Lenders and financial intermediaries are much more confident about the prospect for business growth in 2025 than they were heading into 2024, according to France Media’s 14th annual forecast survey conducted nationally.

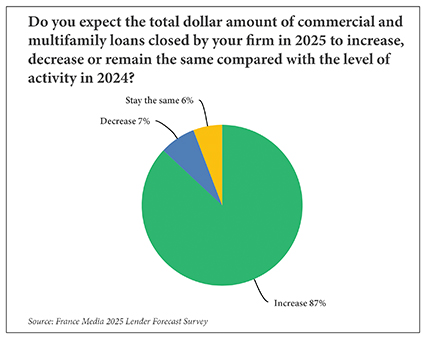

A massive 87 percent of debt providers and arrangers of capital expect the total dollar amount of commercial and multifamily loans closed by their firm in 2025 to be higher than in 2024, versus 7 percent who expect a decrease, according to the survey findings. Another 6 percent anticipate no change (see above chart).

The sentiment is much more bullish than it was heading into 2024 when 58 percent of survey respondents projected an increase in deal volume, 24 percent predicted a decrease and 18 percent said deal volume would remain the same.

Among those who expect a rise in annual deal volume in 2025, 43 percent predicted the increase will be by more than 20 percent. Another 17 percent of survey participants expect the increase in deal volume to range between 16 and 20 percent, and 15 percent of survey respondents expect an increase of 11 to 15 percent.

Slightly more than half of respondents (52 percent) said that refinancing activity will make up the bulk of lending activity at their firms in 2025, followed by construction financing (23 percent), acquisition financing (19 percent) and other (6 percent).

The email survey was conducted from mid-November to mid-December 2024. Nearly two-thirds of respondents (64 percent) identified as a mortgage broker or financial intermediary. Another 30 percent worked for either a community, regional or national bank. Survey respondents were most active in the Southeast and Western states, but all areas of the country were well-represented.

Interest Rates Are a Wild Card

The federal funds target rate range currently stands at 4.25 to 4.5 percent after the Federal Reserve lowered the rate three times in the latter stages of 2024 by a total of 100 basis points. The Fed’s rate reductions in turn caused the 30-day average Secured Overnight Financing Rate (SOFR) to drop from 5.3 percent in mid-September 2024 to 4.5 percent at the start of 2025.

That’s good news for commercial real estate borrowers because SOFR is a benchmark rate used by lenders to provide variable-rate, short-term financing.

The bad news is that the U.S. 10-year Treasury yield increased from approximately 3.7 percent to 4.6 percent during the same period. The 10-year Treasury yield is the benchmark rate used for establishing long-term rates for permanent financing.

“In the short run, borrowers with floating-rate bridge debt could benefit by these decreases. On long-term financings (loans made through Fannie Mae, Freddie Mac, HUD and CMBS), this is unlikely to affect lending activity much,” said Kevin Roach, vice president of originations at South Bend, Indiana-based Centennial Mortgage.

“Benchmarks, such as the 10-year Treasury yield, for long-term rates have increased since the Fed rate cuts. And the Fed cuts don’t have a direct impact on those benchmarks.”

Charles Krawitz, executive vice president at Chicago-based Alliant Credit Union, cited two factors that are causing short-term and long-term rates to move in opposite directions.

“While the Fed is lowering interest rates and is likely to continue to do so, the market has responded with higher rates due to inflationary concerns relating to potential tariffs and labor considerations,” stated Krawitz.

Trump, who won both the Electoral College and the popular vote in the race for U.S. president, has threatened to place a 25 percent levy on goods from Canada and Mexico to rein in illegal immigration and drug trafficking. Trump has also threatened to impose tariffs of up to 60 percent on Chinese imports in retaliation for unfair trade practices.

Nearly half of survey respondents (48 percent) indicated that interest rates will decrease during the next 12 months, but another 44 percent expect rates to remain relatively unchanged. Those figures are quite similar to last year’s survey results.

Office Sector Woes Continue

The delinquency rate of office mortgages securitized into commercial mortgage-backed securities (CMBS) increased from 10.38 percent in November 2024 to 11.01 percent in December, the highest level since Trepp began tracking delinquency rates in 2000. More than $2 billion in office loans became newly delinquent in December.

Meanwhile, the retail delinquency rate jumped 86 basis points to 7.43 percent, a 2.5-year high. (The delinquency figures are based on loans 30 days or more past due.)

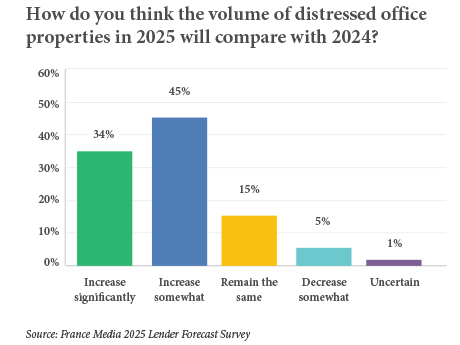

Respondents of the lender survey were asked whether they believe the volume of distressed office properties in 2025 will be greater or less than in 2024.

A combined 79 percent of respondents indicated that the volume of distressed office properties will increase either somewhat or significantly, 15 percent said the volume will remain the same and 5 percent expect it to decrease somewhat. Only 1 percent expressed uncertainty (see chart below).

In the write-in portion of the survey, some respondents cited the office market as one of the biggest challenges of 2025 in commercial real estate. One anonymous survey participant wrote that many office leases are still maturing and likely won’t be renewed at the same square footage because the work-from-home lifestyle change has reduced the demand for office space, a trend the contributor believes is here to stay.

