By Duke Wheeler, Reichle Klein Group

The ongoing redevelopment of nonfunctional department store structures such as Sears and Elder Beerman, along with the retenanting or repurposing of structures such as Kmart, Giant Eagle and Value City, paved the way for many statistical and actual market improvements in the greater Toledo, Ohio, trade area. This positive trend and message supersede the closing announcements from over the past several months.

First, the numbers: The overall retail market vacancy rate improved from 11.5 percent to 8.3 percent over the prior five-year period. This represents approximately 650,000 square feet of positive absorption. Most of this absorption occurred among anchor space, defined for the purpose of this article as space 20,000 square feet or larger. The vacancy rate for anchor space improved from 11 percent to 5.1 percent. Self-storage played a large role as roughly 300,000 square feet of anchor retail space was converted by the storage industry.

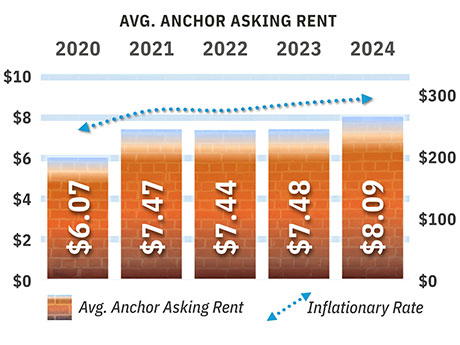

The balance of positive absorption can be attributed to pent-up retail demand as occupiers compete for well-located, existing space in a market with limited new construction and increased construction costs. In some cases, landlords have found or will find themselves better off with a replacement tenant than with their original tenant, as it relates to the rental rate. Over the previous five-year period, the average anchor asking rent increased by ±50 percent.

Vacancies created by recent store closures are likely to see tenant interest. Closures include Rite Aid, Joann, Party City, Big Lots and Family Dollar.

New construction declined from a high of 141,000 square feet in 2021 to 18,000 square feet at the end of 2024, as ongoing projects were delivered and fewer projects commenced. When new construction occurs, it is rarely speculative, and it commands a rental rate that justifies the construction cost. This often lends itself to new construction occurring in highly desirable, infill locations.

A strong employment base along with a stable population played vital roles in the figures shown here. These aspects are taken into consideration as retailers determine sales forecasts and projections.

Some of the larger employers in Northwest Ohio include ProMedica Health System, Nationwide Children’s Hospital, Owens Corning, Owens-Illinois Inc., Dana Inc., The Andersons Inc., General Motors Corp./GM Powertrain, First Solar, Marathon Petroleum Corp., The University of Toledo and Bowling Green State University. The population of the Toledo metropolitan area is about 650,000 people.

Now, the retail projects and expanding market segments: There are exciting recent and planned retail projects of note. These projects are driven by retailer demand as well as developer creativity and desire. The developments speak to the continuation of consumer demand for brick-and-mortar retail and for the growing number of food service offerings.

Notable recent developments/re-developments include:

• French Quarter Square by River Rock Property Group, completed in 2022: 50,000-square-foot, multi-building retail development consisting of Raising Cane’s, Condado, Buffalo Wild Wings, First Watch and others;

• Central Avenue Center by River Rock Property Group, completed in 2024: Conversion of a 90,000-square-foot vacancy to self-storage and creation of ±40,000 square feet for Aldi, Five Below, Pet Supplies Plus, Dunkin’ and Five Guys;

• North Towne Commons by Redevelopers Ltd., completed in 2024: Conversion of an 80,000-square-foot, single-tenant vacancy to a multi-tenant retail building for Ross Dress for Less, Michaels and Five Below.

Planned developments include:

• Westgate Village North by Abbell Associates, planned for 2026–2027:

27-plus acre development with 250,000 square feet of planned space for junior anchor, multi-tenant, restaurant and freestanding opportunities;

• Oregon Town Centre by River Rock Property Group, planned for 2025–2026: 10-plus acre development with planned freestanding, multi-tenant and junior anchor space available.

Expanding retail segments include grocery, coffee, fuel/convenience, fast-casual food offerings (smoothies, Mexican, chicken, ice cream, baked goods), discount soft goods, tools and equipment as well as pet supplies. Although these retailers demand quality locations, they are willing to pay a market rental rate for new construction in order to secure space in this competitive market. Drive-thru availability commands higher rents within the market.

Given the general demand from retailers, it is expected that retail property owners and developers will find a way to provide and create the desired supply.

The prior five-year period for Northwest Ohio shows dramatic improvement on both statistical and actual scales. Looking forward, there are exciting projects in the works and the retail demand needed to bring them to fruition.

Duke Wheeler is a senior vice president with Reichle Klein Group. This article originally appeared in the May 2025 issue of Heartland Real Estate Business magazine.