CAMBRIDGE, MASS. — Newmark has negotiated the sale of three life sciences facilities totaling 552,543 square feet in Cambridge, located across the Charles River from Boston. The facilities are located at 215 First St., 150 Second St. and 11 Hurley St. in the Kendall Square submarket. Robert Griffin, Edward Maher, Matthew Pullen, James Tribble, Samantha Hallowell and William Sleeper of Newmark represented the seller and procured the buyer, both of which requested anonymity, in the transaction. Newmark’s Grady Zink provided financial analysis support for the transaction.

Acquisitions

Cushman & Wakefield Brokers Sale of 400,833 SF Industrial Park in Plant City, Florida

by John Nelson

PLANT CITY, FLA. — Cushman & Wakefield has brokered the sale of Peak Logistics Center, a two-building industrial park located at 3501 Fancy Farms Road in Plant City, a city in west-central Florida. EQT Exeter purchased the property for an undisclosed price from TA Realty LLC. Rick Brugge, Mike Davis, Rick Colon and Ryan Jenkins of Cushman & Wakefield represented the seller in the transaction with assistance from Clay Witherspoon of Avison Young, who oversees leasing for the property. Peak Logistics Center I & II span 400,833 square feet and were completed in 2022 and 2023. The development was fully leased to four tenants at the time of sale.

NEW YORK CITY — Terreno Realty Corp., an investment firm with offices in metro Seattle, San Francisco and New York City, has purchased a 33,000-square-foot industrial building in Queens for $50.1 million. The building sits on a 2.6-acre site at 49-15 Maspeth Ave. and features 40 dock-high and four grade-level loading positions, as well as parking for 31 cars and 50 trailers. The property was 100 percent leased at the time of sale to an HVAC and industrial products distributor. The seller was not disclosed. The sales price translates to a cap rate of 4.5 percent.

BOSTON — Marcus & Millichap has brokered the $7.9 million sale of three retail buildings totaling 20,924 square feet in Massachusetts and New Hampshire that are leased to automotive services provider Town Fair Tire. The Massachusetts buildings are located in Billerica and Brockton, and the New Hampshire property is located in Nashua. Jim Koury and Alex Quinn of Marcus & Millichap represented the seller, Orion Buying Corp., in the deal. Ryan Wilmer, also with Marcus & Millichap, procured the buyer of the Massachusetts buildings. Robert Rohrer Jr. of Colliers represented the buyer of the New Hampshire asset.

ENGLEWOOD, COLO. — A joint venture between DPC Cos. and Ogilvie Partners has acquired Englewood CityCenter for an undisclosed price. Brad Lyons of CBRE handled the transaction. Englewood CityCenter offers 220,000 square feet of office, retail and multifamily space. The joint venture is working with the City of Englewood on a master redevelopment plan to transform Englewood CityCenter into a community center with multifamily housing, open space for community gathering and a walkable live/work/shop area with retail, services, restaurants and a hotel within the 12-acre site. At the time of sale, the property was 40 percent leased. Current tenants include Harbor Freight, Ross Dress for Less, Petco, Tokyo Joe’s, Jersey Mike’s Subs and Einstein Bros.

SRS Real Estate, Hanley Investment Group Broker $7.2M Sale of Retail Property in Corning, California

by Amy Works

CORNING, CALIF. — SRS Real Estate Partners and Hanley Investment Group have arranged the sale of a retail property located at 570 Solano St. in Corning, approximately 25 miles from Chico. A Redding, Calif.-based private investor sold the asset to a Napa Valley, Calif.-based private investor for $7.2 million. Sav-Mor Foods occupies the 32,000-square-foot property, which is situated on 2.6 acres. The store is run by North State Grocery, which operates 21 locations in California and Oregon. Alexander Moore of SRS Capital Markets and Lee Csenar of Hanley Investment Group represented the seller in the transaction.

Coastal Holdings Group Buys 11,050 SF Industrial Building in Poway, California for Relocation

by Amy Works

POWAY, CALIF. — Coastal Holdings Group has acquired an industrial building located at 12155 Paine Place in Poway for $4.1 million from Bergo Enterprises. The buyer plans to use the 11,050-square-foot property to accommodate its electrical contracting business. Chris Duncan of Voit Real Estate Services represented the buyer, while Robb Kerr of Intersection Commercial Real Estate represented the seller in the deal. Prior to the acquisition of 12155 Paine Place, Duncan brokered the $3.4 million sale of an 8,049-square-foot industrial building located at 13851 Danielson St. on behalf of Coastal Holdings Group. Escobar Family Real Estate Holdings acquired the asset as an investment property. Travis Jaedtke of Strategic Real Estate Group represented the buyer.

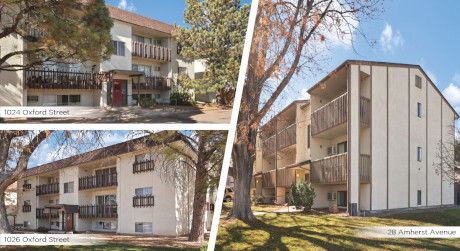

Pinnacle Real Estate Advisors Negotiates Sale of Oxford Pines Apartments in Pueblo, Colorado

by Amy Works

PUEBLO, COLO. — Pinnacle Real Estate Advisors has arranged the sale of Oxford Pines Apartments, located at 1024-1026 Oxford St. and 28 Amherst Ave. in Pueblo. The three-building property offers 35 one- and two-bedroom units, many with private balconies, as well as 23 carports and two garages. Chris Knowlton of Pinnacle Real Estate Advisors represented the undisclosed seller and undisclosed buyer in the deal. The asset traded for $3.1 million, or $90,000 per unit.

NOBLESVILLE, IND. — CBRE has arranged the sale of Federal Hill Apartments, a 222-unit multifamily property in the Indianapolis suburb of Noblesville. The sales price was undisclosed. Built in 2024, the asset features a range of studio, one- and two-bedroom floor plans averaging 863 square feet. Amenities include a fitness center, pool, indoor pet grooming spa, electric vehicle charging stations and an outdoor grilling area. There are three onsite retailers — Indie Coffee Roasters, Café Noricha and Bocado. Hannah Ott, George Tikijian, Cam Benz, Clair Hassfurther, Ryan Stockamp and Sean Pingel of CBRE represented the seller, Old Town Cos. Summit Equity Investments was the buyer.

BELLEVUE, NEB. — Investors Realty Inc. has brokered the $13.6 million sale of the Twin Creek Shopping Center in Bellevue, a southern suburb of Omaha. Situated at the intersection of 36th Street and Highway 370, the property consists of eight retail buildings totaling 83,085 square feet. Ember Grummons of Investors Realty represented the seller, River Village Twin Creek LLC. Tim Kerrigan, Grant Kobes and Jarrot Simon of Investors Realty represented the buyer, Classic Street Partners LLC.