NEEDHAM, MASS. — Newmark has negotiated the $132 million sale of 140 Kendrick Street, a 400,00-square-foot office property in Needham, located southwest of Boston. Wellington Management anchors the property, which comprises three interconnected buildings that are also home to tenants such as Clarks, CyberArk and Focus Partners Wealth. Robert Griffin, Edward Maher, Matthew Pullen, James Tribble, Samantha Hallowell and William Sleeper of Newmark represented the seller, BXP (formerly known as Boston Properties), in the transaction. The team also procured the buyer, a partnership between Cross Ocean Partners and Lincoln Property Co.

Acquisitions

SELLERSBURG AND JEFFERSONVILLE, IND. — Cushman & Wakefield | Commercial Kentucky has brokered the sale of the Southern Indiana 3 Portfolio for an undisclosed price. The portfolio includes three workforce multifamily communities totaling 312 units. The assets include Ashby Apartments and Lakeview Apartments in Sellersburg and Carrington Place Apartments in Jeffersonville. All three communities are located within a 12-minute drive of downtown Louisville. Craig Collins, Austin English, Mike Kemether and James Wilbur of Cushman & Wakefield represented the seller, Salt Lake City-based Shamrock Communities. The buyer was The Clear Blue Co., a Nashville-based real estate firm.

NOBLESVILLE, IND. — JLL Capital Markets has arranged the sale of Outlook Hamilton, a 172-unit luxury active adult community in Noblesville. Delivered in 2023, the property is situated adjacent to Hamilton Town Center and features one- and two-bedroom floor plans. Amenities include a fitness center, sports lounge, theater, great room, courtyard, community garden, dog park and detached garages for rent. Jay Wagner, Rick Swartz, Aaron Rosenzweig, Sam Dylag, Tim Hosmer and Sandis Seale of JLL represented the seller, Capitol Seniors Housing. The team partnered with JLL’s Amanda Friant, Jenny Hull, Holly Hunt, Ken Martin and Nelson Almond. Middle Street Partners and its limited partner, Parse Capital, purchased the asset.

BRICK, N.J. — Marcus & Millichap has brokered the $7.2 million sale of Yorketown Plaza, a 41,219-square-foot shopping center in Brick, located near the Jersey Shore. The center sits on 5.8 acres and is home to tenants such as Domino’s, Mariner Finance, Crown Fried Chicken, Nova Games and Community Medical Center. Brent Hyldahl, Alan Cafiero and Seth Goldberg of Marcus & Millichap represented the seller, Ocean County Equities LLC, in the transaction. The buyer was not disclosed.

Crescent Communities, Fortius Capital Sell 449,069 SF Industrial Facility in Charlotte Leased to Amazon

by John Nelson

CHARLOTTE, N.C. — Crescent Communities and Fortius Capital Partners have sold AXIAL Rapid Commerce, a 449,069-square-foot industrial facility located at 500 Rhyne Road in Charlotte. The owners recently signed Amazon to a full-building lease at the facility, which is situated within the 1.5 million-square-foot, 140-acre Rapid Commerce Park. Pacolet Milliken, the project’s limited partner, is purchasing the facility from Crescent Communities and Fortius Capital for an undisclosed price. The LEED-certified property features 3,850 square feet of office space, 338 automobile parking spaces, 106 trailer parking spaces, two drive-in doors, multiple storefronts, 36-foot clear heights and abundant dock doors.

Cushman & Wakefield Negotiates Sale of 134,832 SF Publix-Anchored Shopping Center in Boca Raton, Florida

by John Nelson

BOCA RATON, FLA. — Cushman & Wakefield has negotiated the sale of Polo Club Shops, a 134,832-square-foot shopping center located in Boca Raton. The center is anchored by Publix, which completed a full demolition and reconstruction of its store in 2022, expanding the property by an additional 48,387 square feet. Mark Gilbert, Adam Feinstein and Mitchell Halpern of Cushman & Wakefield represented the seller, Atlanta-based Jamestown Properties, in the transaction. The buyer, Publix Super Markets, purchased the shopping center for an undisclosed price. The Lakeland, Fla.-based grocer is operating with a new 20-year lease. Other tenants at Polo Club Shops include Beignets & Brews, Brendy’s Ice Cream, Ernie’s Açai Bowls, First Watch, Peak Beauty Studio, Manhattan Joe’s Pizzeria, Pet Supermarket and Phenix Salon Suites.

CONYERS, GA. — Highline Real Estate Capital has acquired Salem Gate Market, a 177,527-square-foot shopping center located in Conyers, a southeast suburb of Atlanta in Rockdale County, for $25.4 million. Situated directly off I-20, the center’s tenant roster includes anchors Academy Sports + Outdoors and Floor & Décor. The Miami-based investor purchased Salem Gate Market from the undisclosed seller via its Highline Real Estate Fund 1, which launched in 2023 and has completed more than $350 million in acquisitions. Brad Buchanan and Jim Hamilton of JLL’s Atlanta office represented the seller in the transaction. Highline also recently sold an unanchored retail center in Conyers in a separate transaction totaling $9 million.

IRVING, TEXAS — Fort Worth-based investment firm PHP Capital Partners has purchased Gateway Business Center, a 115,000-square-foot industrial park in Irving. The development consists of four buildings that house suites that range in size from 2,500 to 16,000 square feet. The seller and sales price were not disclosed. PHP Capital has tapped Property Advisers Realty Inc. as the leasing agent.

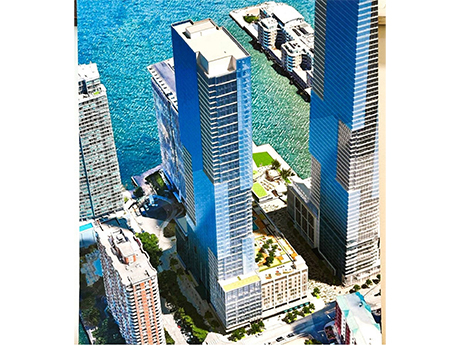

JERSEY CITY — Locally based investment and development firm GN Management has acquired a multifamily development site in Jersey City with plans to construct a 57-story tower. The waterfront site is known as Harborside 9 and is approved for the development of 579 units, as well as 14,800 square feet of retail space and a 555-space parking garage. Fifteen percent (87 residences) will be set aside as affordable housing. Information on floor plans and amenities was not disclosed. Jim Pompa of Coldwell Banker brokered the sale of the site from Panepinto Properties, which recently closed on financing for a 678-unit multifamily project at Harborside, to GN Management. Construction is targeted for a 2027 commencement.

BURLINGTON, MASS. — Newmark has arranged the $84.5 million sale of the 431,233-square-foot campus of Keurig Dr Pepper in Burlington, located north of Boston. The two-building campus was constructed in 2014 and consists of a 280,560-square-foot office building and a 150,673-square-foot research-and-development/manufacturing facility. Robert Griffin, Edward Maher, Matthew Pullen, James Tribble, Samantha Hallowell and William Sleeper of Newmark represented the seller, Peakstone Realty Trust, in the transaction. The team also procured the buyer, Montana Avenue Capital Partners.