— By Berkadia —

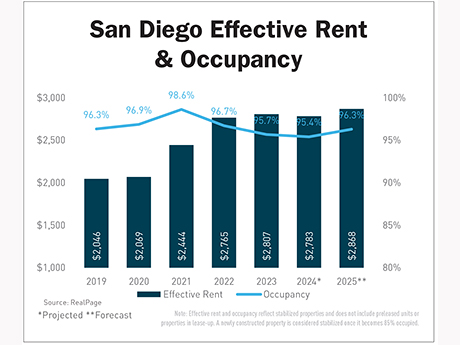

San Diego’s apartment market is poised to strengthen in 2025, with demand poised to set a record and fundamentals outperforming most other major California metros. This is a welcome change from 2024, where a slower leasing environment for Class A properties led to more concessions.

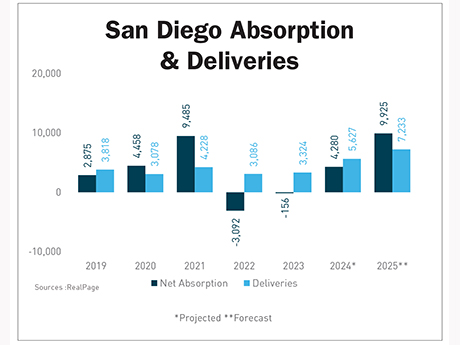

The big story is demand. More than 9,900 net units are expected to be leased this year, surpassing the previous high of 9,500 in 2021. This figure will also outpace what is likely to be a record year for new deliveries, with 7,233 units slated to debut this year across the metro.

By year-end, occupancy is projected to climb to 96.3 percent, up 90 basis points from 2024 and above the market’s 10-year pre-pandemic average. That puts San Diego ahead of Los Angeles, San Francisco-Oakland and San Jose on the occupancy leaderboard. Effective rent is expected to rise 3.1 percent year over year to a projected $2,868, marking a solid improvement from last year’s flat performance.

Fundamentals Point to a Solid Year

Employment growth remains a tailwind. The metro added 16,200 new jobs between May 2024 and May 2025, pushing total employment to nearly 1.6 million. That economic momentum is supporting household growth too, with an estimated 9,900 new households formed across the region.

Occupancy reached nearly 96 percent in the first quarter, up 60 basis points year over year and well above pre-pandemic norms. Rents edged up to $2,795 that quarter, marking a modest 0.6 percent annual increase, though stronger growth is expected later in the year. The metro absorbed 7,772 units over the trailing four quarters, with net move-ins on pace to surpass 2021’s record. At the same time, inventory expanded by 6,127 units, which is up 1.9 percent year over year.

Hot Submarkets

Northwest San Diego stands out, with leasing activity forecast to triple in 2025. This submarket has found increased interest from young professionals who want to live in coastal neighborhoods like Pacific Beach, Ocean Beach, Mission Beach and Mission Bay. Northwest San Diego also offers residents a central location between San Diego’s employment hubs: it’s north of Downtown San Diego, west of Kearny Mesa, and south of Sorrento Valley and the University of California, San Diego (UCSD).

Net absorption there is projected to reach more than 2,000 units, up from 2024 when only 647 units were absorbed. Northwest San Diego’s inventory is set to expand by 5.2 percent to facilitate the climbing leasing activity.

Deal Activity

Several multifamily properties changed hands in the first half of 2025, including one of the nation’s largest trades this year— and the biggest locally since 2020: MG Properties’ $309 million acquisition of Park 12 Apartments in Downtown. Other active investors this year include American Assets Trust, Pacific Urban Investors and Bridge Investment Group.

On the development side, Raintree Partners committed $225 million to build three new Class A apartment communities in the metro. Additionally, Sunstone Two Tree entered the San Diego market with the $45 million purchase of the 1970s vintage property Terraza Hills.

With tight vacancies, healthy job creation and limited land for future projects, San Diego remains one of the most supply constrained markets in the West. And one of the most stable.

This article was originally published in the July 2025 issue of Western Real Estate Business.