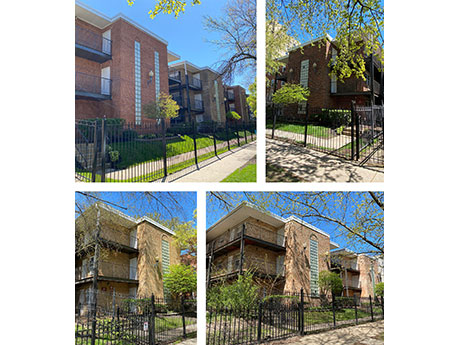

CHICAGO — Kiser Group has brokered the $17.2 million sale of Ravenswood Gardens, a multifamily portfolio consisting of 151 units across seven buildings in the Sheridan Park Historic District of Chicago’s Uptown neighborhood. Katie LeGrand, Lee Kiser and Jacob Price of Kiser brokered the transaction. Initially marketed in summer 2023, the portfolio went under contract but did not close due to market volatility. The seller, continuing its strategic exit from Chicago, revisited the sale in 2024. The buyer plans to reposition the units and rebrand them as Sheridan Park. The buyer assumed the seller’s existing loan, which features an interest rate below 4 percent for the next five years. The buyer now owns more than 400 units in the Uptown neighborhood.

Acquisitions

KANSAS CITY, MO. — Hunt Midwest has sold a portion of its industrial outdoor storage portfolio at Hunt Midwest Business Center in Kansas City to national industrial outdoor storage firm Alterra IOS. The Philadelphia-based firm purchased 58 acres at three locations along Parvin Road and Arlington Avenue. The facilities include staging lots leased by Adrian Steel, a manufacturer for commercial van and truck equipment, and Ford Motor Co.’s North American Vehicle Logistics Outbound Shipping Center, the waystation for nearly every Ford Transit built in North America. Austin Baier of CBRE represented Hunt Midwest, while Joe Orscheln of CBRE represented Alterra IOS, which now owns more than 250 properties across 30 states.

NAPERVILLE, ILL. — Bucksbaum Properties LLC has acquired River District, a retail and office property in downtown Naperville. Built in 1988, the asset sits on 2.7 acres at the southeast corner of Washington Street and Chicago Avenue. The property totals nearly 59,000 square feet of retail space with tenants such as Rosebud, Fat Rosie’s Taco & Tequila Bar, Chipotle and Five Guys, as well as 12,000 square feet of second-floor office space. The seller and sales price were not provided.

DALLAS — SRS Real Estate Partners has arranged the sale of the $3.7 million ground lease sale of a 4,680-square-foot restaurant in Dallas that is triple-net-leased to Chick-fil-A. The building, which was constructed on 1.5 acres in 2023, is an outparcel to The Shops at Redbird, a 720,000-square-foot development on the city’s southwest side. Matthew Mousavi and Patrick Luther of SRS represented the seller, a Dallas-based developer, in the transaction. The buyer was a Dallas-based 1031 exchange investor. Both parties requested anonymity. The corporate-guaranteed lease has 14 years of term remaining.

HAMMOND, IND. — Marcus & Millichap has arranged the $2.8 million sale of a 10,122-square-foot retail property net leased to Five Below in Hammond near Chicago. Located at 1035 Indianapolis Blvd., the asset was built in 2024 and is situated on a pad site to a Walmart Supercenter and Ross Dress for Less-anchored retail center. Nicholas Kanich of Marcus & Millichap represented the seller, an Indiana-based retail developer and manager, and procured the buyer, a Michigan-based REIT. Josh Caruana, broker of record in Indiana, assisted in closing the transaction.

SEGUIN, TEXAS — The Boulder Group has brokered the $2.4 million sale of a single-tenant net-leased (STNL) retail property in Seguin, located on the northeastern outskirts of San Antonio. The sale encompassed two buildings that are located across the street from one another and operated under a single lease with Joe Hudson’s Collision Center, an automotive repair operator with more than 200 locations nationwide. Zach Wright and Brandon Wright of Boulder Group represented the seller, a local investor, in the transaction. The buyer was a 1031 exchange investor. Both parties requested anonymity.

NEWPORT, TENN. — Marcus & Millichap has brokered the sale of Five Rivers Plaza, a 40,085-square-foot retail center located on 8.3 acres at 140 Five Rivers Plaza Way in Newport, a suburb of Knoxville. Zach Taylor and Eric Abbott of Marcus & Millichap’s Atlanta office represented the seller, a local developer, in the transaction. The duo also sourced the buyer, a private 1031 investor based in Nashville. Both parties requested anonymity. Additionally, Jody McKibben, Marcus & Millichap’s broker of record in Tennessee, assisted in closing the transaction. “We received a tremendous amount of interest in this property,” says Taylor. “The unanchored service retail sector remains the gold standard. We closed all-cash with a private buyer.” Built in 1983 and renovated in 2023, Five Rivers Plaza was 77 percent leased at the time of sale to 11 tenants, including newly established Family Dollar and Dollar Tree stores.

BRANFORD, CONN. — Locally based brokerage firm O,R&L Commercial has negotiated the $7.2 million sale of Lockworks Square, a 35,600-square-foot shopping center in Branford, located in southern coastal Connecticut. The four-building center is located in the downtown area and is home to tenants such as SaltBrick Prime, Lockworks Tavern, Cheri’s Bakery, Digestive Disease Associates, Physical Therapy & Sports Medicine Centers and Branford Tech Team. Will Braun of O,R&L represented the seller and buyer, both of which requested anonymity, in the transaction.

IPA Brokers $87.2M Sale of Paragon at Old Town Multifamily Property in Monrovia, California

by Amy Works

MONROVIA, CALIF. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Paragon at Old Town, an apartment community in Monrovia, northeast of Los Angeles. Sequoia Equities sold the asset to SCS Development Co. for $87.2 million, or $535,276 per unit. Paragon at Old Town features 163 apartments in six floor plans with units ranging from 744 square feet to 1,247 square feet, a resident lounge, fitness center, game room, and elliptical swimming pool and spa with private cabanas, outdoor lounges and courtyards. The 6,077-square-foot ground-floor retail space offers four suites that are fully occupied by The UPS Store, eateries and a sporting goods store. Joseph Grabiec, Kevin Green and Gregory Harris of IPA represented the seller and procured the buyer in the deal.

MDH Partners Buys 249,600 SF KV Buckeye 10 Industrial Park in Buckeye, Arizona for $51M

by Amy Works

BUCKEYE, ARIZ. — MDH Partners has acquired KV Buckeye 10, a two-building industrial property located at 835 and 945 N. 215th Ave. in the Phoenix suburb of Buckeye, from Kentwood Ventures for $51 million. Situated on 18.8 acres, KV Buckeye 10 features 249,600 square feet of Class A industrial space spread across two buildings. Built in 2023, the asset feature 535 car parking spaces and 28-foot clear heights. Building A is 115,200 square feet and Building B is 134,400 square feet, with each building offering 12 truck-well doors and six grade-level doors. Currently KV Buckeye 10 is 60 percent leased to a variety of tenants, including the City of Buckeye; Hajoca, a privately held wholesale distributors of plumbing, heating and cooling, pool and industrial supplies; Safelite, a national automotive glass repair and replacement provider; and AVI, an international provider of communications and audio-visual technology. Greer Oliver and Connor Nebeker-Hay of JLL represented the seller in the deal. John Lydon, Hagen Hyatt and Kelly Royle of JLL are handling leasing for the project.