The effects of sweeping macroeconomic forces in recent years are now manifesting themselves in industrial projects in Dallas-Fort Worth (DFW). And while the market still enjoys healthy fundamentals and tenant demand, the product being delivered now comes with a new look, functionality and set of requirements from end users. To some degree, this paradigm shift in how industrial properties are conceived, designed and constructed stems from major economic factors and trends that are beyond the ability of architects, contractors and developers to control. To start with the obvious, interest rates are now five times what they were 18 months ago. When hikes of that magnitude are enacted so expeditiously, real estate professionals of all walks are impacted, even if it’s in an indirect manner. “Demand for industrial space is there; if developers are building, the rents are probably there to cover those costs,” says Mike Williams, vice president of preconstruction at Dallas-based Talley Riggins Construction Group. “But for developers that are trying to form a team to get enough equity to get a loan — those deals aren’t working anymore with these rates. So paying extra close attention to who your clients are and their funding sources has been the …

Texas

By Taylor Williams Brick-and-mortar retail has quietly, yet emphatically resurrected itself from the e-commerce- and COVID-induced death knell, bolstered by multiple years of low supply growth that have put a premium on quality space and allowed landlords to zero in on what truly constitutes a winning concept. This notion is inherently subjective and difficult to quantify. But in Dallas-Fort Worth, retail owners and operators say that authenticity — as defined by uniqueness of the offerings and adherence to and reflection of local culture — is paramount to success. From the presentation and packaging of products and services to utilization of local architectural styles to creating a certain shopping or dining ambiance, the ability to capture the authenticity of the market is crucial. Consumers and landlords can afford to be choosy, and they won’t waste time at stores, restaurants or entertainment venues that feel cookie-cutter, phony or out-of-place. But retail landlords can ill-afford to do deals with tenants that simply look the part but lack the financial ability to pay rents, which are growing in urban locations where availability of space remains tight. Monetary due diligence remains critical, but as often as not, there is considerable overlap between the financial solvency …

By Ryan Kimura, senior vice president of strategic partnerships, Premier The changing landscape of work and the future of the office remains in flux, leading to a reduced demand for office space in major metropolitan areas throughout the country. This shift has rendered many office buildings underutilized and obsolete, prompting developers and investors to seek alternative uses for these structures. Simultaneously, urbanization continues to grow, fueling the demand for housing and a need for innovative multifamily solutions. Office-to-multifamily conversions provide an answer to both challenges, repurposing office spaces into much-needed residential units while allowing investors to capitalize on demand. This perfect storm of reduced office demand, increased housing needs and favorable regulatory conditions has driven the popularity of office-to-multifamily conversions, positioning them as a sustainable strategy for urban development. These conversions began to surge in popular metro areas during the height of the pandemic as uncertainty surrounded the return to the workplace. Fast forward three years later and office conversions are still booming — especially in the Dallas market. The region, which has witnessed some of the largest population increase in the country over the past five years, has also had a double-digit office vacancy rate in its downtown area …

By Herb Weitzman, executive chairman, Weitzman The major Texas metro areas of Austin, Dallas-Fort Worth, Houston and San Antonio all share one thing in common: Their retail markets are posting balances of supply and demand that outpace every other major commercial real estate category. This milestone was not achieved without overcoming significant obstacles. The major Texas retail markets have survived decades of back-to-back challenges, including major market disruptors like e-commerce, the 2008 Financial Crisis that knocked out several major chains and 2020’s pandemic-induced shutdowns. Each of these significant disruptions and challenges first resulted in store closings and higher vacancy rates. But retail operators as well as commercial brokers and landlords all learned from the setbacks by embracing the lessons of these disruptions to understand how to creatively bounce back stronger. As a result of the market’s careful pivoting, the retail markets in Texas’ major metros have right-sized and are reporting a yearslong trend of balance in supply and demand. To illustrate this point, we used the mid-year reports from CoStar Group on the non-retail CRE types. We compared retail vacancy rates in the four Texas markets to CoStar’s mid-year rates for the industrial, office and multifamily spaces in each of …

By Ron Gilbreath, managing director of asset & property management, Westmount Realty Capital It’s no trade secret that global lockdowns during the pandemic had a significant and lasting impact on supply chains worldwide. EY’s 2023 poll revealed that 72 percent of senior-level supply chain executives experienced negative impacts on their businesses due to the pandemic, resulting in the emergence of a concentrated focus on supply chain visibility. The crucial point to acknowledge during this continued disruption is that these impacts are closely tied to the just-in-time (JIT) inventory management system. As a result of these challenges, businesses are actively reassessing their distribution network strategies, leading to a surge in demand for industrial warehouse space. With the necessity to maintain greater inventory levels, companies are re-evaluating their warehouse space requirements and distribution setups to mitigate the risk of future supply shortages. The lockdowns disrupted two essential elements of JIT strategy: steady production and supplier reliability. Suppliers forced to comply with government lockdowns incurred major disruptions across various business lines due to the challenge of maintaining consistent production. This is a key component of JIT delivery that relies on having materials physically present during the production process. When these materials are unavailable, …

