ALBUQUERQUE, N.M. — Scottsdale, Ariz.-based SimonCRE has acquired Cottonwood Corners, a 218,144-square-foot retail center located in Albuquerque. An entity doing business as Gibson-Cottonwood LLC sold the property for an undisclosed price. Tenants at the property, which was developed in two phases in 1996 and 1998, include Barnes & Noble, Best Buy, Michaels, Ross Dress for Less, Legacy Furniture, New Balance, The UPS Store, Mattress Firm, Leslie’s Poolmart, Scrub Spot, LA Luxe Nails and Firehouse Subs. The center also features 29,233 square feet of big box space and 4,679 square feet of small shop space that has been leased but is not yet occupied. Kino James and David Chavez of Base 5 Retail will manage leasing at the property on behalf of the new owner.

Acquisitions

SANTA CRUZ, CALIF. — Marcus & Millichap has arranged the sale of Seaside Apartments, an 84-unit affordable housing property in Santa Cruz. The asset traded for $45 million, or $535,714 per unit. Comprising five two-story residential buildings and one single-story office and amenities building, Seaside Apartments offers 16 one-bedroom units, 52 two-bedroom apartments and 16 three-bedroom townhome units. Community amenities include a children’s playground, barbecue and picnic area, laundry facilities and carports. Mitchell Zurich, Kirk Trammell, David Cutler and Joshua Johnson of Marcus & Millichap represented the seller and procured the buyer in the deal. The names of the seller and buyer were not released.

LA MIRADA, CALIF. — LD Valley View Holdings has purchased an industrial asset in the Mid-Counties submarket of Los Angeles from an undisclosed seller for $32.4 million. Totaling 124,480 square feet, the asset has entitlements for a 143,627-square-foot, Class A industrial building. The property is situated on 7.2 acres at 16930 Valley View Ave. Tony Phu of Colliers represented the buyer, while Michael Kendall, Gian Bruno, Kenny Patricia and Kylie Jones of Colliers represented the seller in the deal. Chris Sheehan, Mike Foley, Jeff Smart, Liz Capati and Senna De La Cruz of Colliers provided local market advisory services.

Limited Partnership Buys Safeway-Occupied Retail Property in Florence, Arizona for $10.2M

by Amy Works

FLORENCE, ARIZ. — A limited partnership has acquired a grocery store located at 3325 N. Hunt Highway in Florence, approximately 60 miles southeast of Phoenix. Mark Ruble, Scott Ruble, Chris Land and Zack House of Marcus & Millichap procured the buyer in the $10.2 million deal. The seller was not disclosed. Safeway occupies the 57,860-square-foot property on a net-lease basis. Situated on 6.3 acres, the store was built in 2008.

PEORIA, ILL. — Marcus & Millichap has brokered the $4.4 million sale of Oakridge Apartments in Peoria. Built in 1990 and 2013 by previous ownership, the 48-unit multifamily property consists of four 12-unit buildings. The asset is located at 2700 W. Willowlake Drive near I-74 and Illinois Route 6. David Tarnoff, Patrick Suffield and Yianni Mouflouzelis of Marcus & Millichap represented the seller, an Illinois-based limited liability company. Christopher Malay and Eric Bell of Marcus & Millichap represented the buyer, a California-based investment group.

FORT WORTH, TEXAS — Industrial Realty Group (IRG) has acquired a 364,667-square-foot manufacturing and distribution facility in Fort Worth. The address of the property was not disclosed, but the site spans 10.4 acres and houses three buildings that were formerly owned by industrial equipment supplier S&B Technical Products, which will lease back a portion of the space. Lee & Associates is marketing the remainder of the space for lease. The new ownership plans to implement capital improvements to the property.

NEW YORK CITY — Marcus & Millichap has brokered the sale of a portfolio of six multifamily buildings totaling 56 units in Manhattan’s East Village area. The portfolio features units with floor plans that range from one to six bedrooms, with 70 percent of the residences rented at market rates, as well as commercial spaces. Joe Koicim, Logan Markley, Matt Berger and Zan Colin represented the seller, Kushner Cos., in the transaction. The team also procured the buyer, a partnership between Edifice Real Estate Partners, Holliswood Development and JSB Capital Group.

MANSFIELD CENTER, CONN. — The Kislak Co., a New Jersey-based brokerage firm, has negotiated the $12 million sale of East Brook Mall in Mansfield Center, located east of Hartford. Built in 1975 and renovated in 2005, the property totals 275,239 square feet and comprises an enclosed mall as well as open-air retail space and pad sites. Old Navy, Kohl’s, T.J. Maxx and Michaels are the anchor tenants. Barry Waisbrod of Kislak and Andrew Knight of New England Commercial Brokerage represented the seller, America’s Realty, in the transaction.

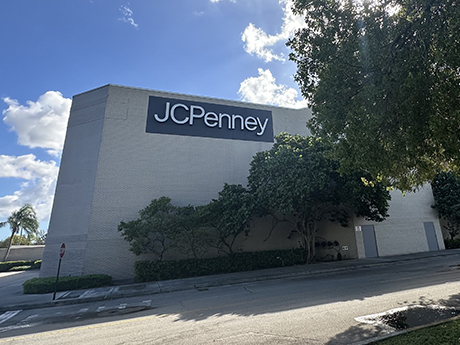

Easton Group Acquires JCPenney-Leased Department Store at Miami International Mall for $12M

by John Nelson

DORAL, FLA. — An affiliate of The Easton Group has acquired a single-tenant department store and adjacent parking lot in the Miami suburb of Doral for $12 million. Situated on a 10-acre site within Miami International Mall, the property totals 150,108 square feet of big box retail space. JCPenney currently occupies the building. Edward Easton, CEO and chairman of Easton Group, says that the company will keep JCPenney in place “as long as the rent payments remain current.”

ANNAPOLIS, MD. — Berkadia’s Seniors Housing & Healthcare team has brokered the sale of Gardens of Annapolis, a 106-unit active adult community. A joint venture between Corten Real Estate and Real Asset Industries purchased the property from Crow Holdings, a Texas-based real estate investment and development firm. Cody Tremper, Dave Fasano, Ross Sanders and Mike Garbers of Berkadia Seniors Housing & Healthcare represented Crow Holdings in the transaction. Berkadia also provided $17.4 million in Fannie Mae acquisition financing on behalf of the buyer. The seven-year, fixed-rate acquisition loan features both an attractive interest rate and interest-only period, according to Berkadia. Austin Sacco, Steve Muth and Alec Rosenfeld of Berkadia originated the acquisition financing. Built in 2002, Gardens of Annapolis is located near historic downtown Annapolis and the U.S. Naval Academy. The property features a mix of 42 one-bedroom, one-bathroom units; 23 two-bedroom, one-bathroom units; and 41 two-bedroom, two-bathroom units.