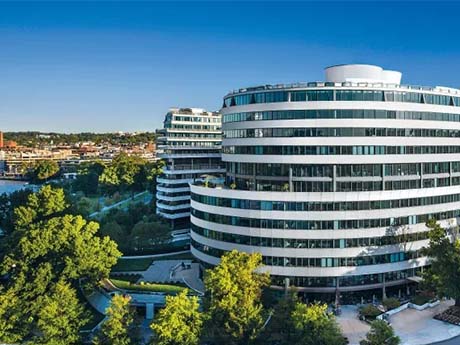

WASHINGTON, D.C. — Stream Realty Partners has arranged the sale of Watergate 600, a 12-story, 316,000-square-foot office building located at 600 New Hampshire Ave. N.W. in Washington, D.C.’s East End district. The buyer and sales price were not disclosed, but the Washington Business Journal reports that an affiliate of locally based Jetset Hospitality purchased the building for $52.5 million. Elme Communities, formerly known as Washington Real Estate Investment Trust, sold the property amid liquidating all of its assets and dissolving its business, according to the Washington Business Journal. Matt Pacinelli, Charlie Smiroldo and Lukas Stanat of Stream Realty represented Jetset in the transaction, while JLL represented the seller. The new owner has tapped Pacinelli, along with Tim McCarty, John Klinke and Josh McDonald of Stream Realty, to handle leasing at Watergate 600, which has a 125,000-square-foot top-block office space available. Amenities at the waterfront office building include a wraparound terrace on the seventh floor offering views of the Potomac River, a new lobby designed by LSM, new conference and event facilities, a modern fitness center and newly updated windows and elevators.

Acquisitions

MORRISVILLE, N.C. — Foxfield has purchased 3503 Page Road, a newly built, 57,000-square-foot life sciences building located in Morrisville, about 14 miles west of Raleigh. The seller and sales price were not disclosed. Kryosphere, a biorepository solutions and cold chain logistics user, operates the facility under a 12-year net lease. The company has invested $5 million into the specialized build-out for pharmaceutical-grade cold storage infrastructure, with plans for an additional $5 million investment for equipment upgrades, according to Foxfield. Built in 2025, 3503 Page Road is situated within the World Trade Park industrial park and offers direct connectivity to I-40, I-540 and Raleigh-Durham International Airport. The building features industrial space, lab support and research-and-development space, as well as 24-foot clear heights.

Sands Investment Group Brokers $23.4M Sale of Kroger-Anchored Center in Metro Atlanta

by John Nelson

LAWRENCEVILLE, GA. — Sands Investment Group has brokered the $23.4 million sale of River Exchange Shopping Center, a 273,023-square-foot, Kroger-anchored shopping center located in Lawrenceville, roughly 30 miles northeast of downtown Atlanta. Liam Rowan and Tyler Baughman of Sands represented the seller, a joint venture between BASH Capital, Dragonfly Investments and Baltimore-based America’s Realty LLC, and the buyer, an entity doing business as Vishal River Exchange LLC, in the transaction. SouthState Bank provided acquisition financing. River Exchange was 80 percent leased at the time of sale to tenants including Goodwill, ReStore, Citi Trends, Cato Fashions, Farmers Furniture, Subway, Riverside Pizza and Cosmetic Dental.

ROCKY HILL, CONN. — Marcus & Millichap has negotiated the $14.3 million sale of Big Y Plaza, a 60,497-square-foot shopping center in Rocky Hill, located south of Hartford. Built on 14 acres in 1988, the center was fully leased at the time of sale to the namesake grocer and Wells Fargo. Joseph French Jr., Jeffrey Stearney and John Krueger of Marcus & Millichap represented the Connecticut-based seller in the transaction and procured the buyer, a New York-based investor. Both parties requested anonymity.

Granite Capital Group Divests of 105-Unit Multifamily Property in Fort Collins, Colorado

by Amy Works

FORT COLLINS, COLO. — California-based Granite Capital Group has sold Enclave Rigden Farm, a multifamily property in Fort Collins, to Avanti Residential for $40.8 million, or $389,285 per unit. Located at 2758 Iowa Drive, Enclave Ridge Farm features 105 townhome-style apartments with direct access to car garages and private patios. Built in 2007, the property was 95 percent occupied at the time of sale. Robert Bratley, Jack Sanders, Mike Grippi and Pamela Koster of Berkadia represented the seller in the transaction. The Berkadia team also arranged financing for the deal.

