By John Dickerson, OMNE Partners

Omaha continues to be strong economically. The Omaha-area population is nearing the 1 million mark, and Omaha has been rated in the top 10 of cities to move to. Unemployment is less than 3 percent compared with about 4 percent nationally, and employment growth is about 2 percent per year.

In commercial real estate, business news generally says that Omaha is doing better than larger cities in the U.S. Of the key sectors, industrial has performed very well.

Leasing pace

Per CoStar information, Omaha’s vacancy rate is 3 percent. The total industrial square footage is 108 million square feet, and there is approximately 4 million square feet under construction. A large share of construction is due to Google, Facebook and other large users adding facilities. About 1.7 million square feet has been absorbed in the last year.

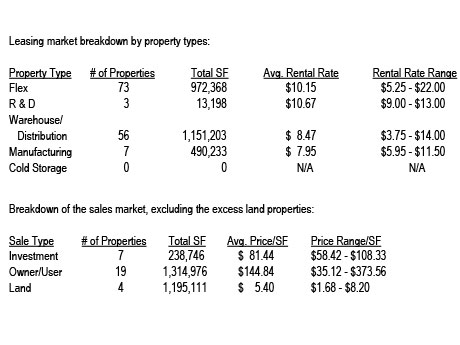

Currently, per market information gathered from Crexi listings, there is approximately 2.6 million square feet available for lease in Douglas and Sarpy counties. (See chart for a breakdown by property types.)

One other thing to note is that in the 139 properties with space for lease, there appears to be only 20 spaces for lease with 2,000 square feet or less. For those businesses needing a small space, it is a very tight market. Fortunately, there are several developers constructing flex industrial properties with positive leasing activity and with some leases getting done before the project is even completed. Most spaces available for lease are 5,000 to 20,000 square feet and some in the 50,000-square-foot or more range.

Sales activity

Sales of all property types have been difficult since the Fed interest rates have been higher. Omaha banks have been setting loan rates at 8 percent or higher, which has made it difficult for an investor to make a purchase work. And sellers are pricing their properties with cap rates that are too low. Property owners, who may have considered selling, have held back in putting their property on the market. Most of the buyers of industrial are either owner/users or buyers that need to do a tax-deferred exchange.

Per a Crexi report, there were 39 industrial properties for sale. The median cap rate is 7.2 percent and the median price is $116 per square foot. However, per CoStar data on sales, the cap rates have been in the 8.5 to 9 percent range and have averaged $107 per square foot.

In addition to developed properties for sale, there are currently 33 land properties for sale in Douglas and Sarpy counties. The total acres for sale are 1,502.5. The average asking price is $6.44 per square foot with a price range of $1.26 to $18 per square foot.

For industrial sales in Douglas and Sarpy counties in 2024, there have been 38 properties sold. Of those, 14 sales are considered investment sales; however, seven of those properties were sold with excess land, which some may have been purchased to develop the excess land. Owner/user properties were the most active with 19 sales transactions. Four land sites were sold for industrial development. (See chart for a breakdown of the sales, excluding the excess land properties.)

Industrial future

With industrial being the highly desired commercial real estate investment, future sales should increase in activity, especially with the Fed beginning to lower interest rates. Lenders should lower their interest rates accordingly, as well. However, we will probably not see the very low interest rates we experienced prior to the second half of 2022, and this will mean that cap rates will not get back to the 4 to 5 percent range. Actually, it is foreseen that interest and cap rates will be back to the historic normal levels.

This will make it difficult for owners who purchased properties from roughly 2019 to 2022 at low cap rates and high prices, so they will have difficulty selling their property for what they paid for it. The good news is that rental rates have risen. The bad news is that development, taxes, insurance and maintenance costs will probably never get back to pre-2020 levels.

John Dickerson is an executive vice president with OMNE Partners. This article originally appeared in the October 2024 issue of Heartland Real Estate Business magazine.