SAN CLEMENTE, Calif. — CareTrust REIT Inc. (NYSE:CTRE), a San Clemente-based seniors housing investor, has acquired three continuing care retirement communities (CCRCs) located in Los Angeles, Orange, and San Diego counties.

The portfolio totals 475 assisted living, skilled nursing and memory care beds/units. Bayshire Senior Communities, an existing CareTrust tenant based in Southern California, has taken over management of all three properties.

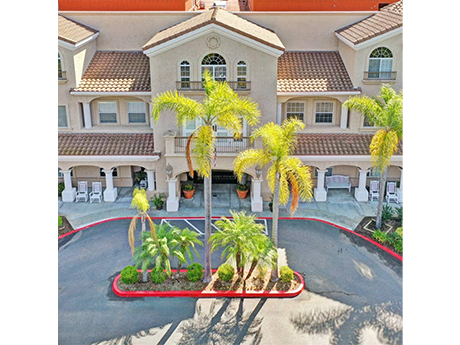

The highest profile property of the three is Torrey Pines Senior Living in San Diego. CareTrust paid $32.3 million for the asset, including transaction costs. Annual cash rent for the first year is approximately $2.6 million, increasing to approximately $3 million in the second year with CPI-based annual escalators thereafter.

CareTrust completed the acquisition of the other two CCRCs through a joint-venture arrangement with a third-party regional healthcare investor. Pursuant to the arrangement, CareTrust is the managing member of the joint-venture entity. CareTrust provided a combined common equity and preferred equity investment amount totaling approximately $28 million.

The joint-venture landlord has leased these facilities to Bayshire pursuant to a new, triple-net master lease agreement with an initial term of 15 years with two five-year extension options. CareTrust’s initial contractual yield on its combined preferred and common equity investments in the joint venture is approximately 9.1 percent. Agreed-upon annual increases to base rent and to CareTrust’s preferred rate of return increase CareTrust’s contractual yield to 9.7 percent and 10.2 percent in years two and three, respectively. Commencing in year four, contractual base rent increases by a fixed 2 percent annually.

The investments were funded using cash on hand. The sellers were not disclosed.