EDINA AND EDEN PRAIRIE, MINN. — MLG Capital has acquired the Golden Triangle Portfolio in suburban Minneapolis for an undisclosed price. The flex portfolio includes a blend of industrial and office space across nine buildings in Edina and Eden Prairie. Golden Triangle is the 20th acquisition within MLG’s most recent fund, MLG Private Fund VI, and its 48th investment in metro Minneapolis. MLG partnered with Big River Real Estate on the acquisition.

Acquisitions

APEX, N.C. — Boston-based Rockpoint has sold Building I at Apex Commerce Center, a four-building industrial park totaling 845,000 square feet in Apex, a city roughly 15 miles southwest of Raleigh. LaSalle Investment Management purchased the 233,818-square-foot facility for an undisclosed price. Dave Andrews and Pete Pittroff of JLL represented Rockpoint in the transaction. Building I at Apex Commerce Center was built in 2023 and was fully leased at the time of sale. The rear-load facility features 32-foot clear heights, ESFR sprinklers and LED lighting. Building I is the first of four buildings at Apex Commerce Center, which Rockpoint developed in partnership with Oppidan Investment Co.

ALPHARETTA, GA. — Coro Realty Advisors has sold North Point Village, a 57,219-square-foot shopping center in the northern Atlanta suburb of Alpharetta. Mimms Enterprises purchased the property from Coro Realty for $19 million. Fred Victor of Atlantic Retail brokered the transaction. Situated on 5.2 acres near Ga. Highway 400, North Point Village’s tenant roster includes Talbots, Kohler and Learning Express. The 1.3 million-square-foot North Point Mall is immediately adjacent to the center.

BOYNTON BEACH AND JUPITER, FLA. — Redfearn Capital has purchased two industrial facilities in South Florida for a total of $10.8 million. The Delray Beach, Fla.-based investment firm acquired a 17,215-square-foot, multi-tenant facility at 4875 Park Ridge Road in Boynton Beach for $3.4 million and a 30,920-square-foot property at 1445-1449 Jupiter Park Drive in Jupiter for $7.4 million. The seller(s) was not disclosed.

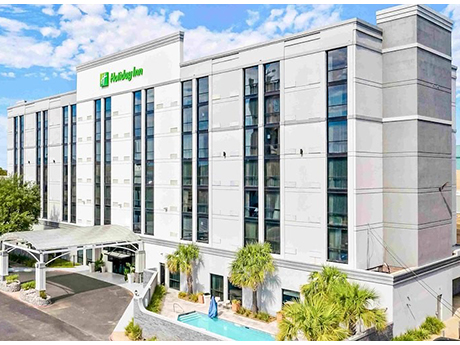

ALEXANDRIA, LA. — Marcus & Millichap has brokered the $9.8 million sale of Holiday Inn Alexandria Downtown, a 169-room hotel located at 701 4th St. in downtown Alexandria that fronts the Red River. The seller was Sharpco Hotels, an investment firm based in Natchitoches, La., that purchased the formerly vacant hotel from the City of Alexandria and revitalized and rebranded the property. A partnership between Tennessee-based VJ Hotels and Texas-based ARK Hospitality purchased the hotel. David Altman of Marcus & Millichap represented the seller in the transaction. Steve Greer served as Marcus & Millichap’s broker of record in Louisiana for the transaction. Holiday Inn Alexandria Downtown features 11,000 square feet of meeting space, a restaurant and Tesla car chargers, as well as direct access to the Randolph Riverfront Convention Center.

FCP Sells Atlanta Apartment Community to Monday Properties, RSN Property Group for $36.8M

by John Nelson

ATLANTA — FCP has sold Villas at Princeton Lakes, a 210-unit apartment community located at 751 Fairburn Road SW in west Atlanta. A partnership between Monday Properties and RSN Property Group purchased the garden-style complex for $36.8 million. Travis Presnell and James Wilber of Cushman & Wakefield represented FCP in the transaction. Built in 2004, Villas at Princeton Lakes offers a mix of one-, two- and three-bedroom floor plans. FCP had originally purchased the community in late 2020 for $30 million, including the assumption of an existing mortgage, and implemented upgrades to the property’s common areas and exteriors.

Marcus & Millichap Brokers Sale of New Restaurant in Boiling Springs, South Carolina Leased to Whataburger

by John Nelson

BOILING SPRINGS, S.C. — Marcus & Millichap’s Taylor McMinn Retail Group has brokered the sale of a new restaurant in Boiling Springs, a city about eight miles northwest of Spartanburg, S.C. Texas-based burger chain Whatburger occupies the restaurant on a 15-year, corporate-guaranteed ground lease with planned rental increases and extension options for the tenant. Built on 1.5 acres earlier this year, the 3,318-square-foot restaurant serves as an outparcel to a Target-anchored shopping center. Don McMinn of Marcus & Millichap represented the seller, a developer based in Tennessee, in the sale. The buyer was an all-cash exchange investor. “This is our second Whataburger closing this month, and we are closing another one in Atlanta in December,” says McMinn. “Whataburgers continues to garner strong demand and attractive pricing from investors and are one of the more desirable QSR options in the market today.”

Goodman Real Estate Sells Three Multifamily Properties in Tacoma, Washington for $102.6M

by Amy Works

TACOMA, WASH. — Goodman Real Estate has completed the disposition of three multifamily assets in Tacoma to American Capital Group for $102.6 million. Giovanni Napoli, Philip Assouad, Ryan Harmon, Nick Ruggiero and Anthony Palladino of Institutional Property Advisors, a division of Marcus & Millichap, represented the seller and procured the buyer in the deal. Totaling 557 units, the properties are situated within Tacoma’s Parkland neighborhood, which is accessible from Interstate 5 and Washington State Routes 512 and 7. The properties include:

MONROVIA, CALIF. — Hanley Investment Group Real Estate Advisors has brokered the sale of Huntington Oaks Center, a 250,787-square-foot shopping center located in Monrovia, approximately 20 miles outside Los Angeles. A Newport Beach, Calif.-based private investor sold the asset to a Los Angeles-based buyer for an undisclosed price. Built in 1984, the property was 75 percent occupied at the time of sale. Tenants at the center include Trader Joe’s, Burlington, Marshalls, Crunch Fitness, Chili’s Grill & Bar, Mimi’s Café, Chipotle Mexican Grill and Panda Express. A Kohl’s is also located at the property but was not included in the sale. Hanley Investment Group represented the seller, while the buyer was self-represented in the deal.

PEORIA, ARIZ. — The City of Peoria, an Arizona municipal corporation, has purchased an industrial building at 10857 N. 95th Ave. in Peoria from Glez C Properties LLC for $11 million. The city will utilize the 81,060-square-foot property as a training facility for its police officers and a storage facility for its tactical vehicles. Built in 2005, the asset offers freeway access. Jeffrey Garza Walker of NAI Horizon represented the seller in the transaction.