrastructure and traffic at Port Houston, as well as organic population growth and economic diversification that has elevated the market’s role as a distribution hub. According to data from CBRE, the market has a 6 percent vacancy rate and posted 5.1 million square feet of positive net absorption through the first three quarters of 2023. The volume of new construction was on track to outpace absorption in 2023 when the report was released. But that was not the case in 2021 and 2022, years in which net absorption equaled and exceeded 7 million square feet, respectively. New deliveries totaled approximately 5.6 million and 5.4 million square feet in each of those years, driven not only by the aforementioned factors but also by a temporary uptick in demand for e-commerce services in the wake of the pandemic. In any market or asset class, when absorption exceeds supply …

By Sandy Schmid, director of acquisitions and development, StarPoint Properties In the fast-paced world of commercial real estate, foresight is as valuable as bricks and mortar. Despite whispers of distress on the horizon for the Lone Star State in 2024, the multifamily real estate market is ablaze with potential. Texas is one of the hottest destinations for developers and investors, and the strategic play is to not just weather the storm, but rather to ride it to success. Recent predictions of multifamily distress starting in the latter half of 2023 have certainly raised eyebrows and fueled speculation. However, predicting the Texas real estate market is akin to forecasting a Wild West shootout — a challenging task given the state’s history of resilience and its ongoing growth. Texas has consistently proven its ability to rebound from economic challenges, and current indicators suggest that the multifamily sector is poised for sustained growth. A Growth Powerhouse One factor supporting the optimistic outlook is the impressive trajectory of Texas’ GDP growth. The state saw a notable increase in its GDP over recent years: 5.7 percent growth in 2021, 2.7 percent in 2022 and 3 percent in the first quarter of 2023 alone. This data compares …

By Ryan Johnson and Tyler Grisham, managing partners and market leaders, SRS Real Estate Partners Those who live and work in Dallas-Fort Worth (DFW) should be grateful for the metroplex’s strong fundamentals. There are a lot of macro-level factors that are out of whack and hurting the commercial real estate business, but there are also a lot of macro factors working in favor of DFW that not many major markets in the United States can claim. Thinking glass half-full, DFW has enjoyed exceptional growth in employment, housing and population over the last decade. According to the U.S. Census Bureau, DFW now boasts nearly 8 million residents, which makes it the nation’s fourth-largest metropolitan area. According to the Dallas Regional Chamber, 14 major companies relocated to North Texas in 2023 — Kelly Moore Paint Co., Inbenta, McAfee Corp., Frontier Communications and West Shore Homes, among others. Thinking glass half-empty, DFW has sky-high construction costs, the highest interest rates in recent memory, highest exit cap rates/lowest valuations in recent memory and just a general market mentality that causes developers, banks and investors to exercise great caution. Active Segments, Trends Given these challenges, it may be surprising that there are retailers that are …

By Taylor Williams The growth story of Central Texas is compelling enough that commercial developers and investors are still aggressively targeting the region, even as costs of doing business hit the roof. In fact, both cities recently cracked the Top 10 on Urban Land Institute’s list of markets to watch in the organization’s Emerging Trends report for 2024. To dispense with the bad and obvious, the region — loosely defined as the swath of land bookended by the Austin and San Antonio metro areas — is not exempt from wide-ranging industry headwinds. Newer trends like working from home, as well as entrenched issues like a shortage of affordable housing and crushing interest rates, impact deals and projects in high-growth markets perhaps even more harshly than their smaller counterparts. This is simply due to the principles of supply and demand. Further, the region faces homegrown challenges stemming from a decade-plus of hyper-accelerated expansion, namely a skyrocketing cost of living and insufficient infrastructure to support demand from tenants and residents. But the fundamentals of job and population growth remain so robust in Central Texas that buyers and builders, particularly within the industrial and multifamily spaces, can still invest and develop in this …

Newer Posts