While rising interest rates, inflation and economic volatility have hurt many sectors of the economy, the rental housing market has maintained solid footing, according to Arbor Realty Trust’s Summer 2022 Special Report: Rental Housing Market Exhibits Cyclical Stability, Contains Structural Questions. The report was written by Ivan Kaufman, Arbor’s chairman and CEO, and Sam Chandan, founder of Chandan Economics.

In a time of economic uncertainty, renting has become more appealing. Households seeking an affordable place to live, those who are delaying homeownership and others who prefer the flexibility and amenities associated with multifamily units all add to the increasing numbers of potential renters.

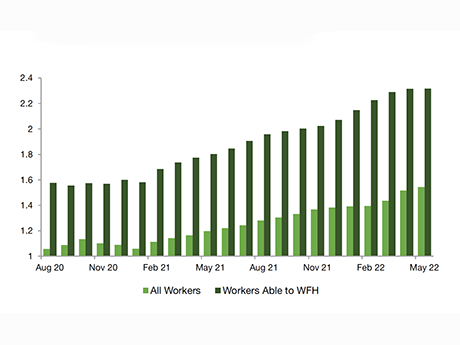

Less traditional factors may also increase interest in renting, especially outside of tier-one markets. The expansion of work-from-home (WFH) culture is likely to be another reason rental demand is high right now. Meanwhile, the flexibility to work where the cost of living is lower and space is at less of a premium is pushing some renters who work remotely to explore living outside traditional hotspots.

Economic Uncertainty Spreads as Interest Rate, Inflation Rise

The Arbor Realty Trust report highlights a host of factors that are leading to economic uncertainty. Inflation (and its secondary effects) are contributing to households’ loss of spending power. Consumer prices rose 8.5 percent in July. This was an improvement over the 9.1 percent increase in the consumer price index for June, when inflation reached its highest level in over 40 years.

Sam Chandan,

Chandan Economics

The Federal Reserve increased its Federal Funds Rate (FFR) by 75 basis points in both June and July to combat steeply rising costs for goods and services. However, with another increase in the FFR highly likely in September, many believe some economic disturbance may be necessary to lower inflation.

“Fundamental to our outlook for the months ahead is the understanding that the Fed will continue to engage in aggressive monetary policy to reassert control over price dynamics” to slow inflation further, says Sam Chandan.

Good News for Multifamily: Mortgage Rates, Risks to Growth, WFH Culture

With mortgage rates rising faster than the Fed’s own target rate, households may choose to rent as part of a “wait-and-see” approach. In a period of slow growth or recession, would-be homeowners have historically sought to rent for longer and rent at higher price points to take advantage of additional amenities while they wait for economic stabilization. This trend could push rental rates higher in the coming months.

However, it is not just concern for the future that is transforming the rental market. According to Arbor’s special report, the flexibility to work from anywhere means that many renters are taking the opportunity to work outside the metro areas of major cities.

“Superstar” cities, previously strongholds for multifamily rentals catering to in-person offices, may also have drawbacks for those with WFH flexibility. Higher costs of living, confining spaces less conducive to telecommuting and a lack of infrastructure modernization could make these types of cities less attractive to remote workers suddenly untethered from physical offices in metro areas.

Arbor’s report presents a variety of methods that cities might use to lure back labor and improve workers’ overall opinion of downtown cores. However, the possibility of a larger exodus to rentals in tier-two and tier-three cities or to more suburban settings remains a potential disruption for traditional multifamily markets, one that would not have occurred before a recent shift in where and how knowledge workers can do their jobs.

— By Sarah Daniels. Arbor Realty Trust is a content partner of REBusinessOnline. To read all of the Arbor Realty’s Trust’s Summer 2022 Special Report: Rental Housing Market Exhibits Cyclical Stability, Contains Structural Questions, click here.