SAN ANTONIO — Nashville-based brokerage firm Matthews has arranged the sale of a 12,719-square-foot healthcare building in San Antonio. The single-tenant building at 855 Proton Road is located adjacent to Methodist Hospital Stone Oak on the city’s north side and is leased to Gastroenterology Consultants of San Antonio. Rahul Chhajed, Michael Moreno and Tyler Swade of Matthews represented the undisclosed seller in the transaction.

Acquisitions

CAPREIT Acquires 157-Unit Build-to-Rent Development Underway in Woodruff, South Carolina

by John Nelson

WOODRFUFF, S.C. — CAPREIT has acquired Hart Townes, a 157-unit build-to-rent residential community located at 339 Hart Townes Way in Woodruff, about 21 miles southeast of Greenville, S.C. The seller and sales price were not disclosed. Construction began last year and is scheduled to wrap up before the end of the year. First move-ins to the community are currently underway. Homes at Hart Townes span in size from 1,570 to 1,693 square feet and include wood floors, stainless steel kitchen appliances, granite countertops, attached garages, 2.5 bedrooms and private patios. Common area amenities include a swimming pool and cabana, as well as onsite property management and maintenance.

Eagle Partners Buys 551-Unit, Age-Restricted Apartment Portfolio in Escondido, California for $162.5M

by Amy Works

ESCONDIDO, CALIF. — Eagle Partners has acquired an affordable housing preservation portfolio in Escondido for $162.5 million in an off-market transaction. Totaling 551 units, the portfolio includes The Hendrix Apartments and The Hadley Apartments. The adjacent communities offer one- and two-bedroom residences serving the senior demographic (55+) in North San Diego County. Eagle Partners will implement a long-term affordable preservation strategy while executing a targeted capital improvement program designed to enhance the resident experience. Community amenities include resort-style swimming pools, fitness centers, landscaped common areas, a fenced dog park and covered parking. The buyer partnered with Red Stone Equity Partners, JPMorgan Chase, The California Statewide Communities Development Authority and Affordable Housing Access to execute the transaction.

TEMPE, ARIZ. — ViaWest Group and Walton Street Capital have completed the disposition of Farmer Industrial Center, a two-building industrial park in Tempe. Speed Bay acquired the asset, located at 9185 and 9245 S. Farmer Ave., for $24.5 million. Totaling 93,903 square feet, the property features a clear height of 20 feet, six dock-high and 13 grade-level doors, with additional capacity through two punch-outs, wet-pipe sprinkler systems and ample parking at 2.6 spaces per 1,000 square feet. At the time of sale, the property was 94.1 percent leased to seven tenants, including aerospace, third-party logistics, home improvement services and electrical testing industries. Ben Geelan, Greer Oliver, Bryce Beecher and Gigi Martin of JLL Capital Markets represented the seller in the deal.

HOFFMAN ESTATES, ILL. — SVN Chicago Commercial has brokered the $3.7 million sale of a 7.2-acre development site at 2350 W. Higgins Road in Hoffman Estates. The property, located adjacent to a 101,769-square-foot shopping center, is slated for the construction of approximately 300 luxury apartment units. Wayne Caplan and Al Lindeman of SVN Chicago Commercial represented the sellers, Dutch-based Depa Holding Co. and its U.S. partner Caruso Development. An entity of Chicago-based Synergy Construction Group was the buyer. Originally zoned for commercial use, the site is the former home of a Kmart store and a Menard’s store. In addition to rezoning to accommodate residential use, the Village of Hoffman Estates also approved a new residential-oriented redevelopment and tax-increment financing (TIF) agreement. The village restructured a previous TIF agreement with the adjacent properties owned by the sellers.

