DALLAS — Multifamily brokerage firm GREA has negotiated the sale of Park Lane Terrace, a 152-unit apartment complex located at 6864 Larmanda St. in the Vickery Meadows neighborhood of Dallas. According to Apartments.com, Park Lane Terrace was originally built in 1968. The property offers one-, two- and three-bedroom apartments with an average unit size that exceeds 800 square feet. A California-based firm sold the property to a private equity real estate firm, with both parties requesting anonymity. Mark Allen and Chibuzor Nnaji of GREA brokered the deal.

Acquisitions

GREENWICH, CONN. — Marcus & Millichap has brokered the $19 million sale of a four-building, 47,256-square-foot mixed-use portfolio in Greenwich, located in southern coastal Connecticut. Known as the Nolan Thomas Portfolio, the properties comprise 17 retail spaces, 17 office suites, 10 apartments and an 11,226-square foot, single-story warehouse. Stephen Westerberg of Marcus & Millichap represented the undisclosed seller in the transaction. The buyer was also not disclosed.

CHICOPEE, MASS. — Regional brokerage firm Northeast Private Client Group (NEPCG) has arranged the $10.5 million sale of Brook Edge Apartments, an 82-unit multifamily complex in the western Massachusetts city of Chicopee. The property, which according to Apartments.com was built in 1970, comprises 36 studios, 30 one-bedroom units and 16 two-bedroom apartments. Taylor Perun of NEPCG represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

LAS VEGAS AND HENDERSON, NEV. — Colliers has arranged the dual acquisitions of a two-parcel infill logistics portfolio in Henderson and Las Vegas by BKM Capital Partners and an Ares Management Real Estate fund. Michael Kendall, Gian Bruno, Dan Doherty, Paul Sweetland, Jerry Doty, Chris Lane, Brian Riffel and Tyler Jones of Colliers represented the seller, a private institutional investment firm, in the sales. BKM Capital Partners purchased a two-building, 153,368-square-foot property at 6620 Escondido St. in Las Vegas for an undisclosed price. BKM plans to implement a $4.4 million capital improvement program to execute structural and cosmetic improvements to the property, as well as speculative tenant improvements to turn the two large units into nine warehouses ranging in size from 7,000 square feet to 31,000 square feet each. The asset was constructed in 1995. An Ares Management Real Estate fund acquired Airparc Heights, a six-building, Class A business park at 3225-3255 Sunridge Parkway and 1065-1085 Alper Center Drive in Henderson. Ares acquired the park, which will be managed by the Ares Industrial Management team. Spanning 339,214 square feet, the project was delivered in 2022 and gained full occupancy within one month of delivery.

FORT COLLINS, COLO. — Green Leaf Partners Management has purchased Alvista Harmony, a garden-style multifamily community in Fort Collins, from an affiliate of Phoenix Realty Group and its joint venture partner. Located at 2002 Battlecreek Drive, the property comprises 16 two- and three-story buildings offering 280 one- and two-bedroom units with an average size of 924 square feet. All units feature walk-in closets, private balconies or patios and a washer and dryer. Community amenities include a clubhouse, business center, fitness center, swimming pool, hot tub, grill station, playground, pet park, dog wash, onsite bike storage, 380 surface parking spaces and 96 detached garages. Phoenix Realty Group has completed renovations to the clubhouse and common areas and has fully renovated 116 units. Previous ownership upgraded 52 of the units, with 42 additional units including finish levels comparable to the classic interior scope. Shane Ozment, Terrance Hunt, Andy Hellman, Justin Hunt, Chris Hart and Brad Schlafer of CBRE represented the seller in the deal.

