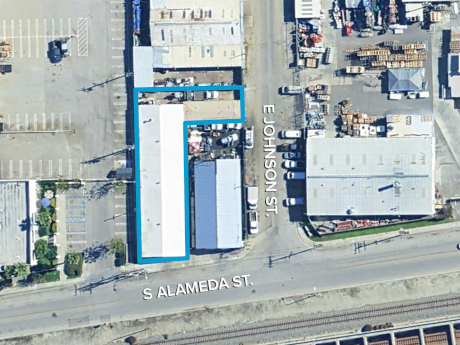

COMPTON, CALIF. — FallTech has purchased an industrial building located at 1414 S. Alameda St. in Compton from Accurate Glass & Mirror Corp. for $1.5 million. Situated on a 9,269-square-foot site, the 6,432-square-foot property features one ground-level door and a clear height of 14 feet. FallTech, which makes fall protection, will use the property to expand its operations. Scott Anderson of The Klabin Co. represented the seller, while Matt Stringfellow of The Klabin Co. represented the buyer in the transaction.

Acquisitions

BENSALEM, PA. — Hanley Investment Group Real Estate Advisors has arranged the $12.5 million sale of Bensalem Crossings, a 67,215-square-foot shopping center located roughly 19 miles north of Philadelphia. Bensalem Crossings was fully leased at the time of sale, with ShopRite and CVS occupying 93 percent of the space. Kevin Fryman, Bill Asher and Jeff Lefko of Hanley, in association with ParaSell Inc., represented the seller, Adler Realty Investments Inc., in the transaction. The team also procured the buyer, an undisclosed, Southern California-based private investor.

PEEKSKILL, N.Y. — MAG Capital Partners has purchased a two-building, 104,220-square-foot industrial facility in Peekskill, about 50 miles north of Manhattan, in a sale-leaseback. The site spans approximately 6 acres along the Hudson River and houses the headquarters operations of White Plains Linen, which in 2019 expanded its services to include e-commerce fulfillment of similar products. STREAM Capital Partners’ Daniel Macks, Jonathan Wolfe and Joe DiGennaro represented the seller in the transaction.

MANCHESTER, N.H. — Colliers has brokered the $3.4 million sale of a portfolio of three multifamily buildings totaling 21 apartments in Manchester, located near the Massachusetts-New Hampshire border. The portfolio offers one-, two- and three-bedroom units, as well as one commercial space, and was fully occupied at the time of sale. Andrew Robbins of Colliers represented the seller, Select Capital LLC, in the transaction and procured the buyer, White Barn Real Estate LLC.

FOREST PARK, ILL. — Eastham Capital has sold Central Park Apartments in Park Forest, a southern suburb of Chicago, for $23.2 million. Eastham acquired the 220-unit property for the portfolio of Eastham Capital Fund V LP in partnership with Bender Cos. in September 2019. At the time, Central Park Apartments marked the second collaboration between Eastham and Bender. To date, the companies have co-invested in 10 properties. Over the six-year hold period, ownership completed exterior renovations to Central Park Apartments, including parking lot resurfacing, sidewalk repairs and patio concrete upgrades. The property averaged more than 97 percent occupancy during the ownership period. The community at 11 Fir St. features a mix of one-bedroom units as well as two- and three-bedroom townhomes ranging from 724 to 1,326 square feet.

GREENWOOD, IND. — Marcus & Millichap has arranged the $3.8 million sale of an auto repair center occupied by Caliber Collision in Greenwood. The property totals 33,511 square feet and is located at 155 Melody Ave. Caliber Collision occupies the asset under a double-net lease with more than three years remaining on the lease. Mitch Grant, Nicholas Kanich and Josh Caruana of Marcus & Millichap represented the Indiana-based seller. Dominic Sulo, Ryan Engle and Andrean Angelov of Marcus & Millichap procured the Illinois-based buyer.

DALLAS, ARLINGTON AND GARLAND, TEXAS — California-based investment firm BKM Capital Partners has purchased a portfolio of three industrial properties totaling 512,310 square feet across seven buildings in the Dallas-Fort Worth (DFW) metroplex. The properties include the 34,325-square-foot Northgate 22 in Dallas, a 42,506-square-foot facility at 501 106th St. in Arlington and Market Street Distribution Center, a five-building, 435,479-square-foot park in Garland. BKM Capital, which plans to implement capital improvements, purchased the portfolio for $60.3 million from Boston-based TA Realty.

LAKE CITY, GA. — JLL Capital Markets has negotiated the $30 million sale of Lake City Distribution Center, a 157,371-square-foot industrial facility located at 5380 Dixie Industrial Drive in Lake City, about 11 miles south of downtown Atlanta. Britton Burdette, Dennis Mitchell, Jim Freeman, Maggie Dominguez and Bobby Norwood of JLL represented the seller, InLight Real Estate Partners, in the transaction. Situated within Atlanta’s Airport submarket, Lake City Distribution Center was constructed in 2023 and features 32-foot clear heights, concrete tilt-wall construction, a rear-load configuration with 42 dock-high doors and two ramped drive-in doors. The property also offers 46 trailer parking spaces and 133 car parking spaces, along with 185-foot truck courts to accommodate large distribution operations. Maersk, a Danish shipping and logistics company, occupies roughly two-thirds of the building, while DB Schenker, a logistics and transportation provider, occupies the rest of the property.

AUBURN, ALA. — Matthews Real Estate Investment Services has arranged the sale of Flint’s Crossing, a 97,668-square-foot neighborhood shopping center situated three miles from Auburn University. HomeGoods and Michaels anchor the fully leased center. Other tenants include Panera Bread, The UPS Store, Subway, CiCi’s Pizza, Plato’s Closet, Kumon and uBreakiFix. In addition to the 22,850-square-foot HomeGoods store, which operates at the property on a new 10-year lease, Flint’s Crossing has introduced roughly 15,115 square feet of new tenants since 2022. Kyle Stonis, Pierce Mayson and Boris Shilkrot of Matthews represented the repeat seller, an entity doing business as RECS Flint’s Crossing LLC, in the transaction. The buyer and sales price were not disclosed.

DALLAS — A partnership between two locally based firms, Leone Real Estate Partners and Lampasas Partners, has purchased a 24,942-square-foot warehouse in the Valwood area of North Dallas. The property features 14- to 24-foot clear heights, two dock-high loading doors, two grade-level loading doors, 4,100 square feet of office space and one acre of fenced outdoor storage space. The seller and sales price were not disclosed.