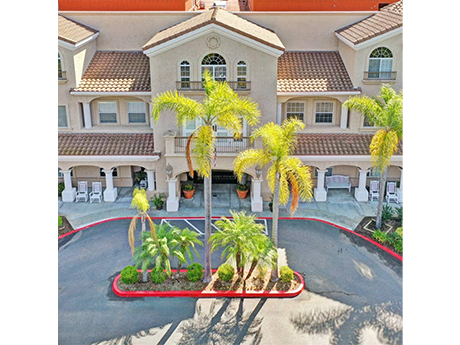

SAN CLEMENTE, Calif. — CareTrust REIT Inc. (NYSE:CTRE), a San Clemente-based seniors housing investor, has acquired three continuing care retirement communities (CCRCs) located in Los Angeles, Orange, and San Diego counties. The portfolio totals 475 assisted living, skilled nursing and memory care beds/units. Bayshire Senior Communities, an existing CareTrust tenant based in Southern California, has taken over management of all three properties. The highest profile property of the three is Torrey Pines Senior Living in San Diego. CareTrust paid $32.3 million for the asset, including transaction costs. Annual cash rent for the first year is approximately $2.6 million, increasing to approximately $3 million in the second year with CPI-based annual escalators thereafter. CareTrust completed the acquisition of the other two CCRCs through a joint-venture arrangement with a third-party regional healthcare investor. Pursuant to the arrangement, CareTrust is the managing member of the joint-venture entity. CareTrust provided a combined common equity and preferred equity investment amount totaling approximately $28 million. The joint-venture landlord has leased these facilities to Bayshire pursuant to a new, triple-net master lease agreement with an initial term of 15 years with two five-year extension options. CareTrust’s initial contractual yield on its combined preferred and common equity investments …

Acquisitions

NORMAN, OKLA. — Marcus & Millichap has brokered the sale of Campus Lodge, a 192-unit student housing property located about two miles from the University of Oklahoma campus in Norman. Built in 2004, Campus Lodge comprises 19 buildings that house 768 beds in three- and four-bedroom layouts. Amenities include a pool, sand volleyball court, basketball court, outdoor grilling and dining stations and a coffee bar. Patrick Mullowney and Joel Dumes of Marcus & Millichap represented the seller, The Collier Cos., in the transaction. The duo also procured the buyer, Denver-based investment firm Cardinal Group. Campus Lodge was 97 percent occupied at the time of sale.

DENVER — Graham Street Realty (GSR), an affiliate of Hamilton Zanze, has completed the disposition of Commerce Square, a light industrial facility located in the Interstate 70 East submarket in Denver. Terms of the transaction were not released. GSR originally purchased Commerce Square in December 2020. The asset comprises 144,464 rentable square feet of shallow-bay light space across two Class B buildings. Commerce Square offers above-standard loading capabilities, front park/rear load orientation, 18-foot clear heights, dock and drive-in loading capabilities and 265 parking spaces. At the time of sale, the property was 96.4 percent leased. Paramount Property Co., an Oakland, Calif.-based GSR affiliate, managed Commerce Square during GSR’s ownership of the asset.

LONGMONT, COLO. — Coldwell Banker Commercial Realty has arranged the sale of an office and research and development building in Longmont, approximately 35 miles north of Denver. Mountain View Fire Protection District acquired the asset from Gunbarrel Properties LLC for $7.3 million. Constructed in 1998, the two-story building features 36,900 square feet of space. The property is located at 6328 Monarch Park Place. Brian Campbell of Coldwell Banker Commercial Realty represented the buyer in the deal.

Progressive Real Estate Partners Negotiates $6.1M Sale of Value-Add Retail Property in Desert Hot Springs, California

by Amy Works

DESERT HOT SPRINGS, CALIF. — Progressive Real Estate Partners has brokered the sale of a retail property, located at 13000-13160 Palm Drive in Desert Hot Springs, located in the Coachella Valley. An Orange County-based private investor sold the property to a Los Angeles County-based private investor for $6.1 million in an all-cash transaction. Totaling 33,004 square feet, the property features a multi-tenant building and two pad buildings, one of which is occupied by Chase Bank. Greg Bedell of Progressive Real Estate Partners represented the seller, while Heather Sharp of Progressive Real Estate Partners procured the buyer in the transaction.

SAN MARCOS, TEXAS — New Jersey-based investment firm Denholtz Properties has acquired Clovis Crossing, a 213,235-square-foot industrial building in San Marcos, located roughly midway between San Antonio and Austin. The newly constructed, two-building facility sits on 13 acres and features 32-foot clear heights. Mike Klein, Jon Mikula, Michael Johnson and John Beeler of JLL arranged $26.1 million in acquisition financing for the deal through Palladius Capital Management. Charles Strauss, Tom Weber and Trent Agnew, also with JLL, represented the seller, Freehill Development Co.

NEW YORK CITY — Locally based development and investment firm Fetner Properties has sold its remaining interest in The Victory, a 45-story apartment tower located at 561 10th Ave. in Manhattan’s Hell’s Kitchen neighborhood. The percentage and sales price were not disclosed. The building houses 417 units in studio, one- and two-bedroom formats and 12,000 square feet of commercial space. Empire State Realty Trust (NYSE: ESRT), which previously bought a majority stake in The Victory in late 2021, now owns the building outright.

MOUNT LAUREL, N.J. — JLL has arranged the sale of a 117-room, Marriott-branded hotel located outside of Philadelphia in Mount Laurel. The SpringHill Suites by Marriott Voorhees Mt. Laurel/Cherry Hill hotel is a four-story building that offers amenities such as a pool, fitness center, business center and 375 square feet of meeting and event space. Ketan Patel, Phil White and Vasilis Halakos of JLL represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

FONTANA, CALIF. — JLL Capital Markets has arranged the $197 million sale of Commerce Way Distribution Center in Fontana, which is located about 50 miles east of Los Angeles in the Inland Empire. EQT Exeter was the buyer. Built in 2000, Commerce Way Distribution Center totals 819,004 square feet. Located on Santa Ana Avenue, the property features a cross-dock configuration and a clear height of 30 feet. JLL says the facility benefits from its location in the Inland Empire, the largest industrial market nationwide with immediate access to critical supply chain infrastructure and Southern California’s population of more than 25 million people. As of the fourth quarter of 2023, the vacancy rate for the Inland Empire industrial market was 5.9 percent, a 90-basis-point increase quarter-over-quarter due to a high volume of new industrial space delivered by developers, according to JLL. The market experienced positive net absorption despite the 10.5 million square feet of new space delivered in the quarter. Patrick Nally, Mark Detmer, Evan Moran and Makenna Peter of JLL represented the seller, Manulife Investment Management on behalf of clients, and procured the buyer. JLL’s debt advisory team on the deal included Kevin Mackenzie, Brian Torp and Samuel Godfrey. Mike …

ASHEVILLE, N.C. — TruAmerica Multifamily has acquired Westmont Commons, a 252-unit apartment community in Asheville, for $49.9 million. Rob Russell and Richard Kourbage of Greystone originated a Freddie Mac acquisition loan for the buyer. The seller was not disclosed. Westmont Commons was built in phases in 2003 and 2008. The new buyer plans to make capital improvements in every unit with modern finishes, including new washers and dryers. TruAmerica also plans to upgrade the property’s swimming pool, fitness center and clubhouse, as well as convert the laundry room to a pet spa.