BRIDGEVIEW, ILL. — Entre Commercial Realty has brokered the sale of a 43,750-square-foot industrial building in the Chicago suburb of Bridgeview for an undisclosed price. The multi-tenant property is located at 9700 Industrial Drive immediately off the four-way interchange of I-294 and 95th Street. Jeffrey Locascio and Chris Wilbur of Entre brokered the transaction. The buyer was a joint venture between Clear Height Properties and Harbert US Real Estate, an investment strategy sponsored by Harbert Management Corp. Entre has been retained to market the property for lease. The seller was undisclosed.

Acquisitions

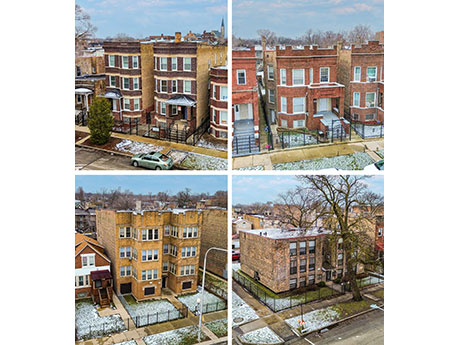

CHICAGO — Kiser Group has negotiated the $2.1 million sale of a portfolio of multifamily properties in Chicago’s West Garfield Park neighborhood. The newly renovated units were fully occupied at the time of sale. Jack Petrando and Noah Clark of Kiser brokered the transaction. Buyer and seller information was not provided.

CLAWSON, MICH. — Dominion Real Estate Advisors has brokered the sale of a 14,350-square-foot industrial building located at 850 N. Rochester Road in Clawson, a northern suburb of Detroit. The sales price was undisclosed. Barry Landau of Dominion represented the seller, LT Property Holdings LLC. Ernie Dearman of CLG Realty Advisory represented the buyer, OM3 LLC.

CHICAGO AND LOS ANGELES — A joint venture between Remedy Medical Properties and Kayne Anderson Real Estate has acquired a portfolio of 37 healthcare properties from Broadstone Net Lease (NYSE: BNL), a diversified real estate investment trust with an industrial focus. The properties traded hands for $252 million. JLL served as the broker for the transaction. The 37 properties were selected from a larger collection of healthcare assets designated for sale by Broadstone Net Lease. The properties are being sold as part of the REIT’s plan to focus on core net lease assets in the industrial, retail and restaurant sectors. As of March 31, industrial properties comprised 54.2 percent of the REIT’s portfolio. The portfolio totals more than 708,000 square feet across 13 states. Each property is fully leased. The assets are situated in prominent markets that include: Chicago; Houston; Charlotte, North Carolina; Indianapolis; Seattle; Milwaukee; Tampa, Florida; and Arlington, Texas. The properties are leased by health systems and physician groups such as Advocate, Emerge Ortho, Froedert Health, IU Health, Tampa General, TGH Imaging and USPI. The largest facility included in the portfolio is Ridgeway Medical Campus in Greece, New York, near Rochester. The multi-specialty outpatient medical center comprises 120,000 …

NASHVILLE, TENN. — Host Hotels & Resorts Inc. has purchased the fee simple interest in a two-hotel complex in downtown Nashville. The properties in the $530 million acquisition include 1 Hotel Nashville, a 215-room hotel, and the 506-room Embassy Suites by Hilton Nashville Downtown. Affiliates of Starwood Capital Group, Crescent Real Estate LLC and High Street Real Estate Partners sold the hotels, which they built in 2022. Situated adjacent to Bridgestone Arena and across from the Music City Convention Center, the hotels feature a combined 721 rooms averaging approximately 500 square feet in size, as well as seven food-and-beverage options, including Harriott’s Rooftop. Amenities include a spa with six treatment rooms, two fitness centers, a yoga studio and 33,000 square feet of shared meeting space, including a 9,400-square-foot ballroom and 9,300 square feet of pre-function space.

RALEIGH, N.C. — SRS Real Estate Partners has brokered the ground-lease sale of a newly built, 2,775-square-foot retail property located at 615 Oberlin Road in Raleigh. Fifth Third Bank occupies the single-tenant property, which features a drive-thru ATM, on a 20-year lease. Matthew Mousavi and Patrick Luther of SRS’ Newport Beach, Calif., office represented the seller, a private developer, in the $6.9 million sale. A New York-based private investor purchased the asset at a 4.86 percent cap rate.

CHARLOTTE, N.C. — JLL has arranged the sale of CBI Distribution Center, a 60,000-square-foot industrial facility located at 2817 Westinghouse Blvd. in Charlotte. Built in 2017 within two miles of the I-485/I-77 interchange, the distribution center was fully leased at the time of sale to CBI Workplace Solutions, with 6.5 years of lease term remaining. An unnamed family investment company based in Charlottesville, Va., purchased the asset for an undisclosed price. Dave Andrews, Pete Pittroff, Josh McArdle and Michael Lewis of JLL represented the seller, an affiliate of Zurich Alternative Asset Management, in the transaction.

DALLAS — JLL has arranged the sale of Muse Shops at Midtown, a 112,162-square-foot shopping center in North Dallas. Built in 1999 and renovated in 2022, the four-building center was 58 percent leased at the time of sale to tenants such as Starbucks, Land Design, United Real Estate and Natuzzi Editions. Adam Howells, Erin Lazarus, Megan Babovec and Keenan Ryan of JLL represented the undisclosed seller in the transaction. The buyer and sales price were also not disclosed.

VON ORMY, TEXAS — Partners Real Estate has negotiated the sale of a 26-acre industrial outdoor storage facility in Von Ormy, located on the southwestern outskirts of San Antonio. The site at 14603 and 14710 Speedway Park also houses a 7,500-square-foot truck terminal building. Stan Nowak of Partners represented the buyer, a private equity firm, in the transaction. Additional terms of sale were not disclosed. Partners has also been retained as the property’s leasing agent.

NEW YORK CITY — Cushman & Wakefield has brokered the $7 million sale of a multifamily development site in The Bronx. The site at 3083 Webster Ave. can support approximately 100,000 buildable square feet of product. Jonathan Squires, Josh Neustadter and Austin Weiner of Cushman & Wakefield represented the seller, Atlantis Management, in the transaction. The buyer, SKF Development, plans to build an affordable housing complex that will be financed with Low-Income Housing Tax Credits and subsidies from the NYC Department of Housing Preservation & Development and NYC Housing Development Corp.