— By Andrew Hitchcock of CBRE —

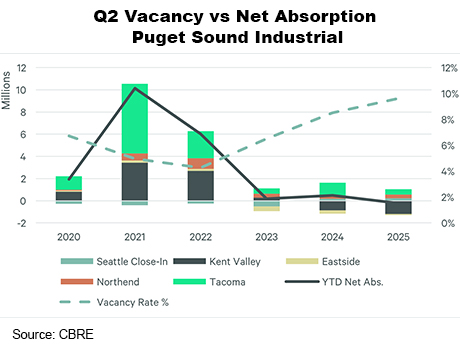

The Puget Sound industrial market is showing signs of modest recovery through the first half of 2025. Tenants are increasingly seeking flexible leases, renewing in place and right-sizing operations, resulting in smaller or more cautious leasing commitments rather than long-term deals. Shifts in port activity have also affected leasing decisions, exacerbated by the raft of universal tariff announcements in April.

While some submarkets have regained momentum after a slow start, demand across the region is still uneven, with lingering uncertainty keeping vacancy rates elevated. Submarkets demonstrating momentum include Tacoma, which recorded 308,153 square feet of positive net absorption in the second quarter, alongside notable third-party logistics provider (3PL) leasing activity. The Seattle Close-In area also saw vacancy decrease to 9.3 percent, driven by healthy tenant demand from companies like Evergreen Goodwill and South West Plumbing.

Conversely, Kent Valley faced challenges. The vacancy rate climbed to 8.4 percent due to significant speculative deliveries that outpaced absorption and traditional users downsizing. Port activity temporarily dampened demand, compounded by a 21.2 percent year-over-year drop in international imports in May. This reflects uncertainty surrounding future tariff rates. On the plus side, year-to-date container volumes remain above 2024 levels.

Developers continued to deliver new supply across the region, with 2.1 million square feet completed in the second quarter and 4.5 million square feet under construction. Speculative projects, particularly in logistics corridors like the Northend and Kent Valley, have contributed to higher vacancy rates as many speculative buildings were delivered amid tepid demand. Caution among developers persists, yet activity continues where logistics and distribution fundamentals remain strong.

Rental rates have stayed mostly flat or declined slightly in select submarkets. For instance, average second-quarter asking rents stood at $1.16 per square foot, per month, triple net, in Kent Valley, and $0.91 in Tacoma — both steady from previous quarters. Tenants are exercising caution, extending decision timelines and demonstrating a clear flight to quality. There is a marked preference for newer, efficient facilities as occupiers aim to optimize costs and operational flexibility while they keep an eye on broader economic signals. In some cases, landlords are weighing higher tenant credit risk, reduced rents and larger concessions as they work to keep existing tenants or lease long-vacant space.

Market stabilization is expected to continue through the second half of the year if tenant demand gradually picks up. High-demand corridors may also see rental growth if net absorption improves and speculative vacancies are filled.

Seattle’s industrial market remains resilient but in transition. Shifts in ecommerce, global logistics and regional manufacturing — along with the impact of tariffs — will drive future absorption patterns. Stakeholders are encouraged to stay agile as the market navigates this period of elevated vacancy and shifting demand. Monitoring consumer behavior and trade patterns will be critical to anticipating changes in market fundamentals.

— By Andrew Hitchcock, Executive Vice President, CBRE. This article was originally published in the August 2025 issue of Western Real Estate Business.