WASHINGTON, D.C. — The Federal Deposit Insurance Corp. (FDIC), as receiver of Signature Bridge Bank, has sold 20 percent of its equity stake in the defunct bank. The agency received the loan portfolio after the failure of Signature Bank in March.

Hancock JV Bidco L.L.C. (Hancock), an entity indirectly controlled by Blackstone Inc. and other investors, paid $1.2 billion for a 20 percent equity interest. The portfolio consists of approximately $16.8 billion in commercial real estate loans collateralized by office, retail and market-rate multifamily assets. FDIC will retain an 80 percent equity interest in the venture.

Hancock will be responsible for the management, servicing and liquidation of the venture’s assets. The entity will also be required to manage the portfolio in accordance with the terms of the transaction, subject to monitoring and oversight by FDIC.

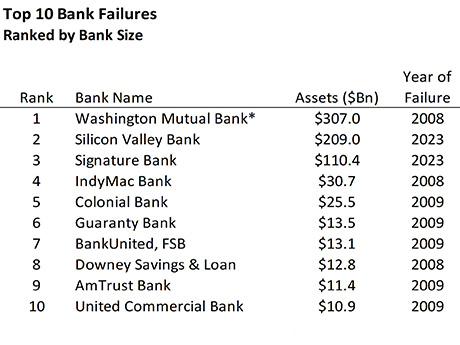

The New York State Department of Financial Services (DFS) took possession of Signature Bank on March 12. The bank failed after depositors withdrew substantial amounts of money in the wake of the collapse of Silicon Valley Bank on March 10. DFS named FDIC as receiver, and FDIC in turn transferred all deposits of Signature Bank to a new entity called Signature Bridge Bank. The bridge bank will operate the insolvent company until a buyer can be found.

FDIC began marketing the portfolio in September. According to the receiver, the transaction was marketed on a competitive basis, with a seven-week due diligence period for qualified parties.

— Channing Hamilton