BOSTON — Shaving products company P&G Gillette has unveiled plans to purchase 232 A Street in South Boston as the future home of its nearly $1 billion Grooming Headquarters and Technical Innovation Center. The company is also expanding its Andover, Mass., manufacturing facility and redeveloping its 31-acre South Boston campus. The new headquarters announcement marks the single-largest investment made by Gillette in Boston, according to the company. The site is currently owned by Breakthrough Properties, a joint venture between Tishman Speyer and Bellco Capital. It is permitted for a 324,315-square-foot research-and-development facility with ground-floor retail space. Jonathan Varholak of CBRE led the brokerage team that facilitated the land sale. Gillette says the purchase of the site unlocks multiple project benefits agreed to when the site was permitted by Breakthrough Properties in 2024. Once complete, the project will contribute 1.5 acres of publicly accessible open space along the Fort Point Channel, including new sidewalks, bike lanes, a waterfront park and improvements to the South Boston Harborwalk. The parcel also includes monetary allocations for public art and shuttle services. “This new development will keep hundreds of high-tech research-and-development jobs in the city and serves as a testament to the strength of our …

SAN ANTONIO — An affiliate of Miami-based investment firm Atlantic Pacific Cos. has acquired Reserve at Canyon Creek, a 314-unit apartment community in San Antonio. Reserve at Canyon Creek is located on the city’s northwest side and offers one-, two- and three-bedroom units that range in size from 676 to 1,657 square feet. Amenities include a pool, fitness center, resident clubhouse and a pet park. The new ownership plans to implement a multimillion-dollar renovation program that will upgrade unit interiors, enhance amenity spaces and deliver exterior building improvements. The seller and sales price were not disclosed.

TEXAS CITY, TEXAS — Florida-based real estate private equity firm Eastham Capital has sold Stone Ridge, a 248-unit apartment complex in Texas City, a southeastern suburb of Houston. The property offers one- and two-bedroom units with an average size of 446 square feet. Amenities include a pool, clubhouse, fitness center and a basketball court. Eastham acquired the property in 2018 in a joint venture with Mosaic Residential and subsequently implemented capital improvements. The buyer and sales price were not disclosed.

BOERNE, TEXAS — JLL has brokered the sale of Oxbow Hill Country, a 172-unit apartment complex in Boerne, located northwest of San Antonio. Built on 6.8 acres in 2003, the nine-building property offers one-, two- and three-bedroom units and amenities such as a pool, fitness center, dog park and outdoor grilling and dining stations. Robert Wooten, Robert Arzola and Ryan McBride of JLL represented the seller, California-based Brixton Capital, in the transaction. The buyer was Steadfast Cos.

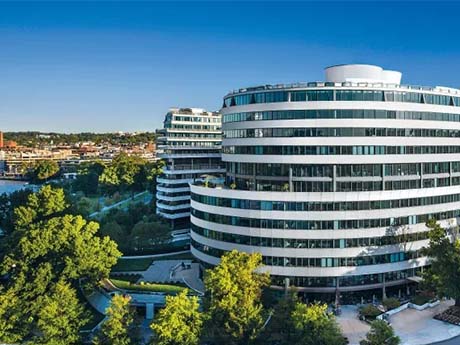

WASHINGTON, D.C. — Stream Realty Partners has arranged the sale of Watergate 600, a 12-story, 316,000-square-foot office building located at 600 New Hampshire Ave. N.W. in Washington, D.C.’s East End district. The buyer and sales price were not disclosed, but the Washington Business Journal reports that an affiliate of locally based Jetset Hospitality purchased the building for $52.5 million. Elme Communities, formerly known as Washington Real Estate Investment Trust, sold the property amid liquidating all of its assets and dissolving its business, according to the Washington Business Journal. Matt Pacinelli, Charlie Smiroldo and Lukas Stanat of Stream Realty represented Jetset in the transaction, while JLL represented the seller. The new owner has tapped Pacinelli, along with Tim McCarty, John Klinke and Josh McDonald of Stream Realty, to handle leasing at Watergate 600, which has a 125,000-square-foot top-block office space available. Amenities at the waterfront office building include a wraparound terrace on the seventh floor offering views of the Potomac River, a new lobby designed by LSM, new conference and event facilities, a modern fitness center and newly updated windows and elevators.