Amidst economic uncertainty, Louisville stands out for its resilience, establishing itself as a stalwart in today’s market. According to Apartments.com, Louisville ranked No. 1 in the nation for rent growth in the second quarter of 2024. Factors such as Louisville’s non-cyclical job growth, expanding industries including EV production and the burgeoning River Ridge project in Southern Indiana all contribute to its growth.

When we inspect the data, we see a basic yet fundamental market factor at play: supply and demand. Louisville’s supply is low relative to the growth in renters, resulting in upward pressure on rents despite a nationwide market that is largely declining.

Supply dynamics

The bulk of Louisville’s development pipeline is concentrated in Southern Indiana, with 1,039 units under construction in the Jeffersonville submarket. The Southern Indiana region has experienced solid growth with over 10,500 incoming jobs due to the economic activity from River Ridge. River Ridge Commerce Center reported an economic impact of $2.93 billion for calendar year 2023, up over $2.7 billion compared with 2022, according to Inside INdiana Business. Notable development projects in Southern Indiana include:

• The Flats on 10th, 3300 Schosser Farm Way (300-units by Schuler Bauer Real Estate)

• The Warren, 4501 Town Center Blvd. (264 units by Denton-Floyd)

• Arbour Place, 4038 Herb Lewis Road (256 units by Denton-Floyd)

Like many markets, Louisville has experienced a surge of incoming deliveries from projects that broke ground during the low interest rate period of 2021 and early 2022. In first-half 2024, 2,186 units were added to the market, which represent 2.35 percent of the multifamily inventory. This is a record amount of supply in the first half of the year, yet Louisville continues to post year-over-year rent growth every quarter.

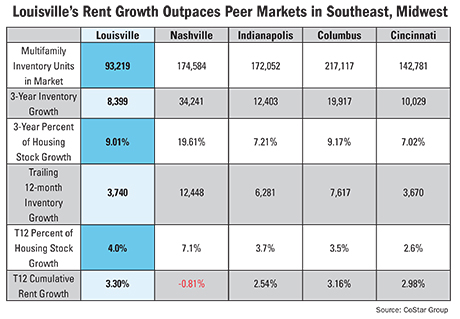

Consider Louisville’s supply relative to its neighboring markets (see table). From 2021 to 2024, Louisville delivered 8,399 units, a 9 percent growth of its multifamily housing stock. Compare this to Nashville, which delivered 34,241 units in this same period, a 19.6 percent growth of its multifamily housing stock. Even with Louisville posting record breaking inventory growth, the supply is modest, yet demand continues to outpace incoming supply.

Absorption trends

In second-quarter 2024, Louisville’s 12-month absorption was 2,389 units, exceeding the forecasted deliveries of 2,289 for the next year. This indicates that incoming deliveries cannot keep up with the trailing absorption of units. This is why Louisville is experiencing strong demand amidst a volatile and uncertain market. Louisville’s absorption is outpacing all its neighboring markets relative to the amount of incoming supply, pointing to healthy underlying dynamics.

Sales velocity

One would expect a healthy sales velocity with Louisville’s resiliency and steady rent growth. However, given the current interest rate environment and the uncertainty in the national market, sales volume continues to decline. In the first half of the year, sales volume decreased by more than 60 percent from 2023, and 2023 sales volume decreased more than 80 percent compared to 2022.

Active buyers in this market are primarily private investors, with over 50 percent of the buyers in the first half of the year being local investors. These investors benefit from their relationships with local lenders and credit unions, allowing them to qualify for value-add opportunities that do not qualify on a trailing cashflow debt-service coverage basis.

For example, a notable sale amongst private buyers includes a four-property portfolio of nearly 400 units in the south end of Louisville. The buyer was a local investor that secured financing with a local credit union. The value-add opportunity included working with nonprofit programs and government assistance to place tenants while achieving roughly a $150 to 200 monthly premium on rents.

Outlook

Looking ahead, it’s anticipated that we will start to see an uptick in sales volume for the remainder of the year. By 2025, we expect a more stable velocity trend as price discovery materializes, interest rates decrease and sellers adjust expectations.

Louisville’s multifamily market stands out for its ability to maintain stability and growth amidst broader economic uncertainty. The interplay of limited supply, strong absorption rates and active local investment underscores the market’s resilience and potential for continued success in the multifamily sector.

— By Tim VanWingerden, Associate Vice President, Matthews Real Estate Investment Services. The article was originally published in the September 2024 issue of Southeast Real Estate Business.