COMPTON, CALIF. — CSME Partners LLC has completed the disposition of an industrial property located at 1800 S. Anderson Ave. in Compton. Yueji Inc. acquired the asset in a transaction valued at $28.2 million. Yuejie, a freight forwarding company, will use the 83,527-square-foot property for warehouse and distribution services, including port-oriented distribution space to serve customers across the Los Angeles Basin. Nick Buss, Frank Schulz and Tyler Rollema of The Klabin Co. represented the seller, while Andrew Dilfer, Luke Staubitz and Harvey Beesen of Kidder Mathews represented the buyer in the deal.

Hanley Investment Group Arranges $6.9M Sale of Two Retail Pad Sites in Murrieta, California

by Amy Works

MURRIETA, CALIF. — Hanley Investment Group Real Estate Advisors has arranged the $6.9 million sale of two single-tenant retail pads at the intersection of California Oaks Road and Jackson Avenue in Murrieta. A private developer based in Orange County, Calif., sold the properties to a private 1031 exchange investor based in California’s Central Valley. Sean Cox and Bill Asher of Hanley Investment Group represented the seller, while Brendan Tyoran and Jake Linsky of Matthews Real Estate Investment Services represented the buyer in the deal. The two-tenant property features two separate, stand-alone pads on a 1.78-acre parcel. Built in 2022, Quick Quack Car Wash occupies the 4,126-square-foot property at 40640 California Oaks Road on a 20-year absolute triple-net ground lease with approximately 17 years remaining, including 12 percent rental increases every five years and multiple renewal options. Popeyes, which closed on a lease prior to the sale, will begin construction on a 1,983-square-foot restaurant at 40642 California Oaks Road. The tenant signed a 20-year, absolute triple-net ground lease with 10 percent rental increases every five years.

NEW LENOX, ILL. — NAI Hiffman has negotiated a long-term lease for Silver Cross Hospital at 1890 Silver Cross Blvd. in New Lenox. The 174,855-square-foot, six-story medical office building is known as Pavilion A. Immediately following execution of the lease, the building was sold for $88.6 million to Chicago-based Farpoint and Dallas-based The Landes Group. The transaction included the renegotiation of Silver Cross’ existing lease and established Silver Cross as the largest tenant in the building, which is 96 percent occupied. Silver Cross will retain its footprint on the first and lower-level floors plus the upper levels. Existing healthcare providers, including the Shirley Ryan AbilityLab at Silver Cross, Duly Health and Care, DaVita, Rush University Medical Center and UChicago Medicine will also remain in place. Perry Higa of NAI Hiffman represented Silver Cross in the lease, which was completed at a net per-square-foot rate below the early renewal rate he negotiated on behalf of the tenant in May 2025. NAI Hiffman has also been retained as leasing agent for the building, which was constructed in 2012. Hiffman National will serve as property manager. Chris Bodnar of CBRE represented the sellers, PGIM Real Estate and NexCore Group.

CHICAGO — Greenstone Partners has brokered the $19.5 million sale of a 54,000-square-foot retail center located at 1415-1417 N. Kingsbury St. in Chicago’s Clybourn Corridor. A venture between Chicago-based Honore Properties and Peerless Development acquired the fully leased property. Danny Spitz and AJ Patel of Greenstone represented the seller, Los Angeles-based Westwood Financial. The transaction marks the fourth acquisition in the immediate corridor for Honore and Peerless. Spitz previously represented the venture in the acquisition of the adjacent property at 821 W. Eastman St. Originally acquired by Westwood in 2017 via a loan assumption structure, the Kingsbury center underwent a significant repositioning following the departure of Buy Buy Baby. In 2023, ownership executed a lease-up strategy by securing Sky Zone on a 10-year lease for 35,386 square feet. The center is also home to PetSmart, which has operated an 18,524-square-foot store since 2012. The property also features a redevelopment component. The asset includes nearly 500,000 square feet of transferable air rights, creating a future high-density multifamily development opportunity. Dean Giannakopoulos of Marcus & Millichap Capital Corp. arranged $13.7 million in acquisition financing through Great Southern Bank.

West Capital Lending Acquires 104,375 SF Office Building in Irvine, California for $23.7M

by Amy Works

IRVINE, CALIF. — West Capital Lending has purchased 17911 Von Karman Avenue, a five-story Class A office building in Irvine’s Concourse submarket. John Hancock Insurance sold the asset for $23.7 million. West Capital Lending will occupy approximately half of the 104,375-square-foot building for its corporate headquarters. Two additional tenants will continue to occupy the first and second floors of the asset. Jay Nugent and Scott Read of Newmark represented the buyer in the deal.