“There is a massive oversupply of office buildings in 80 percent of the markets in the U.S. This applies to cities and suburbs and red and blue states,” wrote another respondent.

“The highly hyped ‘wall of maturities’ will continue to weigh on the commercial real estate industry in 2025,” said Alliant Credit Union’s Krawitz, referring to the large number of loans that are due to be repaid in the next several years. “The associated demand for capital will promote creativity in the capital markets as both borrowers and lenders look for innovative solutions.”

Impact of Trump’s Re-Election

The survey included more than 40 write-in responses regarding Trump’s return to the White House. Interestingly, he is only the second U.S. president to have won re-election with a four-year gap in between. The first was Grover Cleveland, who served as the nation’s 22nd president after the 1884 election. Cleveland became the 24th president after the campaign of 1892. Trump was the 45th and now 47th president.

Survey participants were asked what impact Trump’s re-election will have on the commercial real estate industry in the near term. The comments from Roy Haisley, executive vice president and lending manager at First National Bank of Tennessee, reflected the views of many write-in respondents.

“The business outlook should be more positive based on expectations of a more favorable climate for domestic growth and business taxation, plus a reduced regulatory burden. The inflation impact of more aggressive tariffs is yet to be determined but will likely offset some of the growth,” wrote Haisley, who is based in Knoxville, Tennessee.

“The most clear policy direction that we’ve gotten from the Trump administration is that they will deport current immigrants, reduce the overall level of immigration and increase tariffs,” adds Derrick Barker, founder and owner of Nectar, an Atlanta-based lender.

“This will make construction more costly in many regions as immigrant labor is heavily relied on in the construction sector. Many of the materials used in construction — flooring, roofing, appliances, lumber — are imported,” Barker adds. “Tariffs will impact the supply of the majority of materials that go into commercial real estate. This will directly raise prices. Of course, the details of the tariffs and immigration plans will matter and perhaps the impacts will be muted.

Ben Kadish, president of Chicago-based Maverick Commercial Mortgage, said the debt market is demonstrating renewed vigor. “Many lenders have opened up for new loan opportunities since the election. This is a positive for all commercial real estate owners.”

Marc Grayson, president and co-founder of RRA Capital, a Phoenix-based commercial real estate bridge lender and investment firm, believes that it’s unlikely Trump’s second presidency will have a significant impact on the commercial real estate market.

“There are things to watch, however, to see how it might be a factor in specific regions and product types,” wrote Grayson. Tax laws, tariffs, deportations and regulations all can influence the market to a degree, he noted.

“But I believe real estate markets are generally non-correlated to the administration that is in office,” concluded Grayson.

Centennial Mortgage’s Roach said there will be general optimism in the near term as developers and commercial real estate owners rally around the idea that a Trump administration will lead to a more favorable economic landscape and favorable tax policies, such as an extension of opportunity zones.

“That said, it’s unclear how quickly the new administration can actually affect interest rates and cut through the red tape affecting development. And there are legitimate fears that construction and labor costs will continue to escalate due to Trump’s stated policies toward tariffs and immigration,” wrote Roach.

Multifamily Still a Darling

Survey participants were asked, “What property sector(s) do you believe provide the most attractive financing opportunities for lenders today,” with multiple answers allowed. The multifamily sector was the property type most frequently cited by survey participants (73 percent), followed closely by industrial (72 percent) and retail (69 percent).

CBRE recently forecasted that U.S. multifamily construction starts will be 30 percent below the pre-pandemic average by mid-2025. Despite a robust construction pipeline in recent years, the commercial real estate services giant foresees rents and occupancies rising amid strong renter demand.

More specifically, CBRE is forecasting the vacancy rate to decline to 4.9 percent in 2025 from 5.3 percent in the third quarter of 2024. CBRE also projects for the average rent increase to be 2.6 percent.

Securitized Loans Roar Back

The CMBS market, a vitally important financing vehicle that emerged in the 1990s following the savings and loan (S&L) crisis, benefits borrowers and investors. A CMBS loan is a loan on a commercial property designed to be turned into a security, or bond, and sold to investors on the secondary market, according to JPMorgan Chase & Co.

Domestic, private-label CMBS issuance totaled $108.2 billion in 2024, according to Trepp LLC, a sharp uptick from $40.6 billion in 2023. The number of securitizations rose from 67 in 2023 to 125 in 2024, according to Trepp.

Survey participants were asked to predict total domestic CMBS issuance in 2025. The results show no clear consensus. The largest group of respondents (17 percent) projected that total issuance will range from $70 billion to $79 billion, followed by 15 percent who predicted issuance will be $120 billion and above, and 13 percent who forecast that it will range from $100 billion to $109 billion.

During a Jan. 8 webinar hosted by Trepp that recapped U.S. CMBS activity for 2024, Lonnie Hendry, the firm’s chief product officer, acknowledged that the sharp rise in the 10-year Treasury yield has understandably received a lot of attention within the industry.

But he was quick to remind listeners on the call that the U.S. economy is currently not in a high interest rate environment. “From a historical perspective, interest rates today are probably still below the rolling 50-year average,” he emphasized.

To Hendry’s point, the long-term average of the U.S. 10-year Treasury yield is 5.84 percent, according to YCharts, a financial data research company.

“There’s a lot of uncertainty about the incoming Trump administration and how the potential tariff policies and potential inflationary policies and ever-present budget deficits may present fiscal risks,” said Thomas Taylor, senior research manager at Trepp. “That’s the primary reason U.S. Treasury yields are up. They’re approaching 5 percent, and it wouldn’t surprise us if they hit 5 percent over the course of the next year.”

— Matt Valley