FLORENCE, KY. — Walker & Dunlop has negotiated the sale of Legacy Living Florence, a 128-unit seniors housing community in Florence, just south of Cincinnati. Built in 2022, Legacy Living features independent living, assisted living and memory care units. The buyer was an undisclosed REIT. The seller and sales price were also not disclosed. Alex Vice, Joshua Jandris and Brett Gardner led the Walker & Dunlop Investment Sales team in brokering the sale.

Acquisitions

CHATTANOOGA, TENN. — Marcus & Millichap has secured the $5.3 million sale of South Terrace Plaza, a 46,700-square-foot retail center located at 5076-5084 S. Terrace in Chattanooga. The property is shadow-anchored by AMC Theatres and is located near the I-75 transition into I-24. South Terrace Plaza was 94 percent leased at the time of sale to 12 tenants that have an average 23-year tenure at the property. According to Marcus & Millichap, six new leases were executed at the center in the past year. Zach Taylor and Eric Abbott of Marcus & Millichap’s Atlanta office represented the seller, a Tennessee-based developer, in the transaction. Jody McKibben of Marcus & Millichap served as the broker of record in Tennessee in the deal. The buyer was not disclosed. “The strength of the Chattanooga market and the significant upside potential of the center created a highly competitive bid process for this property,” says Taylor.

DETROIT — Bedrock has acquired the Millender Center, including the attached garage and retail atrium, in Detroit for an undisclosed price. Completed in 1985, the 729,079-square-foot property includes 1,738 parking spaces and eight dining and retail tenants. Current Millender Center tenants will continue to occupy the eight-story building. Bedrock says the acquisition provides synergies to its Courtyard Detroit Downtown hotel property as well as mixed-use amenities in the area. An affiliate of General Motors Co. was the seller, according to Crain’s Detroit Business. The property is situated across from GM’s Renaissance Center. Bedrock, the real estate arm of Quicken Loans founder Dan Gilbert, has invested more than $7.5 billion to developing and restoring over 140 properties totaling 21 million square feet since 2011.

BROOKFIELD, WIS. — Mid-America Real Estate has brokered the sale of the Galleria West shopping center in the Milwaukee suburb of Brookfield for an undisclosed price. Located at 18900 W. Bluemound Road, the property totals 65,000 square feet. Tenants include Allen Edmonds, Allure Intimate Apparel, Picardy Shoe Parlour, Bullwinkle’s and Kopp’s Frozen Custard. Dan Rosenfeld of Mid-America represented the buyer, Last Mile Investments, a North American Properties portfolio company based in Cincinnati. Rosenfeld also represented the seller, Galleria West Associates, which has owned and operated the center since the early 1980s. Last Mile Investments plans to begin capital improvements shortly, including a new 20-foot monument sign to enhance visibility for tenants, façade improvements to refresh the exterior and enhanced patio opportunities to accommodate future restaurants and retailers. Andrew Prater of Mid-America will handle leasing.

CPP Acquires 168-Unit Crestview Terrace Affordable Housing Community in Ellensburg, Washington

by Amy Works

ELLENSBURG, WASH. — Community Preservation Partners (CPP) has purchased Crestview Terrace, an affordable housing development in Ellensburg, approximately 110 miles southeast of Seattle. Terms of the transaction were not released. CPP plans to renovate the 168 units at Crestview Terrace, which was built in 1970 and last renovated in 2008. Comprising 76 single-story buildings, the community offers 95 one-bedroom, 36 two-bedroom, 26 three-bedroom and nine four-bedroom units. The property is restricted to residents earning between 40 percent and 50 percent of area median income. Interior upgrades will include the installation of new kitchen cabinets, countertops, flooring, Energy Star refrigerators, dishwashers, ranges, hoods, sinks faucets, low-flow toilets and showerheads, mini-split HVAC units, water heaters, ceiling fans and LED lighting. Exterior upgrades will include window replacement, new roofing and siding, sealcoat and striping of the parking lot, landscape improvements, ADA unit conversions and path-of-travel improvements, as well as the addition of a dog park and community garden. Construction is scheduled to begin this month, with completion slated for July 2025. Each household will be temporarily relocated for seven to 10 days at no cost to the tenants, after which they will return to a fully renovated apartment. The property’s affordability status was set …