By Ben Wallace, SIOR, vice president, Colliers Over the past decade, “suburban industrial” buildings have become more critical than ever. A suburban industrial building can be defined as one that is located within the suburbs of a major metroplex and designed for small- to medium-size users with above-average allotments of office/showroom space to accommodate service and light distribution uses. The typical building and infrastructure designs naturally limit heavy truck traffic and achieve higher rental rates, deterring heavy distribution and manufacturing users from locating there. With macro-level shifts in how people shop for and acquire goods and services, the need for suburban industrial buildings that are located near consumers has become increasingly important. Most cities have done an excellent job of regulating and altering development standards for these assets to meet this need while being careful to avoid creating rundown industrial areas in their communities. These cities have achieved this goal by elevating development standards to feature clean concrete exterior façades as well as the screening of dock loading areas and attractive glass entrances. The reason that many of these items are important is that the vast majority of these suburban industrial developments are not appropriately zoned when developers come to …

By Taylor Williams Multifamily investment sales activity has been muted across major Texas markets during the first half of 2023, underscoring the unfortunate reality that even the most coveted asset classes are not immune to severe macroeconomic headwinds. Much like a year ago, the combined effects of stubborn inflation and corresponding interest rate hikes have wrought visibly negative changes to the world of multifamily investment sales. But in summer 2022, deals were still getting done at a decent clip; price disparities and depreciation were the most significant and obvious impediments to deal velocity. Today, buyers and sellers are more closely aligned on market realities as relates to price points, but many are simply not motivated to transact — at least in the short term. According to data from RealPage, in the first quarter of 2023, there were 337 multifamily transactions within the Dallas-Plano-Irving triangle, down from 510 in the first quarter of 2022. The greater Houston area saw 266 deals executed in the first quarter this year, a decline from 410 during that period in 2022, while the Austin market’s total number of transaction fell from 191 to 123 quarter-over-quarter. Multifamily sales prices responded differently to reduced deal volume from …

By Taylor Williams The current industrial development landscape in Texas is a true testament to the awesome power of demand — and of interest rate hikes. From El Paso to Houston, industrial users of all sizes and across all industries continue to demand new or expanded spaces to accommodate their ever-growing warehousing, distribution and manufacturing needs. E-commerce, nearshoring, COVID-19 — name your impetus — they’ve all contributed to a feverish pace of industrial development and absorption in recent years. According to fourth-quarter 2022 data from CBRE, Dallas-Fort Worth (DFW) saw an annual supply gain of about 36.1 million square feet in 2022 while posting positive net absorption of 36.5 million square feet. Third-party logistics users drove much of the new leasing activity, which contributed to a 4.6 percent vacancy rate at the end of the year. The market has now posted consecutive years of sub-5-percent vacancy. Fittingly, there remains more than 75 million square feet of product under construction throughout the metroplex. In Houston, developers delivered approximately 18.8 million square feet of new industrial space in 2022, per CBRE. Yet the market posted more than 30 million square feet of positive absorption over the course of last year, and the …

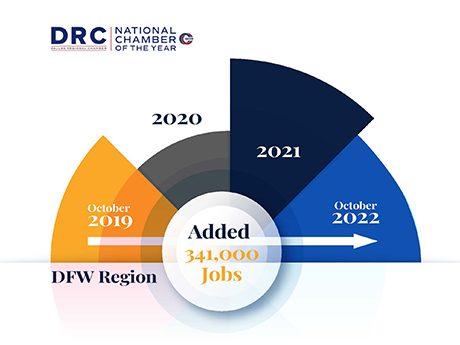

By Kent Elliott, principal, and Chase Fryhover, director, RETS Associates While December’s national jobs report painted an optimistic picture of the employment landscape, some sources have noted that workers in commercial real estate are leaving the industry. Yet although some national brokerage firms may be trimming the fat to cut costs in light of recent economic uncertainty, this trend does not seem to apply to Texas-based commercial real estate companies. In fact, according to Estateserve, with the Texas office market booming, vacancy rates dropping and rents rising, “Texas’ commercial real estate is experiencing a resurgence.” As a national executive search firm that has served the industry for more than two decades, RETS Associates has a seasoned perspective on job markets throughout the country. Here are the trends we are noticing throughout the industry in Texas and why we believe the market is poised for ongoing strength and stability. Continued In-Migration Texas is the ninth-largest economy in the world, as well as one of the leading markets in the country in job and economic growth. The Dallas-Fort Worth (DFW) area in particular, the fourth-largest MSA in the country, led the country in population growth in March 2022 and in post-pandemic job …

HOUSTON — International developer Skanska has topped out 1550 on the Green, a 28-story, 375,000-square-foot office building located within the Discovery Green area in downtown Houston. Designed by BIG Bjarke Ingels Group, the building will include 7,000 square feet of ground-floor retail space, and tenants will have access to a fitness center and outdoor terraces with event spaces. CBRE is marketing the office space for lease, while SHOP Cos. is leading the lease-up of the retail component. The development team expects to begin welcoming tenants to the building before the end of the year.