AUSTIN, TEXAS — Dallas-based investment firm S2 Capital has acquired Vineyard Hills, a 202-unit multifamily property in southwest Austin. The site spans 11 acres, and the property features one-, two- and three-bedroom floor plans. Amenities include a pool, spa, dog park and outdoor grilling and dining stations. Ryan McBride, Robert Arzola, Robert Wooten, Alex Fernandes and Nick Beardslee of JLL represented the seller, Bob Reeves, in the transaction. Mark Brandenburg, also with JLL, arranged an undisclosed amount of acquisition financing for the deal through Benefit Street Partners. S2 Capital acquired the property in conjunction with Belle Rive Club Apartments, a 104-unit complex in Jacksonville, Fla.

Acquisitions

SPRING, TEXAS — Marcus & Millichap has brokered the sale of a 5,677-square-foot retail building in the northern Houston suburb of Spring. The building is located along the I-45 corridor and is leased to breakfast eatery IHOP, which has 15 years remaining on its lease. John Paine of Marcus & Millichap represented the seller, metro Atlanta-based investment firm Greenleaf Property Management, in the transaction. Paine also procured the buyer, a California-based 1031 exchange investor.

MORROW, GA. — ShopOne Centers REIT and Pantheon, along with an unnamed global institutional investor, have acquired Publix at Mt. Zion, a 79,031-square-foot retail center located in Morrow, roughly 15 miles south of Atlanta. Publix anchors the property, which was 98.9 percent leased at the time of sale. The grocer has operated at the property for more than 30 years. The joint venture owns three additional retail properties in the metro Atlanta area, including Sharon Greens in Cumming, Bethesda Walk in Lawrenceville and Kennesaw Walk in Kennesaw.

Marcus & Millichap Negotiates $10.2M Sale of Holiday Inn Express Hotel in Metro Baltimore

by John Nelson

OWINGS MILLS, MD. — Marcus & Millichap has negotiated the $10.2 million sale of an 86-room Holiday Inn Express & Suites hotel in Owings Mills, a northwest suburb of Baltimore. Jack Davis, Gordon Allred, Joce Messinger, Karianne Cibello, Zachary Walsh and Andy Patel of Marcus & Millichap represented the seller and procured the buyer in the transaction. Both parties requested anonymity. Brian Hosey served as Marcus & Millichaps’ broker of record in Maryland for the deal. Built in 2018, the Holiday Inn Express is situated on a 5.7-acre site at 11509 Red Run Blvd. off I-795. The hotel features a fitness center, business center and meeting and banquet facilities.

NEW YORK CITY — Locally based brokerage firm Northgate Real Estate Group has arranged the $34.8 million bankruptcy sale of a hotel project in downtown Brooklyn that is roughly midway through construction. The 22-story building at 291 Livingston St., which is approved for 104 rooms, was sold via auction. Greg Corbin, Chaya Milworn and Felix Ades of Northgate handled the transaction on behalf of the undisclosed seller. The buyer was Midas Hospitality.

WELLESLEY, MASS. — Newmark has brokered the sale of three office and retail buildings totaling 40,860 square feet in Wellesley, a western suburb of Boston. Retail owner-operator EDENS sold the buildings at 34-50 Central St., which were 73 percent leased at the time of sale, to locally based developer Taymil Partners for an undisclosed price. Robert Griffin, Jonathan Martin and Paul Penman of Newmark brokered the deal. David Douvadjian Sr., Timonthy O’Donnell and David Douvadjian Jr. of Newmark arranged acquisition financing.

LAKEHURST, N.J. — Marcus & Millichap has brokered the $6.5 million sale of a retail building in Lakehurst, about 60 miles east of Philadelphia, that is net leased to convenience store Wawa. The building at 604 Pine St. was completed in 2023 and totals 5,000 square feet, according to LoopNet Inc. Derrick Dougherty, Scott Woodard, Mark Krantz and Nick Geaneotes of Marcus & Millichap represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

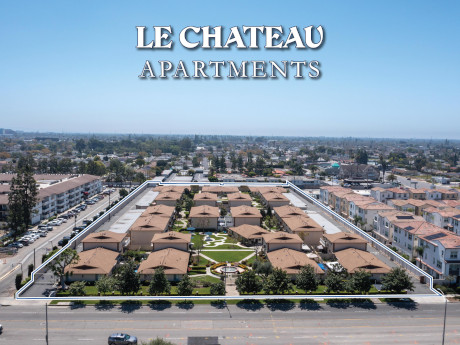

Marcus & Millichap Negotiates $27M Sale of La Chateau Apartments in Anaheim, California

by Amy Works

ANAHEIM, CALIF. — Marcus & Millichap has arranged the sale of La Chateau Apartments, a multifamily community in Anaheim. The asset traded for $27.4 million, or $361,184 per unit. Tyler Leeson, Matt Kipp and Nicholas Kazemi of Marcus & Millichap represented the undisclosed seller, while Drew Holden of Marcus & Millichap represented the undisclosed buyer in the deal. Built in 1964, Le Chateau offers 76 apartments in single-floor and townhome unit styles, all with two bedrooms. Each unit features a private patio and carport with an overhead storage bin. Community amenities include four on-site laundry facilities, a clubhouse and gated garage.

EAGAN, MINN. — Net Lease Office Properties (NLOP) has sold two office assets in the Minneapolis suburb of Eagan for gross proceeds totaling $60.7 million. The properties, which are leased to Blue Cross Blue Shield Inc., are located at 1800 and 3400 Yankee Doodle Road and total 347,472 square feet. Net proceeds after closing costs were used to repay approximately $48 million of JPMorgan’s senior secured mortgage and approximately $8 million on its mezzanine loan. Following the sale, NLOP owns 47 office properties, three of which are leased to Blue Cross Blue Shield.

FARGO, N.D. — Gindi Equities has acquired Osgood Townsite Apartments, a 243-unit multifamily community built in 2004 in Fargo. Property Resources Group sold the asset for an undisclosed price. The acquisition marks Gindi’s entry into the Fargo market. Gindi plans to invest in a renovation program to modernize and enhance the Class B property. Planned improvements include redesigned kitchens and bathrooms and upgraded building exteriors and grounds. Gindi will also implement sustainable elements and energy savings fixtures to increase efficiency and reduce utility costs. Property Resources Group will continue to manage and service the asset. With this acquisition, Gindi’s multifamily portfolio is valued at over $250 million and includes 2,000 units across the country.