PARAMOUNT, CALIF. — CBRE has arranged the sale of Paramount Business Center, a multi-tenant industrial park at 6407-6431 Alondra Blvd. in Paramount, just south of Los Angeles. A local private investor acquired the asset from a publicly traded REIT for $7.6 million. The 30,224-square-foot center features 11 units, ranging in size from 2,025 square feet to 3,794 square feet, with each unit offering 18-foot clear heights, one grade-level door and a high-image storefront. Situated off Interstate 710, the building is 15 miles from both the Ports of Los Angeles and Long Beach. Mark Shaffer, Gerard Poutier, Anthony DeLorenzo, Bryan Johnson and Dylan Rutigliano of CBRE Investment Properties, along with Barbara Perrier and Eric Cox of CBRE’s National Partners, represented the seller in the transaction.

SACRAMENTO, CALIF. — Madera Finra Properties has acquired 1 & 3 Wayne Court, a two-building industrial asset in Sacramento. Terms of the transaction were not released. At the time of sale, the 52,800-square-foot warehouse facilities were 45.5 percent leased. Ryan Sitov, Melinda Marino and Mark Detmer of JLL Capital Markets represented the undisclosed seller in the transaction.

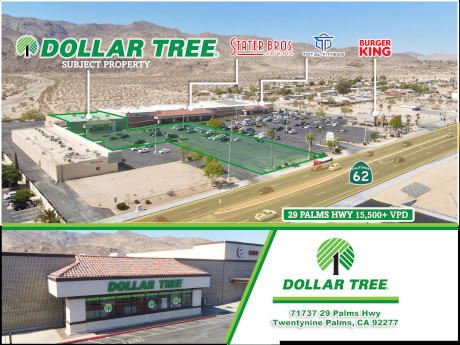

Marcus & Millichap Brokers Sale of Dollar Tree-Occupied Property in Twentynine Palms, California

by Amy Works

TWENTYNINE PALMS, CALIF. — Marcus & Millichap has arranged the sale of Dollar Tree, a net-leased retail property in Twentynine Palms, just north of Joshua Tree National Park in Southern California. An individual/personal trust sold the asset to an undisclosed buyer for $2.1 million. The 15,506-square-foot Dollar Tree is located at 71737 29 Palms Highway. Dollar Tree has committed to four and a half years on the lease, having recently exercised its five-year option period. There are two additional five-year extension options. The asset occupies a 1.5-acre lot within a 90,000-square-foot retail plaza featuring Stater Bros., Burger King and Total Fitness Gym. Michael Grandstaff and Christopher Hurd of Marcus & Millichap represented the seller, while Karl Markarian of JohnHart Corp. represented the buyer in the deal.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has arranged the sale of a development site located at 240 W. 54th St. in Midtown Manhattan. The site can support up to 75,000 square feet of buildable space, and the zoning allows for either residential or commercial product. Christoffer Brodhead, Howard Raber and Nikola Cosic of Ariel represented the undisclosed seller in the transaction. The buyer was also not disclosed.

MOUNT LAUREL, N.J. — Newmark has brokered the sale of an 87,460-square-foot office building located at 250 Century Parkway in the Southern New Jersey community of Mount Laurel. According to LoopNet Inc., the four-story building was originally constructed in 2000. David Dolan, Angelo Brutico and John Cook of Newmark represented the seller, Four Springs Capital Trust, in the transaction. The buyer was a partnership between an entity doing business as 250 Century Parkway LLC and the Needleman Management Co.