DURHAM, N.C. — JLL Capital Markets has brokered the sale of LifeScience Logistics at Durham 85, a 250,541-square-foot industrial facility situated at 2360 Ferrell Road within Durham 85 Industrial Park. The facility, which is located 10 miles from Research Triangle Park, is fully leased by LifeScience Logistics LLC, a supply chain service provider in the healthcare and pharmaceutical industries. The facility features 32-foot clear heights, ESFR fire suppression and energy-efficient LED lighting throughout the property. Dave Andrews, Pete Pittroff, Michael Scarnato and Mike Lewis of JLL represented the seller, a joint venture between Scannell Properties and Manulife Investment Management, in the transaction. Mississippi-based EastGroup Properties purchased the facility for an undisclosed price.

Acquisitions

CORALVILLE, IOWA, AND MAPLEWOOD, MINN. — Davis Healthcare, on behalf of its Davis Medical Investment Fund, has acquired a two-building healthcare real estate portfolio known as CoralBirch for $34.1 million. The assets are located in Coralville, Iowa, and Maplewood, Minn. More than 70 percent of the space in the buildings is leased to high-credit hospital systems. With this acquisition, the fund owns 17 off-campus ambulatory care buildings totaling more than 750,000 square feet. The Coralville West Medical Building at 2769 Heartland Ave. rises three stories and totals 60,351 square feet. It is situated near the University of Iowa campus. Davis acquired the property for $24.2 million, or roughly $400 per square foot. At closing, the building was 97 percent leased with more than 65 percent of the space occupied by University of Iowa Healthcare, which offers primary care and internal medicine, obstetrics and gynecology, neurology, imaging and rehab and dermatology services. Additional tenants of the building are medical practices focused on obstetrics, radiology and rehab. Constructed in 2010, the building’s common areas and restrooms were renovated in 2022. Birch Run Medical Building at 1747 Beam Ave. totals 27,944 square feet. Davis purchased the single-story property for $9.9 million, or roughly …

CHICAGO — Interra Realty has arranged the sales of three multifamily buildings on the North Side of Chicago for a combined $12.4 million. The properties included 931 W. Leland Ave., a 22-unit building in Uptown that sold for $5 million; 1909-13 W. Larchmont Ave., a 16-unit building in North Center that sold for $3.6 million; and 7240 W. Devon Ave., a 13-unit asset in Edison Park that traded hands for $3.8 million. Joe Smazal of Interra represented the buyer and seller of the Leland property. For the Larchmont deal, Smazal represented the seller and Interra’s Joe Braun represented the buyer. Smazal and colleague Colin O’Malley represented the buyer and seller of the Devon property. Sold in an off-market deal, 931 W. Leland features 17 one-bedroom and five two-bedroom units, all of which were recently remodeled. The Larchmont property includes 16 one-bedroom units and sold at more than 97 percent of the list price. Capital improvements were recently made to upgrade the building systems and envelope. The Devon building includes four one-bedroom and six two-bedroom apartments as well as three ground-floor retail units that are fully leased to a Dunkin’ location, private offices for the franchisee and a residential real estate …

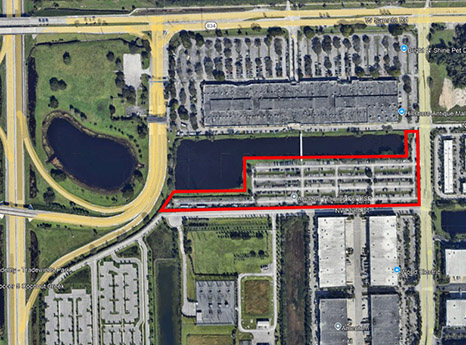

Foundry, Crow Holdings Acquire 10-Acre Site in Pompano Beach, Plan 182,000 SF Industrial Campus

by Abby Cox

POMPANO BEACH, FLA. — A partnership between Foundry Commercial’s Development & Investments platform and Crow Holdings Capital has acquired Festival South, a 10-acre former parking lot site located in Pompano Beach. The site will be redeveloped into a two-building industrial campus that totals 182,000 square feet. The new campus, which will be situated at the corner of NW 33rd Street and NW 27th Avenue near Fort Lauderdale-Hollywood International Airport, marks Foundry’s 21st development in the South Florida market. Further details about Festival South were not released.

NEW YORK CITY — Marcus & Millichap has brokered the $7.5 million sale of a 97-unit apartment building in The Bronx. The six-story, elevator-served building at 1154 Ward Ave. was originally constructed in 1929 in the borough’s Soundview neighborhood. According to Apartments.com, the building exclusively houses one-bedroom units with an average size of 713 square feet. Michael Fusco, Seth Glasser and Benjamin Myerow of Marcus & Millichap represented the seller and procured the buyer, both of which were private investors that requested anonymity, in the transaction.

HOUSTON — JLL has negotiated the sale of Woodlake Plaza, a 106,310-square-foot office building located at 2600 S.Gessner Road in the Westchase area of West Houston. The six-story building was originally constructed on a 3.5-acre site in 1974 and includes a break room and a conference room, as well as parking for 292 vehicles. Marty Hogan led the JLL team that represented the undisclosed seller in the transaction. The buyer and sales price were also not disclosed.

HOUSTON — Philadelphia-based investment firm Alterra IOS has acquired an industrial outdoor storage facility in northeast Houston. The 2.9-acre facility at 7470 Miller Road 2 features 20,980 square feet of warehouse space and was originally built in 2002, according to LoopNet Inc. Jack Zalta of KSR NY brokered the deal. The seller and sales price were not disclosed.

CONCORD AND HAYWARD, CALIF. — BKM Capital Partners and Kayne Anderson Real Estate, the real estate investment arm of Kayne Anderson, have acquired a three-property industrial portfolio in the San Francisco Bay Area. Details of the transaction were not released. CBRE National Partners handled the transaction. Totaling approximately 505,000 square feet across 16 buildings and 94 units, the portfolio consists of institutional quality, light industrial space situated on 34 acres of infill land with access to regional transportation. At the time of sale, the portfolio was 89 percent leased to more than 70 tenants, with unit sizes averaging just over 5,300 square feet. The portfolio includes the 10-building, 245,930-square-foot Concord Industrial Park in Concord as well as the three-building, 176,056-square-foot Huntwood Business Center and the three-building, 82,562-square-foot Hesperian Business Park in Hayward. The Concord asset will be renamed Mount Diablo Industrial Park as part of BKM’s broader repositioning plan.

AVENEL, N.J. — Chicago-based investment firm CenterPoint Properties has acquired two industrial buildings totaling 387,526 square feet in the Northern New Jersey community of Avenel. The building at 191 Blair Road is a 198,854-square-foot, cross-dock facility with a clear height of 36 feet. The building at 215 Blair Road is a 188,672-square-foot, single-load warehouse with clear heights of 22 to 30 feet and several acres of overflow parking space. Gary Gabriel, Kyle Schmidt and Ryan Larkin of Cushman & Wakefield brokered the sales of the buildings, both of which were fully leased at closing.

MILWAUKIE, ORE. — CBRE has arranged the sale of Axletree Apartments, a multifamily complex located at 11125 SE 21st Ave. in Milwaukie. A private seller sold the asset to an undisclosed buyer for $28 million. Built in 2019, Axletree Apartments features 110 studio, one- and two-bedroom units with in-unit washers/dryers and stainless steel appliances. Josh McDonald and Joe Nydahl of CBRE represented the seller in the deal.