By Harrison Kruse and Ned Turner, CBRE

As we near the second half of 2025, the Des Moines industrial market is starting to see a shift in fundamentals, as new deliveries and the pipeline of new big-box speculative warehouse product have come to a complete halt.

Like many cities in the upper Midwest post-COVID, the Des Moines MSA saw an influx of out-of-state developers backed by institutional capital go ground up with new big-box product when the economy was stimulated by the Federal Reserve reducing the federal funds rate below 1 percent. This resulted in historically compressed treasury yields and an abundant amount of liquidity injected into the capital markets.

This effect on the national economy escalated consumer demand for e-commerce and locally, ag-related products, which are the state of Iowa’s most valuable export on an aggregate basis.

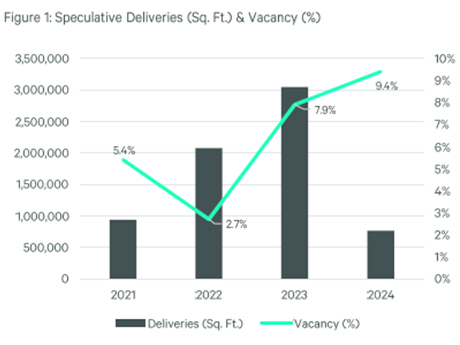

The Des Moines MSA between 2021 and 2024 had more than 6.8 million square feet of new industrial space delivered to the market, which is about 10.2 percent of the total market size on a square-foot basis. During those years, net absorption increased on an annual basis between 800,000 and 1.5 million square feet.

Pre-COVID, Des Moines’s average net absorption was between 350,000 and 500,000 square feet. Most of the absorption was concentrated in the third-party logistics (3PL) sector, as 3PLs accounted for over 60 percent of the absorption for 2021 to 2022. This was a direct reflection of companies outsourcing their supply chain needs as transportation costs increased and supply chain bottlenecks were prevalent.

As developers were tracking the Des Moines market, these numbers created a bullish outlook, which initiated an influx of new development that our market has not historically seen. For example, the Des Moines MSA had two larger cross-dock facilities deliver to the market that we classify as untested product. These assets are catered for larger users that need at least 150,000 square feet or more for their operations.

At the onset of COVID, these assets may have stabilized, but lease sizes historically fall within the 40,000- to 60,000-square-foot range. The developers who have constructed buildings to attract tenants with smaller footprints have significantly outperformed buildings that aren’t able to be subdivided for smaller users.

As these larger buildings received their certificate of occupancy, we saw the vacancy rate increase from 2.7 percent in 2022 to 9.4 percent in 2024 as supply outpaced demand. Due to the increase in vacancy, elongated stability periods and unattractive debt markets, developers have remained on the sidelines for the last 15 months.

Additionally, newer spec product with sizes greater than 200,000 square feet have constantly sat vacant on the market as second-generation space has come available, offering more competitive lease rates. Tenant demand has simultaneously contracted.

Momentum shift

Nonetheless, we’re starting to see a shift in momentum that’s creating a more positive outlook for the Des Moines market dynamics. Our region has recently had two 300,000-square-foot leases executed within the last quarter, and we’ve seen tenant demand gain more traction as users are being more forward looking in their space analysis and inventory management.

We believe this is the result of a short-term outlook from the tariff negotiations, as companies are transitioning their strategy from “just in time” to “just in case” again. We’ve seen this shift back and forth numerous times over the course of the last four years. The two subsequent years after COVID, we saw the “just in case” strategy transition into “just in time” as supply chain bottlenecks were alleviated and trade was unrestricted.

The current vacancy rate in the Des Moines market has fallen to 6.3 percent, which is a significant drop compared to just a few quarters ago. If the current absorption trend continues for the remaining portion of the year, we expect the vacancy rate to fall below 5 percent by the fourth quarter. As the newer product slowly absorbs over the next four quarters, this will be a prudent timeframe for developers to start looking at ground options as we gear up for the next market cycle.

There are numerous factors that will motivate developers to bolster their pipeline, such as rent growth, cost of debt and construction cost. We believe these variables will maintain their current trend where rent growth continues to moderate, interest rates slowly compress and construction costs stay elevated.

Des Moines doesn’t have the volatility of larger gateway and primary markets, which is an attractive environment for risk-averse groups looking to grow their portfolios. We believe proposals for big-box industrial spec product will be re-initiated and our development pipeline will expand to 500,000 to 750,000 square feet by the end of 2026.

We don’t believe we’ll see new deliveries revert back to the immediate years post-COVID, but the pipeline will maintain a more historical threshold of 500,000 square feet, which aligns with pre-COVID absorption numbers. The current outlook is pushing us to a more bullish sentiment but is also aligned with our market’s historical norms.

Harrison Kruse is a first vice president and Ned Turner is a senior associate with CBRE. This article originally appeared in the June 2025 issue of Heartland Real Estate Business magazine.