By Brad Jones of Cushman & Wakefield/EGS Commercial Real Estate

Despite ongoing challenges facing the national economy, Birmingham’s commercial real estate landscape remains steady and consistent. Over the past seven years, encompassing both pre- and post-pandemic periods, the overall vacancy rate for Birmingham’s multi-tenant office market has exhibited fluctuations like most markets, ranging from 12.9 percent in 2017 to 19 percent in 2023, according to research from Cushman & Wakefield/EGS Commercial Real Estate.

However, for perspective, Birmingham’s year-end vacancy rate of 19 percent remains below the national average vacancy rate of 19.7 percent recorded in 2023, according to research from Cushman & Wakefield.

Office leasing activity in Birmingham has maintained momentum, experiencing a notable 12 percent year-over-year increase from 2022. Total leasing activity for 2023 totaled 718,219 square feet. Class A transactions dominated with 564,681 square feet leased, indicating a continued preference for Class A office space (i.e. a flight to quality). This is good news for Class A product in this supposed period of economic slowdown.

Office investment sales activity in Birmingham has, however, decelerated in the current economic climate. The impending ripple of debt maturities poses challenges for large institutional owners and creditors. At the same time, it sets the stage for potential investment opportunities for discerning investors and office users.

As landlords grapple with pricey refinancing due to rising interest rates in a challenging market, they may resort to lowering rents to retain tenants, potentially benefiting office users through reduced rental rates. As the commercial real estate sector navigates these ongoing challenges, office owners in particular will have to be aggressive and creative to weather the lending landscape and looming economic downturn.

Embracing the future

Looking ahead to the next 12 to 24 months, Birmingham’s multi-tenant office market stands poised for healthy growth and success. With Alabama’s unemployment rate at a modest 2.6 percent and wage and salary employment reaching record highs in 2023, the local economic landscape provides a solid foundation for sustained commercial leasing activity.

The Birmingham-Hoover metropolitan statistical area (MSA) boasts an unemployment rate below both the state and national averages, further strengthening confidence in our market. At the close of 2023, the Birmingham-Hoover MSA’s unemployment rate was 2.4 percent.

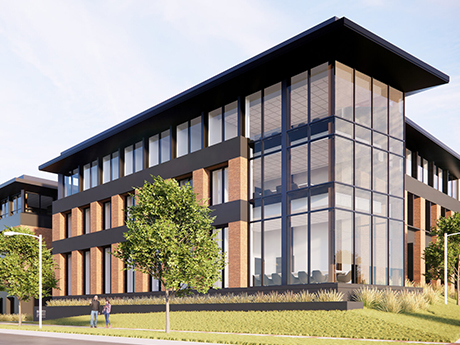

On the horizon, Birmingham anticipates the completion of The Hardwick, a 60,000-square-foot mixed-use adaptive reuse project bringing approximately 40,000 square feet of new Class A office space to the heart of Birmingham’s central business district (CBD). Additionally, Birmingham-based construction firm Brasfield & Gorrie recently announced plans to invest $18.9 million to expand its national headquarters in the city’s Lakeview District.

Also, we expect there to be continued demand for historic “bricks-and-beam” redevelopments in Birmingham’s downtown area. Most of this inventory has been absorbed except for the Young & Vann building and a few other similar properties. The considerable absorption of historic buildings will lead to increased absorption in high-rise office buildings in Birmingham’s CBD.

Finally, construction is expected to begin this spring on Birmingham’s Star Amphitheater, a $50 million, 9,000-seat open-air amphitheater located in Birmingham’s Uptown entertainment district near Protective Stadium. These projects illustrate Birmingham’s ongoing evolution and the collective commitment to fostering a dynamic environment conducive to business growth and investment.

As Birmingham continues to adapt and evolve, it presents compelling opportunities for commercial real estate investment. The city’s resilient fundamentals, strategic location and business-friendly economic environment make it an attractive destination for investors and office users seeking long-term value and growth opportunities. Prudent decision-making and strategic partnerships will be essential as stakeholders navigate the evolving landscape and capitalize on Birmingham’s potential.

— Brad Jones, CCIM, Executive Vice President, Partner, Cushman & Wakefield / EGS Commercial Real Estate. This article was originally published in the March 2024 issue of Southeast Real Estate Business.