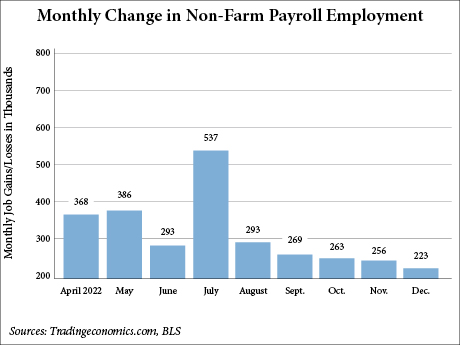

WASHINGTON, D.C. — Total U.S. nonfarm payroll employment increased by 223,000 in December, while the unemployment rate fell to 3.5 percent, according to the U.S. Bureau of Labor Statistics (BLS). The leisure and hospitality industry added 67,000 jobs, leading all employment sectors.

The latest employment figures released this morning beat expectations. Economists surveyed by Dow Jones had estimated the U.S. labor market grew by 200,000 jobs in December.

Meanwhile, average hourly earnings for all employees on private nonfarm payrolls rose by 0.3 percent in December. Over the past 12 months, average hourly earnings have increased by 4.6 percent, coming in below the 5 percent estimate, an indication that inflation pressures could be easing.

In 2022, the leisure and hospitality sector added an average of 79,000 jobs per month, substantially less than the average gain of 196,000 jobs per month in 2021. Employment in the industry remains below its pre-pandemic February 2020 level by 932,000, or 5.5 percent.

Healthcare employment increased by 55,000 in December, with gains in ambulatory health care services (+30,000), hospitals (+16,000), and nursing and residential care facilities (+9,000). Job growth in healthcare averaged 49,000 per month in 2022, considerably above the 2021 average monthly gain of 9,000.

In December, employment continued to trend up in food services and drinking places (+26,000); amusements, gambling, and recreation (+25,000); and accommodation (+10,000).

The government sector added 3,000 jobs in December with most of those gains coming at the federal level.

The BLS, based in Washington, D.C., revised the job gains for October downward by 21,000, from 284,000 to 263,000. The job gains for November were revised downward by 7,000, from 263,000 to 256,000. With these revisions, employment gains in October and November combined were 28,000 lower than previously reported.

“Today’s report will not lead the Fed to quickly change course with respect to the path of interest rates, and we expect a 25-basis-point hike at the next meeting,” stated Mike Fratantoni, senior vice president and chief economist at the Mortgage Bankers Association, in response to the latest nonfarm payroll employment report released by BLS. “Mortgage rates are off their highs from last year, and we expect them to trend down over the course of 2023.”

Although there are an increasing number of high-profile layoffs, particularly in the technology sector and in the mortgage industry, hiring in other sectors of the economy is more than offsetting the layoffs, according to Fratantoni. “Additionally, the November data showed that there were still more than 10 million job openings in the economy.”

— Matt Valley