Atlanta’s multifamily market has been in a slump that would even make Braves fans wince. After peaking with record-breaking sales in 2021, volumes slid as borrowing costs climbed and supply piled up. But just like any good ballclub, the fundamentals matter, and the data suggests momentum is quietly building for a 2026 comeback season.

Sales volume trends

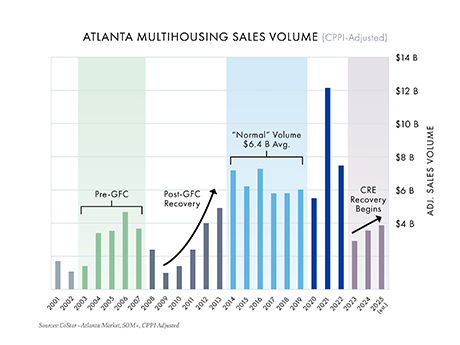

According to research from CoStar Group, institutional multifamily sales in Atlanta (transactions of $50 million or more) peaked in 2021 at $12.8 billion, driven by record pricing, historically low borrowing costs and robust rent growth. Since then, record supply, rising expenses and a sharp increase in borrowing costs have pushed sales volumes down by more than 70 percent, averaging just $3.5 billion annually over the past three years.

While the broader U.S. economy has surged since 2022 — the S&P 500 has climbed 45 percent since fourth-quarter 2022 — commercial real estate has been searching for its bottom. Data now suggests that Atlanta has reached this inflection point, and history indicates increased activity and rising values in the years ahead.

Parallels to the GFC

Looking back at the global financial crisis (GFC) provides valuable context. The chart above (inflation-adjusted using Real Capital Analytics’ CPPI for U.S. multifamily) highlights similarities between the current cycle and the GFC recovery.

Since 2023, Atlanta’s transaction volume has been trending upward. Year-to-date volume is $2.4 billion, with recent momentum suggesting a year-end total near $4 billion, comparable to the $4 billion (CPPI-adjusted) seen in 2012 during the GFC recovery. From 2014 to 2019, Atlanta averaged $6.4 billion annually, and that “normal” range may be achievable again as early as next year.

One key difference: during the GFC, the entire U.S. economy was struggling, with the S&P 500 down more than 50 percent. The “everything is broken” mindset gave lenders and equity managers cover to take losses, fueling transaction activity between 2009 and 2013. This cycle, managers have been slower to recognize losses, delaying the pace of distressed sales.

Asset quality, loan structures

Between 2009 and 2012, 66 percent of Atlanta’s traded assets were over 10 years old. In contrast, just 42 percent of recent trades involve older assets. Many of those older properties changed hands between 2020 and 2022, often financed with variable-rate “3-1-1” loans (three-year term with two one-year extensions).

Although extension hurdles were frequently waived, the final terms of these loans began expiring in 2025 and will accelerate next year. How lenders handle these maturities, whether through continued extensions or forced resolutions, will play a critical role in supporting rising transaction volume.

Pricing dynamics

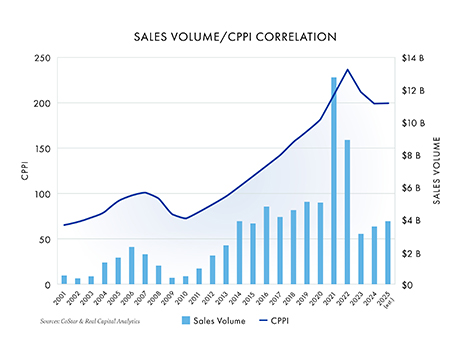

Perhaps the strongest driver of transaction volume is pricing. The chart below left shows Atlanta’s sales volume alongside CPPI trends.

The three main headwinds that eroded values in recent years — higher expenses, elevated borrowing costs and record supply — are now beginning to ease:

• Expenses: Operating cost growth has cooled to its slowest pace since early 2021 (CRE Daily, June 2025).

• Borrowing Costs: Spreads over indexes have tightened, while underlying rates are stable to improving. Anticipated rate cuts should further ease variable borrowing costs.

• Supply: After two years of outsized deliveries (averaging 4.5 percent of inventory annually in 2023 to 2024), Atlanta will add just 3 percent in 2025. More importantly, deliveries are projected to average only 1.2 percent annually from 2026 to 2028, positioning Atlanta ahead of other major Sun Belt markets in moderating supply growth.

With all three value drivers moving in a favorable direction, Atlanta multifamily pricing is expected to appreciate steadily over the next three years.

Falcons-style finish?

We’ve all “survived ’25,” but the real story is what comes next. Like the Falcons’ season: the early games were tough, but the roster is solid, and there’s still a clear path to the playoffs.

With expenses cooling, borrowing costs easing and supply normalizing, Atlanta’s multifamily market is expected to show signs of life moving into 2026.

— By Jason Nettles, managing director, Northmarq. This article was originally published in the October 2025 issue of Southeast Real Estate Business.