As the Atlanta industrial market continued its slowdown as of the end of the second quarter in 2024, there were three main stories to consider.

First, the biggest news was that the Atlanta industrial market experienced four quarters of negative net absorption of 8.8 million square feet during this past year (we have had five quarters in a row.) At the same time in 2023, we reported 17.2 million square feet of positive net absorption, and in 2022, we reported 42.7 million square feet of positive net absorption, so these latest negative absorption numbers were a huge drop from the previous positive absorption numbers.

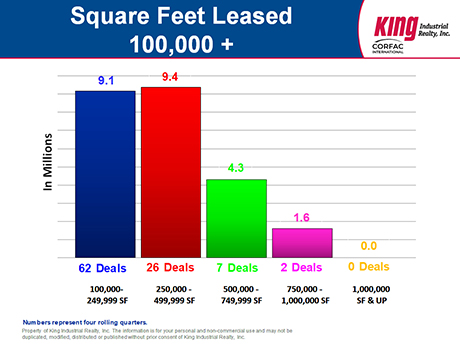

The second biggest news story was that the Atlanta industrial market saw a dramatic slowdown in big-box deals. There were only nine transactions that were consummated over the past four quarters that were 500,000 square feet or larger, and none of those deals were over 1 million square feet. In contrast, in 2023, 21 big-box transactions were completed that were over 500,000 square feet, and 11 of those deals were 1 million square feet or larger. The year-over-year decline was 15 million square feet less.

The third biggest news story was that the new construction numbers at the end of the second quarter were only 16.3 million square feet for the past four quarters. This was well below the new construction numbers from the previous year in 2023 (36.3 million square feet) and also well below the reported numbers from two years ago (43.6 million square feet). This was not surprising when you look at the drop in the absorption numbers, the drop in the activity numbers and the increase in interest rates.

With the Federal Reserve requiring lenders to hold additional reserves due to the rise in interest rates and the economic slowdown, banks have been put into a position where they cannot lend money on speculative developments. Typically, 75 to 80 percent of all new spec industrial development in the Atlanta area has been financed by banks, so the drop-off that we have experienced in new construction was predictable.

The amount of available industrial space in the marketplace has increased to 13.1 percent, which means that there is over 121.6 million square feet available to lease in the Atlanta area. A year ago, the availability rate stood at 11 percent, and in 2022 the availability rate was only 9.3 percent. The 16.1 million square feet of available sublease space represents a 13.2 percent increase year-over-year.

Slowdown in sales, leases

The activity numbers for the Atlanta industrial market have slowed down as well, but they actually went from great activity numbers for the past two years to good activity numbers this year with a total of 2,246 industrial transactions.

During the past four quarters, the activity number was over 49.7 million square feet, and while that seems like a big number, it was much less than the numbers from the past two years. A year ago, the activity was over 62.1 million square feet. In 2022, there was over 86.7 million square feet. So, while we have also seen a sharp decline in the activity numbers for the past two years, the current activity numbers closely mirror the activity numbers that we experienced before the capital markets meltdown in 2008.

Hot submarkets

There were three regions in the Atlanta industrial market that were the hottest over the past four quarters, totaling over 53.6 percent of all of the activity. The close-in I-85 Northeast region led the way with 21.4 percent (110.7 million square feet) of the activity, the Southwest (I-20 West and I-85 Southwest) region was second with 18.2 percent (9 million square feet) of the activity, and the I-75 South market area came in third with 14 percent (approximately 7 million square feet) of the activity.

Despite the negative net absorption that the Atlanta metro area experienced, three submarkets posted positive net absorption. The I-75 Northwest submarket recorded over 2.4 million square feet, the farther north I-85 Northeast submarket had positive net absorption of 937,154 square feet and the I-20 East submarket had 588,043 square feet of positive net absorption.

As far as the slowdown goes regarding new construction in the Atlanta industrial market, it is important to note that there was 222 million square feet of new construction in the Atlanta area over the past eight years, and the availability rate remained almost unchanged going from 13 percent up to 13.1 percent. Even with that much new construction, the Atlanta industrial market had been absorbing the new space up until this latest slowdown.

Macroeconomic influences

A note here regarding the Atlanta industrial investment market: With interest rates having risen as high as they have over the past few years, and with the capitalization rates not rising as fast, it has created a negative leverage scenario. In today’s current environment, if an investor requires debt to purchase an investment property the numbers do not work, and thus it has created somewhat of a disconnect between purchasers and sellers.

It is not unusual to see a market slowdown when the economy is still experiencing lingering inflation (up by 19.3 percent since January 2021), continued higher energy prices (up by 35.6 percent since January 2021), higher interest rates (the federal funds rate is up from 0.09 percent in early January to the 4.75 percent to 5 percent), and we have an upcoming presidential election. All of the above typically leads to uncertainty which usually leads to an economic slowdown.

My thoughts are that the slowdown will continue through the Presidential Election and until the end of the year. I also believe that 2025 will be a bounce-back year for our economy and for the Atlanta industrial market. The Federal Reserve will begin making cuts and lowering interest rates, and we will then see how that will affect the economy and the Atlanta industrial market.

— By Sim Doughtie, SIOR, CCIM, president of King Industrial Realty Inc. / CORFAC International. This article was originally published in the October 2024 issue of Southeast Real Estate Business.