By Matt Valley

An overwhelming percentage of direct lenders and financial intermediaries believe the multifamily and industrial sectors provide the most attractive financing opportunities for the lending community today, according to France Media’s 11th annual reader forecast survey. Conversely, the hotel and office sectors offer the least attractive financing opportunities, say survey participants.

More specifically, 83 percent of participants in the email survey conducted between Nov. 19 and Dec. 13 indicate that the multifamily sector provides the most attractive financing opportunities, followed by industrial (75 percent), mixed-use (25 percent), retail (17 percent), hotel (14 percent) and office (7 percent). Multiple answers were permitted for this question.

On the flip side, 62 percent of respondents believe that the hotel sector provides the least attractive financing opportunities, followed by office (58 percent), retail (27 percent), multifamily (7 percent), industrial (3 percent) and mixed-use (0 percent).

Despite the persistence of the COVID-19 pandemic — which as of early January had claimed the lives of more than 830,000 Americans and has hobbled the hotel, office and retail sectors for nearly two years — the real estate fundamentals of the apartment and industrial sectors have remained rock solid.

Fueled by strong tenant demand, the national apartment vacancy rate stood at 2.5 percent at the end of 2021, according to RealPage Inc., a data analytics firm based in Richardson, Texas. On the industrial real estate front, commercial real estate services firm Colliers reports that seven major markets in the United States currently have a vacancy rate below 4 percent, including Los Angeles, New York City, Philadelphia and Columbus, Ohio.

Deal Volume Looks Promising

Some 64 percent of lender survey participants describe their companies as mortgage brokers or financial intermediaries; 25 percent work for community, regional or national banks; 9 percent are agency lenders (government-sponsored enterprises); and 2 percent are mezzanine lenders.

About three in four respondents (77 percent) expect the total dollar amount of commercial and multifamily loans closed by their firm in 2022 to increase over the prior year, 16 percent anticipate the total loan amount to stay the same and 7 percent predict a decrease.

Among respondents who anticipate an increase in the annual total dollar amount of loans closed by their firm, exactly one-third expect the increase to range from 11 to 15 percent. Slightly more than one in four respondents (26 percent) are forecasting an increase of greater than 20 percent, and another 22 percent of respondents expect a more modest increase of 6 to 10 percent.

Among those who are forecasting a decrease in annual lending activity by their firm, 50 percent expect a drop of 5 percent or less, and another 38 percent are forecasting a decrease of 6 to 10 percent.

CMBS Issuance Soars

Commercial mortgage-backed securities (CMBS), which are fixed-income investment products backed by mortgages on commercial properties, play an important role because they provide liquidity to real estate investors and commercial lenders alike. CMBS loans are nonrecourse, are available to a wide swath of borrowers and tend to offer highly competitive loan terms. In addition, CMBS loans are also assumable, which makes it somewhat easier for a borrower to exit the property before the end of the loan term.

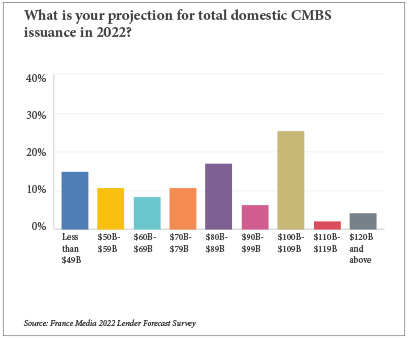

Annual domestic, private-label CMBS issuance soared from $56 billion in 2020 to $109.1 billion in 2021, a 95 percent increase, according to data analytics firm Trepp LLC and Commercial Real Estate Direct. All told, there were 139 private-label transactions completed in 2021, including an abundance of single-borrower deals.

There is no clear consensus among lenders and financial intermediaries about the near-term outlook for the CMBS market (see chart above). The largest group of respondents (26 percent) expects total domestic issuance to range between $100 billion and $109 billion, followed by 17 percent who forecast total issuance will be between $80 billion and $89 billion and 15 percent who indicate total issuance will be less than $49 billion.

