IRVING, TEXAS — Two brokerage firms, Fort Worth-based The Woodmont Co. and California-based Hanley Investment Group, have arranged the sale of Story Crossing, a 6,038-square-foot retail strip center in Irving. The center was fully leased at the time of sale to tenants such as Starbucks, T-Mobile and CBD Kratom. Russel Wehsener of Woodmont and Jeff Lefko of Hanley represented the undisclosed seller in the transaction. Compass Group represented the buyer, which also requested anonymity.

Arbor Realty Trust

Arbor Realty TrustBuild-to-RentContent PartnerDevelopmentFeaturesLeasing ActivityMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasWestern

Arbor Report Finds Rental Housing Insulated from Economic Contraction, Risk Factors Endure

— By Ivan Kaufman, founder, chairman and CEO of Arbor Realty Trust, Inc.; and Sam Chandan, a professor of finance and director of the Chen Institute for Global Real Estate Finance at the NYU Stern School of Business Rental housing is uniquely positioned to withstand tremendous economic headwinds. Although some observers point to the slowdown in apartment rent growth as a sign of growing weakness, this trend is a cyclical feature that is not reflective of any structural change in the profile of demand or supply. It is normal to expect a period of slowing rent growth while there is uncertainty in the economic outlook. In-depth findings on these trends, plus a thorough economic outlook for 2023 and a complete breakdown of risk factors, are detailed in Arbor Realty Trust Special Report Spring 2023: Navigating a Corrective Environment, from which this article is excerpted. While no asset class is immune from the challenges of higher interest rates, the presence of amortization, which spreads out a loan into a series of fixed payments over time, makes the multifamily sector less likely to see mounting distress. All Department of Housing and Urban Development (HUD)-conforming multifamily loans are fully amortizing. Moreover, Fannie …

AcquisitionsArbor Realty TrustBuild-to-RentContent PartnerFeaturesMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasWestern

Investors Drawn to Single-Family Rentals During Tough Economic Times

By John Tarantino, Arbor Realty Trust The ongoing expansion of the single-family rental (SFR) market is capturing investors’ interest like never before. Construction starts in the sector topped a record 69,000 units over the past year, while the rate of rent growth remained positive for new leases and accelerated in renewals. That’s according to the third-quarter Single-Family Investment Trends Report Q3 2022, which Arbor Realty Trust recently published in partnership with Chandan Economics. SFR investors want to know what this latest market data reveals about how the sector is weathering economic changes and what it suggests about how their properties are likely to perform in the months ahead. In December, I was privileged to weigh in on these weighty questions as a panelist at Information Management Network’s 10th Annual Single-Family Rental Forum (West) in Scottsdale, Ariz. One of the messages I sought to convey to the audience that day is that single-family rentals have maintained their momentum as well as any corner of the housing market, as our third-quarter report bears out. And while rising interest rates and elevated risk have placed the housing market on shaky ground, SFR is on a secure foundation moving into 2023. With the average age …

AcquisitionsArbor Realty TrustContent PartnerFeaturesMidwestMultifamilyNortheastSoutheastTexasWestern

Multifamily Opportunity Matrix Reveals Most Promising Markets for Investors, Developers

By Arbor Realty Trust Inflationary environments set many investors’ minds to thinking about multifamily properties, which have tended to perform as well or better than other property types in the face of economic headwinds. Product type is no guarantee of success, however, and careful site selection is essential to ensure a project will have the renter demand and pricing power the owner needs to succeed. Arbor Realty Trust, in partnership with Chandan Economics, developed the opportunity matrix featured in Arbor’s Top Opportunities in Large Multifamily Investment Report 2022. The opportunity matrix helps clients navigate the nation’s apartment markets, enabling them to compare relative strengths from one metro to the next and identify those offering the greatest potential for development or investment. Its ranking system, which analyzes eight key categories, found the top three U.S. metro markets for large multifamily investment in 2022 are San Antonio, Kansas City and Las Vegas. “Reviewing what made these communities rise to the top of our 50-metro ranking will demonstrate how investors can use the matrix to compare the climates of opportunity in the markets in which they operate, or to suggest new fields of opportunity for their next venture,” said Matt Maison, vice president …

Arbor Realty TrustContent PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWestern

