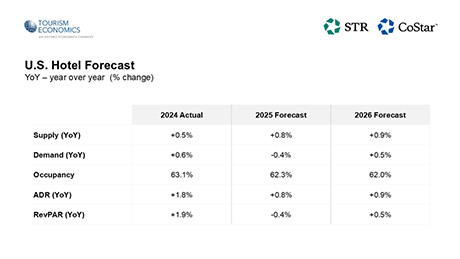

ARLINGTON, VA. — Revenue per available room (RevPAR) was revised downward in the final performance projections for the U.S. hospitality sector in 2025, according to the latest forecast from CoStar Group and Tourism Economics, an Oxford Economics company. RevPAR is projected to finish the year at a decline of 0.4 percent (or negative 40 basis points) compared to a year ago. This would result in the first total-year decline since 2020 and only the second since 2009, both of which were years with major macroeconomic disruptions with the COVID-19 pandemic and Great Financial Crisis, respectively.

CoStar and Tourism Economics also lowered occupancy projections to end the year at 62.3 percent, a decline from 63.1 percent at year-end 2024, while average daily rate (ADR) was held steady at +0.8 percent for the year.

For 2026, occupancy is projected to decline by another 30 basis points, while ADR and RevPAR are projected to trend positive by 90 and 50 basis points, respectively (see chart).

“We expect little change in the macroeconomic environment as unemployment and prices continue to rise,” says Amanda Hite, president of STR, a hospitality research firm owned by CoStar. “As a result, our hotel performance outlook for the remainder of this year and next were lowered once again. ADR is growing well below the rate of inflation, which in turn will put more pressure on margins.”

“Job market softening, policy uncertainty and tariff costs remain near-term drags for consumers. However, heading into 2026, we expect the U.S. travel economy to firm up moderately,” adds Aran Ryan, director of industry studies with Tourism Economics. “Household income growth will continue, accompanied by tax cut benefits, resumed hiring and less policy instability. Expanding global long-haul travel and World Cup interest will bring improved international visitation.”

— Staff Reports