— By Ivan Kaufman, founder, chairman and CEO of Arbor Realty Trust, Inc.; and Sam Chandan, a professor of finance and director of the Chen Institute for Global Real Estate Finance at the NYU Stern School of Business

Rental housing is uniquely positioned to withstand tremendous economic headwinds. Although some observers point to the slowdown in apartment rent growth as a sign of growing weakness, this trend is a cyclical feature that is not reflective of any structural change in the profile of demand or supply. It is normal to expect a period of slowing rent growth while there is uncertainty in the economic outlook. In-depth findings on these trends, plus a thorough economic outlook for 2023 and a complete breakdown of risk factors, are detailed in Arbor Realty Trust Special Report Spring 2023: Navigating a Corrective Environment, from which this article is excerpted.

While no asset class is immune from the challenges of higher interest rates, the presence of amortization, which spreads out a loan into a series of fixed payments over time, makes the multifamily sector less likely to see mounting distress. All Department of Housing and Urban Development (HUD)-conforming multifamily loans are fully amortizing. Moreover, Fannie Mae- and Freddie Mac-conforming multifamily loans require at least partial amortization. Where we are most likely to see debt-related difficulties in the next year and beyond are with CMBS transactions. According to data from Trepp and the Mortgage Bankers Association, a majority (64.6 percent) of outstanding CMBS loans are categorized as interest-only over their entire term. Operators with expiring interest-only loans may run into distress in the next year as they try to replace refinance debt at roughly twice the cost. The multifamily sector’s exposure to this market is limited, accounting for just 10.5 percent of outstanding CMBS debt. Meanwhile, the same cannot be said for the office, retail and hotel sectors — all of which rely more heavily on CMBS capital markets.

On the margins, subsets of mortgages in the multifamily portfolio will still require careful monitoring, especially those that were originated in the years leading up to the pandemic, when over-leveraging was a re-emergent concern.

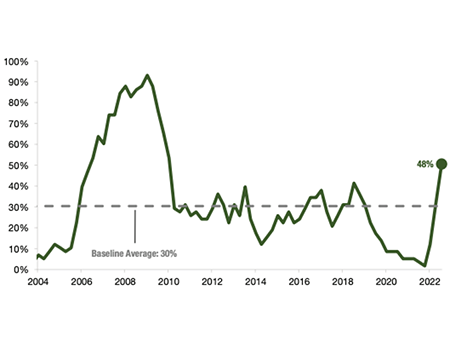

The criterion where real differences are likely to emerge over the next year is along geographic lines. According to MSCI Real Assets, through the third quarter of 2022, nearly half (48 percent) of U.S. markets have seen rising apartment cap rates — the highest share since 2010 (see lead image, Chart 1). We can expect that these performance trends will continue, driven by slowing business sectors and evolving migration patterns.

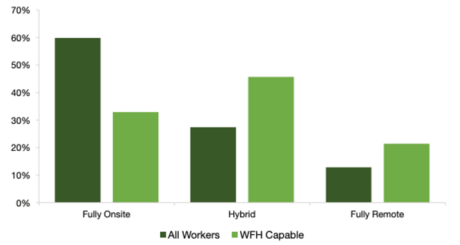

Work-from-home, a trend that seemed capable of upending the rental housing market’s appraising assumptions just a few months ago, now looks like less of a risk than initially feared. Hybrid work has quickly become the dominant alternative to full on-site employment. As a result, more workers are expanding their housing search radius, though they are not untethering from their offices completely (Chart 2).

Chart 2. Share of workers in jobs that are fully on-site, hybrid or fully remote.

Source: Arbor Realty Trust Special Report Spring 2023: Navigating a Corrective Environment.

Among the beneficiaries of the proliferation of hybrid work is a product type that was already enjoying a run of success: single-family rentals (SFR). Beyond a growing willingness of workers to locate further away from their urban offices, the SFR sector is likely to benefit from the increased visibility of this type of housing. Although built-to-rent (BTR) communities have received less attention thus far, their demand should climb as greater awareness of this product type develops. As accessibility to affordable quality housing remains a pressing challenge across the country, it is critical to note that the BTR sector is an area of growth that is adding a significant volume of new homes. According to U.S. Census Bureau, BTR construction starts reached all-time highs even as the broader single-family construction landscape reached an inflection point (Chart 3).

Chart 3. Single-family constructions starts: built-to-rent versus all other single-family. Four-quarter rolling sum, measured in thousands of units, through the third quarter of 2022. Source: Arbor Realty Trust Special Report Spring 2023: Navigating a Corrective Environment.

Ultimately, we see SFR and BTR communities as critical alternatives in the diversification of housing opportunities for all Americans, no matter their homeownership capacity or preference.

Arbor Realty Trust is a content partner of REBusinessOnline. To read all of the Arbor Realty Trust Special Report Spring 2023: Navigating a Corrective Environment, click here.