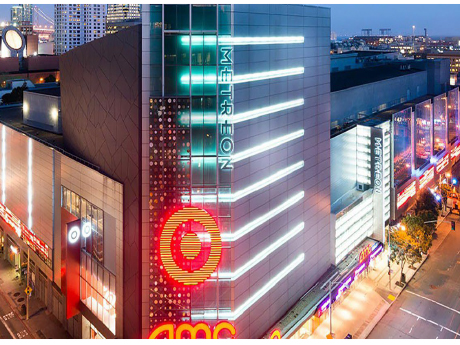

SAN FRANCISCO —TMG Partners and equity partner Bridges Capital LLC have acquired Metreon, a 320,000-square-foot, vertically oriented shopping center in downtown San Francisco. Built in 1999, the retail and entertainment destination is anchored by Target and a 16-screen AMC Theatres that features the tallest IMAX screen in North America.

Locally based TMG and Bridges Capital purchased the four-story property from Acore Capital in a deed-in-lieu transaction. The sales price was not disclosed. The City and County of San Francisco will continue to retain ownership of Metreon’s ground lease through at least 2082, according to the San Francisco Business Times. The news outlet also reported Acore Capital was the mortgage lender for Metreon on behalf of the previous owner, Starwood Capital Group.

“This investment in Metreon is a powerful vote of confidence in our downtown recovery,” says San Francisco Mayor Daniel Lurie. “We’re grateful for [TMG’s] partnership as we work to accelerate San Francisco’s comeback.”

Metreon is located at 135 4th St. at Mission in the city’s Yerba Buena neighborhood. The property includes City View at Metreon, a 31,000-square-foot events venue with floor-to-ceiling windows offering views of the San Franisco skyline. TMG will rebrand the venue and partner with Skylight, a placemaking development firm, to reimagine the space.

The center features more than a dozen indoor and outdoor dining options on the second level, including Chipotle Mexican Grill, East Brother Beer Co., Freshroll, Nick the Greek, Super Duper Burgers, Uji Time and West Coast Sourdough, among others, according to the directory on the property website. TMG plans to add to the tenant roster as the company markets the ground-level retail space for lease.

“Metreon has been a mecca for entertainment, shopping and dining for families, local office workers and visitors to San Francisco,” says Ben Kochalski, TMG’s president and chief investment officer. “TMG will now continue the tradition as we improve the experiential opportunities across the theaters, dining options, retail, common areas and most notably, the top-floor event space.”

Founded in 1984, TMG has a portfolio of 30 million square feet across San Francisco, Oakland, San Jose and other Bay Area cities. The firm’s holdings include office, retail, residential and retail properties.

Bridges Capital was founded in 2024 and specializes in joint venture acquisitions of value-add commercial real estate in the Bay Area. The firm has purchased six office properties spanning more than 700,000 square feet in San Francisco over the past year.

— John Nelson