There is a tie at 11 percent among respondents who anticipate total issuance to range between $50 billion and $59 billion and those who expect total issuance to range from $70 billion and $79 billion.

Refis Still Going Strong

When asked to forecast the concentration of lending activity at their firms in 2022, the largest group of respondents (39 percent) cited refinancing activity, followed by acquisition financing (33 percent), construction financing (25 percent) and other (3 percent).

The continued low interest rate environment provides strong opportunities for borrowers, says Jay Jenkins, president and CEO of CNB Bank, which is headquartered in Carlsbad, New Mexico. At the close of business on Jan. 2, 2022, the 10-year Treasury yield stood at 1.65 percent, up about 60 basis points from a year earlier but still quite low by historical standards.

With individual properties and portfolios trading hands at a brisk pace these days, all those purchases need to be financed unless the buyer is plunking down all cash. Construction financing is also on the rise amid pent-up demand for new product across most property types.

Most respondents (78 percent) believe that interest rates will rise in 2022 versus 22 percent who expect rates to remain relatively unchanged. No respondent predicts a decrease in interest rates.

Because the 10-year Treasury yield serves as a benchmark for permanent, fixed-rate financing, its movement is closely watched. Some 28 percent of respondents predict the rate to be at 2 percent by year’s end, followed closely by 27 percent who expect the 10-year yield to finish the year at 2.25 percent, and 15 percent who indicate the 10-year yield will close out the year at 1.75 percent.

Economic Headwinds

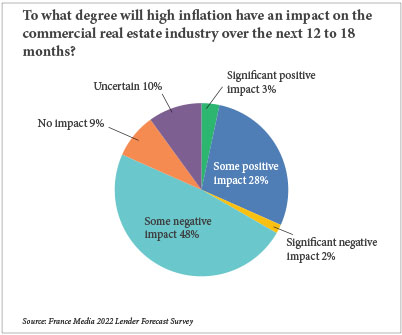

The Consumer Price Index jumped 6.8 percent in November 2021 on a year-over-year basis, the fastest pace since 1982, according to the U.S. Department of Labor.

Respondents were queried on the extent to which high inflation will impact the industry over the next 12 to 18 months. Nearly half of respondents (48 percent) indicate that high inflation will have some negative impact, followed by 28 percent who believe it will have some positive impact (see chart below). Another 10 percent are uncertain; 9 percent say it will have no impact; 3 percent predict that it will have a significant positive impact; and 2 percent say it will have a significant negative impact.

Survey participants were asked to provide their best guesses on how long it will be before office buildings in their markets return to pre-pandemic utilization levels. Fully 25 percent of respondents indicate three years or longer, while 22 percent say it will take two years.

Survey participants were asked to provide their best guesses on how long it will be before office buildings in their markets return to pre-pandemic utilization levels. Fully 25 percent of respondents indicate three years or longer, while 22 percent say it will take two years.

There is a three-way tie at 12 percent between groups that say the office market will fully recover in one year, 1.5 years or never. Meanwhile, 10 percent predict a return to pre-pandemic levels in six months, while 7 percent are uncertain and 2 percent say utilization levels will be back to normal in 2.5 years.

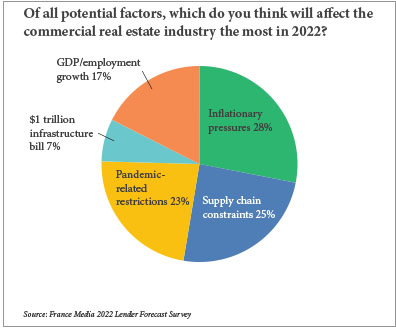

Which potential factor(s) do respondents think will have the biggest impact on the commercial real estate industry in 2022? The most frequently cited factor is inflationary pressures (28 percent), followed closely by supply chain constraints (25 percent) and pandemic-related restrictions (23 percent) (see chart at top of page).

On the issue of the supply chain constraints, 62 percent of respondents expect the situation to improve in 2022, while 20 percent say it will remain the same, 13 percent expect conditions to worsen and 5 percent are uncertain.