Arbor: Multifamily Market Well-Positioned to Withstand Economic Headwinds

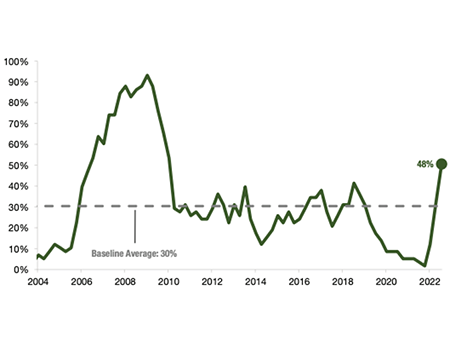

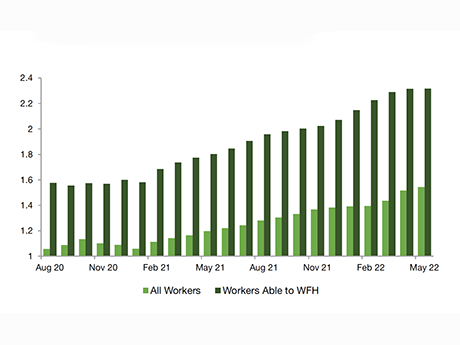

While rising interest rates, inflation and economic volatility have hurt many sectors of the economy, the rental housing market has maintained solid footing, according to Arbor Realty Trust’s Summer 2022 Special Report: Rental Housing Market Exhibits Cyclical Stability, Contains Structural Questions. The report was written by Ivan Kaufman, Arbor’s chairman and CEO, and Sam Chandan, founder of Chandan Economics. In a time of economic uncertainty, renting has become more appealing. Households seeking an affordable place to live, those who are delaying homeownership and others who prefer the flexibility and amenities associated with multifamily units all add to the increasing numbers of potential renters. Less traditional factors may also increase interest in renting, especially outside of tier-one markets. The expansion of work-from-home (WFH) culture is likely to be another reason rental demand is high right now. Meanwhile, the flexibility to work where the cost of living is lower and space is at less of a premium is pushing some renters who work remotely to explore living outside traditional hotspots. Economic Uncertainty Spreads as Interest Rate, Inflation Rise The Arbor Realty Trust report highlights a host of factors that are leading to economic uncertainty. Inflation (and its secondary effects) are contributing to …

Affordable HousingArbor Realty TrustContent PartnerDevelopmentFeaturesMidwestMultifamilyNortheastSoutheastTexasWestern

As Affordability Crisis Deepens, Policies and Market Shift to Assist the Underserved

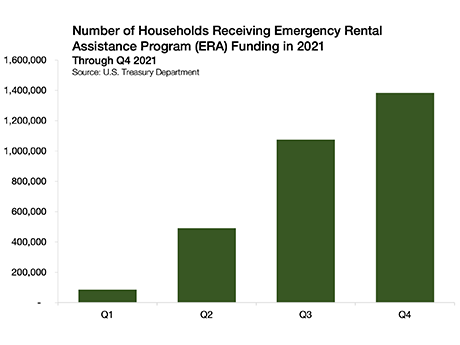

By Omar Eltorai, Arbor Realty Trust To understand the affordable housing market in spring 2022, one needs to first assess how this sector weathered the pandemic and then assess the current state of housing affordability across the country. In-depth findings on these trends are included in the Arbor Realty Trust-Chandan Economics Affordable Housing Trends Report, from which this article is excerpted. Weathering the Pandemic When it comes to the pandemic response, federal policymakers proved effective at defusing a large-scale increase in homelessness from financially insecure households. The Center for Disease Control and Prevention’s (CDC) eviction moratorium, while unpopular among industry advocates, prevented an estimated 1.6 million evictions, according to an analysis by Eviction Lab. After the Supreme Court struck down the federal moratorium in August 2021[1], the wave of evictions that many were forecasting did not immediately materialize. Nationally, tracked eviction filings ticked up but remained well below their pre-pandemic averages, according to Eviction Lab. A key reason why many at-risk renters have remained in their homes is the deployment of funds allocated in the Emergency Rental Assistance Program (ERA) — a funding pool designed to assist households that are unable to pay rent or utilities. The ERA Program was …