MILFORD, DEL. — Berkadia has brokered the $23.2 million sale of The Reserve at Sawmill, a 149-unit multifamily property in Milford, about 20 miles south of Dover. The sales price equates to a cap rate of roughly 5.7 percent. The property was delivered in phases between 1984 and 2008 and offers one-, two- and three-bedroom apartments, as well as five townhomes. Nat Gambuzza, Trevor Fiebel, Zac Pierce, Matthew Stefanski and Maura Spellman of Berkadia represented the undisclosed seller in the transaction. The buyer was also not disclosed. The property was fully occupied at the time of sale.

Acquisitions

SWEDESBORO, N.J. — Regional investment firm DH Property Holdings has acquired a 55,000-square-foot vacant industrial building in Swedesboro, located in Southern New Jersey. The building sits on a 14.7-acre site at 509 Heron Drive and features a clear height of 22 feet, five loading docks, four drive-in doors, 130-foot truck court depths, 60 car parking spots and three acres of fenced storage space. Jonathan Klear of NAI Mertz, along with Ian Richman & Marc Isdaner of Colliers, brokered the off-market deal. The seller was not disclosed.

Evergreen Devco Sells Outlook Table Mesa Multifamily Property in Wheat Ridge, Colorado for $97M

by Amy Works

WHEAT RIDGE, COLO. — Evergreen Devco has completed the disposition of Outlook Table Mesa, an apartment community at 4051 Clear Creek Drive in Wheat Ridge. FJ Management acquired the asset for $97 million. Situated within Clear Creek Crossing, Outlook Table Mesa offers 250 apartments with quartz countertops, wood-looking floorings, oversized windows, tall ceilings, stainless steel kitchen appliances, full-size washers/dryers and designer selected lighting fixtures. Community amenities include a clubhouse with a business lounge, fitness center, electric vehicle charging stations and a secure mail room with package lockers and a dedicated space for oversized deliveries. Additional amenities include a resort-style pool with a swim-up bar and spa, fire pits, barbecue stations, a dog park, pet spa and multiple shade structures and game areas. Dave Martin and Brian Mooney of Northmarq’s Denver office negotiated the sale on behalf of Evergreen.

PORTLAND, ORE. — Merrill Gardens, a senior living owner and operator, has added three communities to its Oregon portfolio. Located in metro Portland, the properties include Merrill Gardens at Cedar Mill, Merrill Gardens at Sherwood and Merrill Gardens at Hillsboro. Merrill Gardens acquired the communities as part of a joint venture with PGIM. An ownership group led by Rembold sold the Cedar Mill and Sherwood properties. Built in 2016, Merrill Gardens at Cedar Mill in Portland totals 163,975 square feet with 147 independent living, assisted living and memory care units. Merrill Gardens at Sherwood, which is located in Sherwood, was built in 2019. The 147,657-square-foot community features 137 apartments with independent living, assisted living and memory care options. Pilar Properties, a sister company of Merrill Gardens that is part of the joint venture with PGIM, developed Merrill Gardens at Hillsboro in Hillsboro. Opened in 2024, the property encompasses 171,732 square feet with 141 independent living and assisted living units. Merrill Gardens will manage and operate each of the communities. The company’s portfolio now comprises 61 seniors housing properties across 16 states.

SAN FRANCISCO — Bridges Capital has acquired 1045 Sansome, an office property located in the Jackson Square submarket of San Francisco, for an undisclosed price. Kyle Kovac and Mike Taquino of CBRE represented the undisclosed seller in the deal. The four-story building offers 83,871 square feet of creative office space. The property was built in 1926 and has been substantially renovated with new windows, interior upgrades, a top-floor lounge and a roof deck. At the time of sale, the building was 64 percent leased to tenants in architecture, design and e-commerce industries.