As for the labor shortage nationwide, 53 percent expect the situation to improve in 2022; 25 percent anticipate it will remain the same; 17 expect the crisis to worsen; and 5 percent are uncertain.

Write-In Responses

Nearly 30 lenders and financial intermediaries weighed in on the greatest challenges and opportunities facing the commercial real estate industry today as part of the write-in portion of the survey. Their insights were wide-ranging.

Nick Martinez, vice president with Phoenix-based Taylor Street Capital Partners, wrote that “the greatest opportunity we see is the massive undersupply in affordable or workforce housing in attractive, business-friendly Sun Belt markets that have increasing populations and employment opportunities.”

Andy Proctor, principal with Glen Allen, Virginia-based Atlantic Real Estate Capital, stated that the greatest opportunity and challenge “is creating or modifying assets that will hold up to external events that are unforeseen and uncontrollable.

These events include pandemics and ESG-related controls that are thrust upon the industry by government and/or society.” ESG (environmental, social and corporate governance) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments, according to Investopedia.

Stanley Sidel, senior advisor, research, at Boston-based EagleBridge Capital, wrote that “the greatest opportunity is winning the fierce competition to purchase properties amidst strong competition amongst national, regional and local buyers.”

Michael Dorff, vice president at The Alison Co., a mortgage banking firm based in Newport Beach, California, cautioned that the continued oversupply of capital is leading to “bubble risk.”

“Every year there is more capital dedicated to the commercial real estate industry. This started a few decades ago when legislation was put forward that allowed pension fund advisors to diversify their investment portfolios, which had historically been invested very heavily in U.S. Treasury bonds and bills,” Dorff further explained when contacted by France Media.

“As it relates to ‘bubble risk,’ if stabilized occupancy goes from 95 percent to 90 percent to 87 percent, values will fall. There will be ownership entities with an investment basis higher than the current market value,” emphasized Dorff.

Ben Kadish, president of Chicago-based Maverick Commercial Mortgage, wrote that “the financing of office buildings over the next 18 months is the biggest challenge and opportunity in the market.”

Michele Pitale, M.D. and managing director at Counterpointe Sustainable Real Estate, addressed the issue of

net-zero emissions, which is defined as the balance between the amount of greenhouse gas produced and the amount removed from the atmosphere.

“We are now at the intersection of sustainability and commercial real estate with the ability to bring buildings to net zero without CapEx (capital expenditures). Never before has it been as important to examine a building’s energy use and to improve building performance to help mitigate climate change,” wrote Pitale, who leads the company’s retrofit financing team.

Based in Connecticut, Counterpointe Sustainable Real Estate provides capital to fuel the deployment of sustainable and energy-efficient infrastructure in commercial and multifamily buildings.

There were some anonymous write-in comments as well, including one from a respondent who sees the potential upside in certain property types that others have shied away from during the pandemic. “Contrarian buyers should have great opportunities to purchase hospitality, retail and office at an attractive basis. The greatest challenges are and will be subdued sales transaction activity due to the potential higher tax consequences being proposed by the Biden Administration.”

Another anonymous write-in comment focused on the tumultuous times the American people have endured the past two years. “The dislocations caused by COVID, political and social issues and massive government ending market intervention will all contribute to significant volatility, both positive and negative unique to each region.”

Several write-in comments focused on the rising costs of doing business in today’s inflationary environment. One survey participant sounded the alarm on rents. “Overall, the commercial markets seem to be in good shape at present. I’m concerned about the large increases in rents occurring in the industrial and multifamily areas. Affordability is going to be a challenge with rental rates skyrocketing.”

ABOUT THE SURVEY

In the week leading up to Thanksgiving, France Media Inc. emailed invitations to participate in an online survey to three groups: brokers; lenders and financial intermediaries; and developers, owners and managers. The survey was held open through mid-December. Invitations to participate were also sent in the Northeast Real Estate Business e-newsletter, as well as through REBusinessOnline.com. For questions about this year’s survey, contact Editorial Director Matt Valley at mvalley@francemediainc.com.