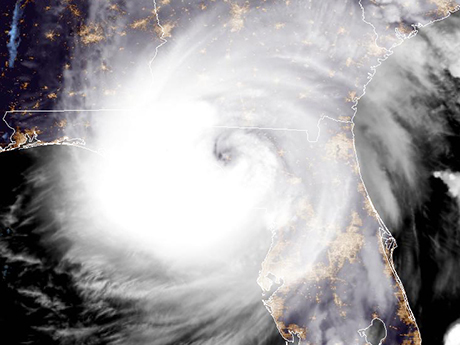

IRVINE, CALIF. — CoreLogic, a real estate information and analytics firm based in Irvine, has estimated that real estate property damages stemming from Hurricane Helene will fall between $30.5 billion to $47.5 billion. The storm made landfall around 11 pm on Thursday, Sept. 26 near Perry, Fla., and made its way through several Southeastern states, with its damage especially severe in western North Carolina. According to several national media outlets, the death toll from the storm stands at 227 across six states as of this writing with an unknown number reported missing.

CoreLogic’s calculations include both residential and commercial real estate properties as well as automobiles in 16 states, but excludes damage to personal marine craft, offshore infrastructure, governmental structures and infrastructure such as roads and bridges.

CoreLogic tabulates that losses from wind damage will fall between $4.5 billion to $6.5 billion; insured flood damage, both for inland flood situations and storm surges, will range from $1.5 billion to $4.5 billion for privately insured properties and $4.5 billion to $6.5 billion from the Federal Emergency Management Agency’s (FEMA) National Flood Insurance Program (NFIP); and $20 billion to $30 billion in uninsured floor damage. Insured loss represents the amount insurers and NFIP will pay to cover damages. Unlike wind damage, which is covered by a standard homeowners policy, flood is a separate coverage that is not mandatory outside the designated special flood hazard areas (SFHAs).

“The fact that so much damage was concentrated outside the SFHAs makes it challenging to realize the full extent of impact to uninsured homeowners,” says Jon Schneyer, director of catastrophe response at CoreLogic. “Thankfully FEMA’s NFIP is expected to provide up to $6.5 billion of insurance for the recovery efforts, which will help bring much-needed recovery aid to the affected areas.”