NANAKULI, HAWAII — CBRE has arranged the acquisition of Pacific Shopping Mall, a fee simple, grocery-anchored shopping center in Nanakuli in West Oahu. The property traded for an undisclosed amount in an off-market transaction. Located at 87-2070 Farrington Highway, Pacific Shopping Mall offers 79,000 square feet of retail space that was 90 percent occupied at the time of sale. Current tenants include Foodland’s Sack N Save, McDonald’s, O’Reilly Auto Parts, Here Fuel and Subway. Nicholas Paulin and AJ Cordero of CBRE represented the private buyer in the acquisition.

PORT HURON, MICH. — Marcus & Millichap has brokered the $9.7 million sale of Port of Call Manufactured Housing Community in eastern Michigan’s Port Huron. Developed in 1995, the community is licensed for 146 homesites, 143 of which are occupied. Of the homes, 112 are community owned and 31 are tenant owned. All utilities are public and individually metered, and the property features off-street parking, community lighting and a basketball court. Chase Gilewski and Marcus & Millichap represented the seller and procured the buyer. Luke Lamoreaux of Marcus & Millichap Capital Corp. arranged $7.2 million in acquisition financing through a national housing lender that specializes in manufactured, modular and mobile homes.

AUBURN, ALA. — Core Spaces has acquired The Union at Auburn, a 501-bed property located near the Auburn University campus in Alabama. The Chicago-based student housing owner-operator purchased the community from Boston-based WFI for an undisclosed price. Newmark brokered the acquisition. Shared amenities at The Union at Auburn include a clubhouse; two-story fitness center with a Barre, Yoga and TRX studio and on-demand fitness classes; cyber café and business center; rideshare lounge; resort-style swimming pool; outdoor kitchen and entertainment area; dog park; and study rooms.

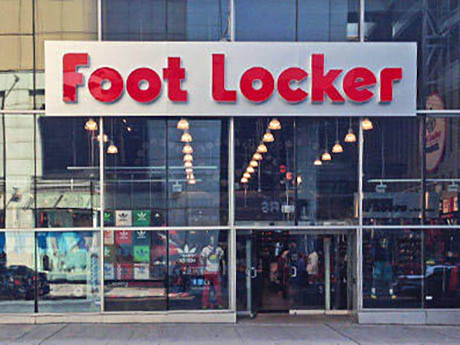

PITTSBURGH AND NEW YORK CITY — DICK’S Sporting Goods Inc. (NYSE: DKS) has entered into a definitive merger agreement with footwear and apparel retailer Foot Locker Inc. (NYSE: FL). Under the agreement, sporting goods retailer DICK’S will acquire Foot Locker for an equity value of roughly $2.4 billion and an enterprise value of $2.5 billion. Foot Locker operates approximately 2,400 retail stores across 20 countries in North America, Europe, Asia, Australia and New Zealand. Foot Locker’s portfolio of brands also includes Kids Foot Locker, Champs Sports, WSS and atmos. DICK’S plans to operate Foot Locker as a standalone business unit and maintain the various Foot Locker brands. This acquisition will mark the first international expansion for the Pittsburgh-based sporting goods retailer. Upon completion of the merger, which has been unanimously approved by the boards of directors of the two companies, Foot Locker shareholders will choose to receive either $24 in cash or 0.1168 shares of DICK’S common stock for each share of Foot Locker common stock. The $24 value represents a premium of roughly 66 percent to Foot Locker’s 60-trading day volume weighted average price. “We have long admired the cultural significance and brand equity that Foot Locker and its …

MAGNOLIA, TEXAS — Marcus & Millichap has brokered the sale of Windcrest Village Square, a 14,907-square-foot retail strip center in Magnolia, a northwestern suburb of Houston. Built on 1.5 acres in 2023, the center was fully leased at the time of sale to tenants such as The Toasted Yolk, Sugar Llamas, Anytime Fitness, Kitchen & Bath Shop and Ally Anne’s Kolache Kitchen. Allie Munday and Philip Levy of Marcus & Millichap represented the undisclosed seller in the transaction.