SEATTLE — Equity Residential has completed the disposition of Urbana, a seven-story multifamily property in Seattle. Carmel Partners acquired the property. The sales price was nearly $121 million, according to local media reports. Giovanni Napoli, Philip Assouad, Ryan Harmon, Nick Ruggiero and Anthony Palladino of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller and procured the buyer. Brian Eisendrath and Cameron Chalfant of IPA Capital Markets arranged acquisition financing for the buyer. Built in 2014, Urbana offers 289 apartments, two rooftop decks, a resident lounge with theater, a dog run and pet spa, bike storage and a gated parking garage, as well as 29,884 square feet of street-level retail space occupied by Verizon Wireless, Papa John’s, Five Guys and Planet Fitness.

Acquisitions

MONTGOMERY, TEXAS — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the sale of Harbor Shores, a 284-unit apartment community located north of Houston in Montgomery. The property, which was built in phases between 2016 and 2023, is located on the shores of Lake Conroe and offers one-, two- and three-bedroom units. Amenities include two pools, pickleball courts, a fitness center, clubhouse, and business center. Greg Austin, Travis Austin, Jackson Hart and Will Balthrope of IPA, along with Kyle Devillier of Marcus & Millichap, represented the seller, an entity doing business as NRG Conroe Villas LP, in the transaction. The quintet also procured the buyer, CEG Multifamily.

PHOENIX — Northmarq has arranged the sale of The Retro on 32nd Street, a garden-style multifamily property in Phoenix. Goodyear, Ariz.-based Belbrook 32 LLC sold the asset to La Jolla, Calif.-based Cane Capital for $8.2 million. Built in 1968 and renovated in 2002, The Retro at 32nd Street offers 62 studio, one- and two-bedroom units. Apartments feature stainless steel appliances, high-speed internet, vinyl plank flooring, oversized closets, open kitchens and ceiling fans. The pet-friendly community includes a swimming pool, leasing office and onsite management, laundry facility, an outdoor grilling space, onsite patrol and gated access. The property is located at 3025 N. 32nd St. Ryan Boyle, Trevor Koskovich, Jesse Hudson and Logan Baca of Northmarq’s Phoenix Multifamily Investment Sales represented the seller in the deal.

Matthews Real Estate Brokers Sale of 6,815 SF Office Property in Burlingame, California

by Amy Works

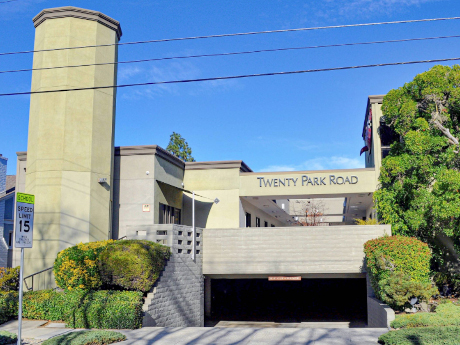

BURLINGAME, CALIF. — Matthews Real Estate Investment Services has arranged the sale of The Clock Tower, an office building in Burlingame. Sazze Partners, a venture capital firm from South Korea, acquired the asset for $5.4 million and plans to establish a U.S. office at the site. Located at 20 Park Road, The Clock Tower offers 6,815 square feet of office space. Marko Buljan of Matthews facilitated the transaction.

WYLIE, TEXAS — Locally based brokerage firm STRIVE has arranged the sale of a 23,900-square-foot warehouse in Wylie, a northeastern suburb of Dallas. According to LoopNet Inc., the property at 1141 Bozman Road comprises four buildings that were delivered in phases over the past several years, with Phase I completed in 2022 and Phase II completed in early 2024. Bryan Meyer and Jennifer Pierson of STRIVE represented the seller and procured the buyer, both of which were California-based investors that requested anonymity.

WEST CHESTER, OHIO — CBRE has arranged the $13 million sale of a 183,178-square-foot industrial property in West Chester near Cincinnati. Located at 9113 LeSaint Drive, the building served as the former headquarters of The O’Gara Group. Built in 1986 and renovated in 2023, the property features seven dock doors and eight drive-in doors on a 10.9-acre site. At the time of sale, the asset was fully occupied by three tenants. Will Roberts, Steve Timmel and Tim Schenke of CBRE represented the seller, TradeLane Properties. Plymouth Industrial REIT Inc. was the buyer.

CHICAGO — Greenstone Partners has negotiated the $7.4 million sale of a 48,500-square-foot flex office and industrial building located at 1100 W. Monroe St. in Chicago’s Fulton Market neighborhood. The three-story property features efficient floor plates, industrial storage, three exterior docks on the first floor and 37 surface parking spaces. The asset, which was well maintained by an owner-occupant for more than 20 years, is located two blocks south of McDonald’s global headquarters. Jason St. John of Greenstone Partners represented the buyer, Alexander West Capital, the family office of the Leopardo family. The property will serve as the new home for Leopardo Construction’s Chicago operations. Andrew Davidson, Jay Beadle and David Kimball of Transwestern represented the seller, 1100 West Monroe LLC, an affiliate of Kolcraft Enterprises.

ROSEMONT, ILL. — Kiser Group has brokered the $3.9 million sale of 35 condominium units in a bulk transaction in Rosemount, a suburb of Chicago. The value-add asset was 97 percent occupied at the time of sale and provides convenient access to Chicago O’Hare International Airport, Rivers Casino and the Rosemont Fashion Outlets. Andy Friedman and Jake Parker of Kiser brokered the sale, which involved multiple sellers. The buyer was a local investor.

WHITE PLAINS, N.Y. — CBRE has brokered the $27 million sale of a multifamily development site in White Plains, located north of New York City. The site at 60 S. Broadway spans 3.6 acres on the eastern edge of the downtown area and is approved for the development of two high-rise buildings totaling 814 units. Jeffrey Dunne, Eric Apfel and Travis Langer of CBRE represented the seller, Quarterra Multifamily Communities, in the transaction. The buyer was an affiliate of New York-based investment and development firm Stagg Group. A construction timeline was not disclosed.

PEBB Enterprises, Banyan Development Sell Shopping Center in Port St. Lucie, Florida for $32M

by John Nelson

PORT ST. LUCIE, FLA. — A joint venture between PEBB Enterprises and Banyan Development has sold The Shoppes at the Heart of Tradition, a 71,000-square-foot shopping center located within the master-planned community of Tradition in Port St. Lucie, for $32 million. One Investment Group represented the buyer, an entity doing business as 4Y Plaza LLC, in the transaction. The center — which was completed in 2024 — is anchored by Aldi. Additional tenants include Papa John’s Pizza, Carmela Coffee, Kyle G’s Amore Italian Chophouse, Spanish restaurant Port Tradition, Tomalty Dental, Peach Cobbler Factory, Picasso Nails & Spa, Rita’s Italian Ice & Frozen Custard and Swift Mediterranean Grill. Tradition, which opened in 2003, spans approximately 8,300 acres and features a variety of residential, retail and commercial spaces. PEBB Enterprises and Banyan Development are also developing Shoppes at Southern Grove within Tradition, which will include a 14.2-acre retail development with additional outparcels available for ground lease.