ORADELL, N.J. — Locally based brokerage firm The Kislak Co. Inc. has negotiated the $2.9 million sale of a 13-unit apartment building in the Northern New Jersey community of Oradell. Completed in 1980, the building at 222 Kinderkamack Roadexclusively offers studio apartments and includes 5,195 square feet of office space. Robert Squires of Kislak represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

Acquisitions

Regency Centers Acquires Brentwood Place Shopping Center in Metro Nashville for $118.5M

by John Nelson

BRENTWOOD, TENN. — Regency Centers Corp. has acquired Brentwood Place, a 320,000-square-foot power retail center located in the south Nashville suburb of Brentwood. According to the Nashville Business Journal, the center sold for $118.5 million. The property was 95 percent leased at the time of sale and comprises more than 100,000 square feet of anchor retail space leased to Nordstrom Rack, Total Wine & More, T.J. Maxx/HomeGoods and Golf Galaxy. Originally developed in 1973, Brentwood Place is adjacent to the site of the future 350,000-square-foot Vanderbilt Medical Campus.

RICHMOND, VA. — Chicago-based JLL Income Property Trust has purchased a 280,000-square-foot distribution center in Richmond for $40.7 million. The Class A property was delivered in 2022 and features a 200-foot truck court, 32-foot clear heights, truck storage spaces and cold storage areas. The property has direct access to I-895 and is located within two miles of Richmond International Airport and eight miles from I-95. Two unnamed, global tenants occupy the facility with a weighted average lease term (WALT) of 8.4 years.

ROCK HILL, S.C. — Avison Young has brokered the $11.5 million sale of a 120,000-square-foot industrial facility located near I-77 at 2690 Commerce Drive in Rock Hill, a South Carolina suburb of Charlotte. Chris Loyd, Tom Tropeano and Ryan Kendall of Avison Young represented the seller, Graham Capital, in the transaction. The buyer, Dallas-based Leon Industrial, has tapped Avison Young to handle leasing of the property moving forward.

Ardent Acquires 1.1 MSF Seminole Towne Center Mall in Central Florida, Plans Mixed-Use Redevelopment

by John Nelson

SANFORD, FLA. — The Ardent Co. has acquired Seminole Towne Center Mall, a 1.1 million-square-foot regional mall located in Sanford, roughly 28 miles northeast of Orlando. The Atlanta-based investor plans to develop the property into a mixed-use development. According to several local media outlets, Ardent purchased the mall from Hollywood, Fla.-based 4th Dimension Properties for roughly $17.5 million. While plans for the 76-acre property will include the addition of new retailers, multifamily housing and a hotel, the center’s four anchor tenants — Dillard’s, JC Penney, Dick’s Sporting Goods and Elev8 — will remain at the property. Seminole Towne Center Mall originally opened in 1995 and officially closed for redevelopment in January.

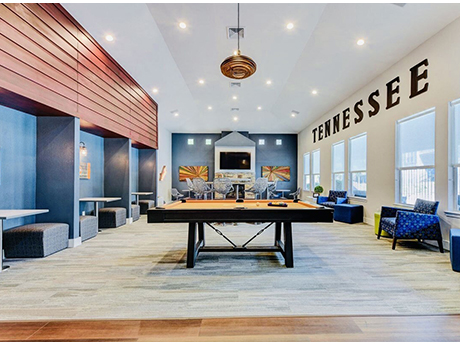

Muinzer, Kayne Anderson Recapitalize 1,356-Bed Student Housing Portfolio Near University of Tennessee

by John Nelson

KNOXVILLE, TENN. — Private equity investment firm Muinzer has partnered with Kayne Anderson Real Estate to recapitalize a two-property student housing portfolio near the University of Tennessee in Knoxville. The 1,356-bed portfolio, which includes The Heights of Knoxville and University Park, was fully occupied at the time of the transaction. Scott Clifton, Kevin Kazlow and Teddy Leatherman of JLL arranged the recapitalization. Los Angeles-based Muinzer originally acquired the two student housing properties in 2021 in a partnership with T2 Capital Management. Further details of the company’s recapitalization with Kayne Anderson were not released.

Bixby Capital Management Purchases 222,382 SF Industrial Facility in Lebanon, Tennessee

by John Nelson

LEBANON, TENN. — California-based Bixby Capital Management has purchased a newly constructed industrial facility located at 212 Alligood Way in Lebanon, about 22 miles east of Nashville International Airport. Completed in 2024 and currently vacant, the 222,382-square-foot property features a rear-load configuration, 32-foot clear heights, an ESFR sprinkler system, 21 dock-high doors, two drive-in doors, 32 trailer parking spaces, 2,500 square feet of speculative office space and a 135- to 185-foot truck court. George Fallon, Frank Fallon and Trey Barry of CBRE brokered the transaction. The seller and sales price were not disclosed.

PARSIPPANY, N.J. — CBRE has negotiated the $10.2 million sale of a 79,766-square-foot office building in the Northern New Jersey community of Parsippany. According to LoopNet Inc., the building at 299 Cherry Hill Road was originally constructed in 1977 and renovated in 2021. Capital improvements included a redesign of the exterior façade; updated roadway signage, a new electronic tenant directory and LED lighting in the lobby and a new tenant amenity center with grab-n-go food service, conference room and a huddle room. Charles Berger and Thomas Mallaney of CBRE represented the seller and procured the buyer in the transaction.

VIRGINIA BEACH, VA. — Alexandria, Va.-based Bonaventure has purchased Solace Apartments, a 250-unit multifamily community located at 400 S. Military Highway in Virginia Beach. The acquisition was made as an UPREIT transaction, an investment strategy where property owners contribute real estate to a REIT’s operating partnership in exchange for ownership interest in that partnership. Robert Prodan served as a contributor with Bonaventure’s REIT, Bonaventure Multifamily Income Trust (BMIT), in the UPREIT acquisition. The seller and sales price were not disclosed. Built in 2014, Solace features one- and two-bedroom apartments, as well as a pool, fitness center, grilling stations and a community clubhouse.

SMITHFIELD, N.C. — Legacy Realty Group Advisors LLC has arranged the sale of Centre Pointe Plaza, a 159,259-square-foot shopping center in Smithfield, approximately 30 miles southeast of Raleigh. An undisclosed buyer purchased the property for $11.6 million. Originally built in 1989, the shopping center is anchored by Belk. Additional tenants at the property include Bealls, Dollar Tree, Hibbett Sports, Subway and T-Mobile. Daniel Baruch of Legacy Realty represented the buyer, and Steve Shields of CBRE represented the undisclosed seller in the transaction.