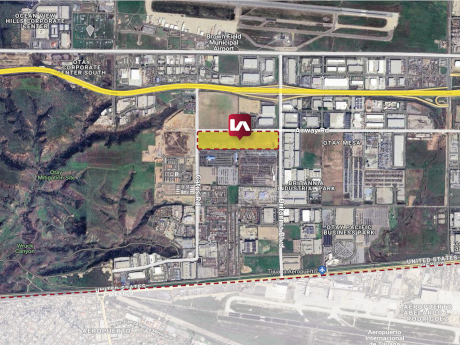

SAN DIEGO — Lee & Associates has arranged the acquisition of 37.9 acres of industrial land at 5761 Airway Road in San Diego’s Otay Mesa neighborhood. Hyundai Translead purchased the asset for $58 million in an off-market transaction. The site will support Hyundai Translead’s operations in San Diego, which will allow the company to continue to utilize the location of Otay Mesa as a thoroughfare for its cross-border operations. Rusty Williams, Chris Roth, Jake Rubendall and Andrew Kenny of Lee & Associates – NSDC, as well as Eugene Kim of Lee & Associates LA North/Ventura, represented the buyer in the transaction.

Acquisitions

OCEANSIDE, CALIF. — Marcus & Millichap has arranged the sale of 1210 South Nevada Street, an apartment property in Oceanside. Matt Vessell sold the asset to Matt Pace for $3.3 million. The apartment building features eight two-bedroom/one-bath units and three one bedroom/one-bath units. Community amenities include 11 single-car garages and 12 offsite parking spaces. Adrian Grobelny and Conor Brennan of Marcus & Millichap’s San Diego Del Mar office represented the seller and procured the buyer in the deal.

HOUSTON — Bel Air Lighting has purchased a 112,667-square-foot industrial building in North Houston. According to showcase.com, the building at 16622 Hafer Road was constructed in 2023 and features 32-foot clear heights, 22 dock doors, two drive-in doors and 130 car parking spaces. Jeremy Lumbreras and Garret Geaccone of Stream Realty Partners represented the seller, locally based firm Alliance Industrial Co., in the transaction. The sales price was not disclosed.

SOUTHFIELD, MICH. AND JACKSONVILLE, FLA. — Southfield-based Sterling Bancorp Inc. (NASDAQ: SBT), the holding company of Sterling Bank and Trust FSB, has entered into a definitive agreement to sell all of its shares to Jacksonville-based EverBank Financial Corp. for $261 million. The sale is subject to customary closing conditions, including regulatory approvals and approval by Sterling’s shareholders. Sterling’s board of directors has unanimously approved the transaction, which is expected to close in the first quarter of 2025. As a condition of the sale, Sterling will sell its residential mortgage loans to Delaware-based Bayview Acquisitions LLC. The closing of the loan sale is to occur immediately prior to the closing of the sale of the bank. In December 2022, Sterling engaged Keefe Bruyette & Woods to serve as financial advisor to assist in exploring and evaluating potential opportunities for a strategic combination with another bank. As that process began, Sterling was also finalizing a settlement with the U.S. Department of Justice. “Ultimately, Sterling’s board of directors determined that there was no practical way to pursue any form of standalone independent operations given the extremely high costs required and the multiple years needed to execute a new strategic vision without risking ongoing …

HERCULANEUM, MO. — The Jefferson County Port Authority (JCPA) has purchased approximately 18 acres along the Mississippi River in Herculaneum, a southern suburb of St. Louis. Riverview Commerce Park LLC (RCP), along with the operations of RCP, sold the acreage in a $20 million transaction. The site will serve as the first publicly owned terminal facility in Jefferson County. The port terminal at RCP is situated below any lock and dam system, providing a direct shot to the Gulf of Mexico. The terminal has more than 3,000 square feet of rail spur, located directly off the Union Pacific Railroad, and is less than two miles from I-55. The port facility and surrounding acreage anchors a broader 300-acre site that received Port District zoning earlier this year, making way for redevelopment as an intermodal transportation hub and industrial park. Under the terms of the deal, the port facility will continue to be operated by RCP in partnership with JCPA. Approximately 1 million tons of freight moved through the port in 2023. In 2022, JCPA received $25 million in funding from the State of Missouri to help support port development. This funding enabled JCPA to enter into this agreement and begin planning …

CHICAGO — Interra Realty has brokered the sale of a five-building, 97-unit multifamily portfolio in Chicago for $19.3 million. Joe Smazal and Mark Dykstra of Interra represented the buyer, Silver Property Group Ltd., a Chicago-based real estate investment and management company. The duo also represented the seller, an East Coast-based investment group. The portfolio consists of the following properties: 4654 N. Monticello Ave., 4718-24 N. Bernard St., 1501 N. California Ave., 4226-30 N. Whipple St. and 4057 W. Melrose St.

AURORA, ILL. — SVN Chicago Commercial has arranged the sale of a 45,000-square-foot industrial building in Aurora for $1.5 million. Located at 325 S. Union St., the 111-year-old property, once utilized for manufacturing World War II vehicle parts, is slated to be converted into multifamily units. James Mead of SVN represented the undisclosed seller. The buyer, specializing in adaptive reuse projects, plans to use historic tax credits to complete the project.

CLIFTON, N.J. — Locally based financial intermediary Cronheim Mortgage has arranged a $20 million loan for the refinancing of Styertowne Shopping Center, a 236,000-square-foot retail property located in the Northern New Jersey community of Clifton. Stew Leonard’s Farm Fresh Food & Wine anchors the center, which was originally built in 1949. Other tenants include Michaels, Planet Fitness, Dollar Tree and GNC. Andrew Stewart, Dev Morris and Brandon Szwalbenest of Cronheim arranged the 10-year loan through Reinsurance Group of America on behalf of the undisclosed borrower.

TINTON FALLS, N.J. — JLL has negotiated the $14.7 million sale of a 90,008-square-foot office building located at 100 Tormee Drive in the coastal New Jersey community of Tinton Falls. The two-story building was constructed on 8.6 acres in 2001 and was fully leased at the time of sale to Hackensack Meridian Health and Opentext. Jeremy Neuer and Jose Cruz of JLL represented the undisclosed seller in the transaction and procured the buyer, Rockford Holdings.

SAN DIEGO — MIG has completed the disposition of Four Governor Park, a two-building office property in San Diego. Cast Capital Partners acquired the asset for $11 million. Situated on 2.7 acres, Four Governor Park includes a 21,715-square-foot building at 5080 Shoreham Place and a 28,521-square-foot building at 5090 Shoreham Place that are connect by a courtyard. At the time of sale, the property was 96 percent occupied by a mix of office tenants. The buyer plans to sell the individual units. Matt Pourcho, Anthony DeLorenzo and Matt Harris of CBRE represented the seller, while Bret Morris of Cast Capital Partners and Ryan King of Voit represented the buyer in the transaction.