Calmwater Capital Provides $20.9M Acquisition Loan for Cathedral City Marketplace Shopping Center Near Palm Springs

by Amy Works

CATHEDRAL CITY, CALIF. — Calmwater Capital has provided Rhino Investment Group with $20.9 million in short-term, first-mortgage debt for its acquisition of Cathedral City Marketplace, a grocery-anchored retail center in Cathedral City. The 195,000-square-foot shopping center is located in Cathedral City, approximately seven miles southeast of Palm Springs. Situated on 21 acres at 34091-34351 Date Palm Drive, Cathedral City Marketplace offers parking for 1,093 automobiles. Current tenants include Kroger’s Food 4 Less, Planet Fitness, dd’s Discounts, DJ’s Sports Bar and Subway. Calmwater’s Larry Grantham, Zach Novatt and DaJuan Bennett originated the loan. The Los Angeles-based JLL Capital Markets team of Jeff Sause, Chad Morgan, Daniel Skerrett and Jalynn Borders arranged the financing.

Greystar Divests of 589-Bed Hale Mahana Student Housing Property Near University of Hawaii at Manoa

by Amy Works

HONOLULU — Greystar has completed the fee-simple sale of Hale Mahana, a student housing property located at 2615 S. King St. in Honolulu. A joint venture between Timberline Real Estate Ventures and an Ares Management Real Estate fund acquired the asset, which is 0.2 miles from the University of Hawaii at Manoa campus, for an undisclosed price. Built in 2018, the 191-unit Hale Mahana offers 589 beds, study rooms, a computer lab, covered parking, fitness center, rooftop deck with grilling stations and ground-level retail space, including Raising Cane’s Chicken Fingers and Jersey Mike’s Subs. The complex offers one-, two-, three- and four-bedroom, fully furnished units with equipped kitchens featuring stainless steel appliances. JLL Capital Markets represented the seller and procured the buyer in the transaction.

Marcus & Millichap Facilitates $19M Sale of Self-Storage Facility in Tacoma, Washington

by Amy Works

TACOMA, WASH. — Marcus & Millichap has negotiated the sale of 12th Street Storage, a self-storage facility in Tacoma. An undisclosed limited liability company sold the asset to a fund manager for $19 million. Located at 1018 E. Highland Ave., 12th Street Storage offers 91,546 square feet of self-storage space. The facility, which was developed in 2020 and 2021 by a local investment group, was acquired by an international real estate firm based in London and Los Angeles. Christopher Secreto of Marcus & Millichap’s Seattle office represented the seller and secured the buyer in the deal.

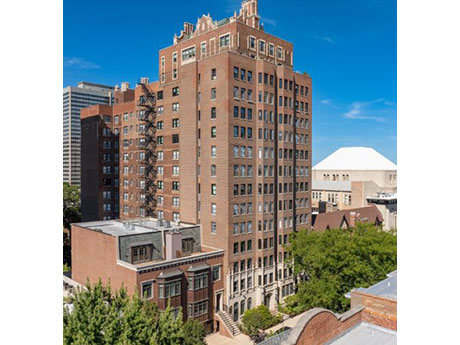

CHICAGO — Greystone has provided an $18.2 million Fannie Mae loan for the acquisition of Cornelia-Stratford in Chicago. Originally constructed in 1927, the 139-unit multifamily property features studio, one-, two-, three- and four-bedroom units. Amenities include bike storage, laundry facilities and a tenant lounge. Clint Darby and Andrew Remenschneider of Greystone originated the nonrecourse loan, which features a fixed interest rate, 15-year term and five years of interest-only payments. The borrower was undisclosed.

HIGHLAND PARK, ILL. — Colliers has arranged the $7.4 million sale of a 55,033-square-foot commercial building in the Chicago suburb of Highland Park. Located at 1770 1st St., the property features 17 apartment units on the upper three floors and 36,000 square feet of medical office space home to Robb Orthodontics, Highland Park Maxillofacial & Implant Surgery and Pediatric Dentistry of the North Shore. The apartment units are fully leased, and the medical office portion is 61 percent leased. Constructed in 1988, the building sits atop a 447-space public parking garage and is across the street from the Highland Park Metra stop. Alissa Adler, John Homsher, Tyler Hague and Lauren Stoliar of Colliers represented the seller, Fulton Design + Build. QMR Partners was the buyer.