Savannah Duncan

CHARLOTTE, N.C. — Economic conditions in the Carolinas and in Charlotte in particular are the envy of many other parts of the country, according to Sam Chandan, president of New York-based Chandan Economics and professor of real estate at the Wharton School of Business.

“A combination of a high quality of life, a low cost of living and an extraordinarily well-educated workforce have combined with a high-quality transportation structure and good quality housing stock to ensure a stronger and more stable recovery than what we see in many other parts of the country.”

His comments came during the InterFace Carolinas Conference, held at the Omni Hotel in Charlotte last week. The one-day event attracted more than 225 industry professionals from across the region and featured networking opportunities.

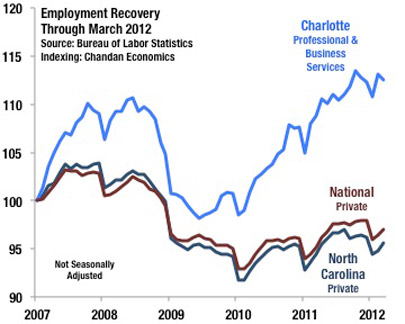

Armed with a strong financial services sector, Charlotte is performing much better than other markets in North Carolina that are more dependent on public services.

“Local and state governments are beginning to lose jobs as they run out of the federal dollars to fund local government as well as teachers and social service workers,” Chandan said.

The unemployment rate in North Carolina reached its peak of 11.4 percent in January 2010 and has been steadily decreasing, according to the Bureau of Labor Statistics. In March, the state unemployment rate registered 9.7 percent, the lowest mark since March 2009. The unemployment rate in Charlotte, however, was a healthier 8.5 percent.

The unemployment rate in North Carolina reached its peak of 11.4 percent in January 2010 and has been steadily decreasing, according to the Bureau of Labor Statistics. In March, the state unemployment rate registered 9.7 percent, the lowest mark since March 2009. The unemployment rate in Charlotte, however, was a healthier 8.5 percent.

“For a lot of people in this country, whether or not a recession is over doesn't depend on the definitions that economists use, but whether or not they are able to re-enter the labor market,” he said.

Full recovery from the Great Recession relies on consumer confidence, which leads to consumption. “Personal consumption is the largest driver of the American economy,” Chandan said.

However, with lower-paying jobs driving growth in the labor market, there's been a relative slow growth of income, which has caused consumer credit to rise.

“Americans are spending again, but it's based on borrowing, not income growth,” he said. “That fundamental mismatch can only be resolved when we start to see job growth. It remains the missing link to this recovery.”

Chandan said that the creation of office-based jobs is the key to commercial real estate experiencing a comeback. “If we aren't creating [those jobs], we aren't driving demand for use of office space,” he said. “If we aren't driving people back to work, we aren't funding the discretionary retail spending that can drive absorption of space in the retail sector. This must be addressed, at least at the national level, in a much more serious way.”

In every recession since World War II, it took roughly 2 years to recover all of the jobs that were lost, but this recession has been harder, he said. “This recession has now been over for longer than it lasted.

— Savannah Duncan