CHICAGO — Venture One Real Estate, through its acquisition fund VK Industrial VII LP, has purchased a 145,500-square-foot industrial building located at 11264 Corliss Ave. in Chicago. The single-tenant property was fully leased at the time of sale. Situated in the Pullman Industrial Park, the facility offers direct access to I-94 via 111th Street. Constructed in 1977, the asset features a clear height of 22 feet, 10 docks, two drive-in doors and parking for more than 129 cars. Mike Wilson, Erik Foster and Brian Colson of Avison Young represented the undisclosed seller. VK Industrial VII is co-sponsored by Venture One and Kovitz Investment Group.

Acquisitions

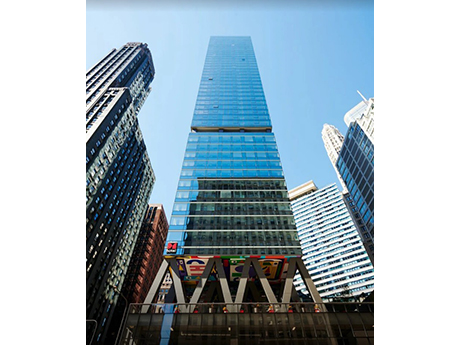

NEW YORK CITY — JLL has brokered the $243.5 million sale of Riverbank, a 44-story apartment tower located at 560 W. 43rd St. in Midtown Manhattan. Barings sold the freshly renovated property to an undisclosed institutional investment firm, with JLL representing both parties in the transaction. JLL also arranged $128.3 million in acquisition financing for the deal. The direct lender and specific loan terms were not disclosed. Originally developed in the late 1980s as a condominium project, Riverbank currently houses 418 rental units comprising 43 studios, 270 one-bedroom units, 62 two-bedroom apartments and 43 three-bedroom residences. The high-rise also features nearly 18,000 square feet of retail space that is fully leased to a nail salon, liquor store and coffee shop. Most of Riverbank’s units have private balconies with city and Hudson River views, and residents have access to a 5,000-square-foot lounge called the Harbor Club that offers poker and billiards tables, a media room and coworking space. Additional amenities include an Olympic-size pool, fitness center, outdoor terrace and grilling stations. Jeffrey Julien, Rob Hinckley, Andrew Scandalios, Steven Rutman and Devon Warren led the JLL Capital Markets team that handled the sale of Riverbank. Kelly Gaines, Geoff Goldstein and Michael Shmuely …

LOS ANGELES — Concord Capital Partners has acquired The Park Wilshire, a multifamily building in Los Angeles’ Wilshire corridor. Kitty Wallace and Simmi Dhillon of Colliers represented the institutional seller and the buyer in the deal. The sale included an adjacent 14,002-square-foot parking lot. Originally constructed as a hotel, The Park Wilshire offers 170 apartments and a variety of amenities.

GLENDALE, CALIF. — Northmarq has brokered the sale and financing of TENTEN Glendale, a mid-rise apartment community at 111 N. Louise St. in Glendale. Amidi Group sold the asset to Regent Properties for $33.5 million. Built in 2019, TENTEN Glendale features 66 studio, one- and two-bedroom apartments with floor-to-ceiling windows, stainless steel appliances, in-home washer/dryers and quartz countertops. Community amenities include a rooftop pool and spa, a fitness center, business center and onsite office/retail space. Northmarq also arranged a $22.7 million bridge loan for the buyer, Regent Properties, through a correspondent relationship with a life insurance company. The transaction was structured on an initial two-year term with three one-year extension options. Vince Norris, Jim Fisher, Mike Smith and Tommy Yates of Northmarq’s Multifamily Investment Sales team represented the seller and secured the buyer in the deal. Joe Giordani, Brendan Golding and Scott Botsford of Northmarq’s Debt + Equity team arranged the financing for the buyer.

CONROE, TEXAS — Marcus & Millichap has brokered the sale of Cool Spaces Storage, a 307-unit self-storage facility located about 40 miles north of Houston in Conroe. The property consists of eight single-story buildings on a 12-acre site that were constructed in 2021. Of the facility’s 71,520 net rentable square feet (NRSF) of space, there is 33,600 NRSF of climate-controlled space, 2,500 NRSF of non-climate-controlled space and 35,420 NRSF of RV and boat storage space. Dave Knobler, Mixson Staffel and Charles LeClaire of Marcus & Millichap represented the seller, a Texas-based developer, in the transaction. The buyer was also not disclosed.

COMMERCE CITY, COLO. — Thrive Preschool has purchased a school property, located at 10000 Chambers Road in Commerce City, for $3.5 million. The 12,014-square-foot property features modern classroom layouts, a fully fenced outdoor play area and ample parking. Thrive Preschool will open enrollment for the new location this fall. Kyle Moyer, Elizabeth Morgan and Cody Stambaugh of Pinnacle Real Estate Advisors represented the buyer in the deal.

DALLAS — Lee & Associates has brokered the sale of a 15-acre multifamily development site in Dallas. The site at 1200 N. Walton Walker Blvd. is located on the city’s west side and is approved for the development of 300 units, construction of which is now underway. Alex Wilson and Jarrett Huge of Lee & Associates represented the seller, England Products, in the land deal. Local broker David Cook represented the buyer, Kentucky-based LDG Development.

SPRING, TEXAS — San Antonio-based Headwall Investments has purchased Shops on Gosling, a 34,613-square-foot shopping center located in the northern Houston suburb of Spring. Built in 2019, the center is home to tenants such as Shipley Do-Nuts, Tune Up Salon, Capital Title, Fajita Pete’s and Center Court Pizza & Brew. Chace Henke and Micha van Marcke of Edge Capital Markets represented the undisclosed seller in the transaction. Dillon Hurley of Argali CRE represented Headwall Investments.

CHICAGO — A joint venture between Kayne Anderson Real Estate and CEDARst Cos. has acquired Millie on Michigan, a newly built luxury apartment tower in Chicago’s Loop. Completed in 2022 and located at 300 N. Michigan Ave., the property rises 47 stories with 289 apartment units and 25,000 square feet of retail space. Amenities include a rooftop pool and lounge, coworking spaces, a fitness center, dog run and integrated smart home features. The asset was 95 percent occupied at the time of sale. CEDARst, which owns and operates more than 5,000 apartment units in Chicago, utilized its Opportunistic Fund I, which launched in February.

EAU CLAIRE, WIS. — Cushman & Wakefield has brokered the sale of a 702,371-square-foot manufacturing facility in Eau Claire, a city in western Wisconsin. Jordan Dick, Todd Hanson and Jason Sell of Cushman & Wakefield represented the seller, Hutchinson Technology, which previously operated the property for its production of disk drive products. TTM Technologies was the buyer. The facility at 2435 Alpine Road features infrastructure that positions it to support advanced technology printed circuit board manufacturing.