HOUSTON — Pocas International has purchased an industrial building at 8008 W. Sam Houston Parkway S. in southwest Houston that totals 27,893 square feet, according to LoopNet Inc. The move represents an expansion for the food-and-beverage products distributor, which simultaneously sold its previous building, a 16,675-square-foot facility located at 711 Buffalo Run in nearby Missouri City. Wes Williams of Colliers represented Pocas International in both transactions. Travis Land of Partners Real Estate represented the seller of the Sam Houston Parkway building, an entity doing business as Ultra Houston Group LP. Harry Lou of Fidelity Realtors represented the buyer of the Buffalo Run building, Wellcom Realty LLC. Sales prices were not disclosed.

Acquisitions

MERRIMACK, N.H. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the $16.6 million sale of Merrimack Village Center, an 82,292-square-foot shopping center located near the Massachusetts-New Hampshire border. Built on 10 acres in 2006, the center was 99 percent leased at the time of sale, with grocer Shaw’s serving as the anchor tenant. Other users include Dental Designs of New England, KT Cleaners, Supercuts and Subway. Jim Koury led the IPA team that represented the buyer and seller, both of which were limited liability companies, in the transaction.

SAN FRANCISCO — San Francisco-based Stockbridge Capital Group has completed the disposition of Project RedHawk, a 1.7 million-square-foot light industrial portfolio spread across multiple markets. The portfolio was sold in four separate transactions to two different buyers between December 2023 and January 2024 and comprises four sub-portfolios totaling 49 buildings in Tempe, Ariz.; San Jose, Calif.; Denver; and Pompano Beach, Fla. BKM Capital Partners acquired Gateway University Park I & II, a 16-building, 258,409-square-foot asset at 1605-1635 and 1705-1797 W. University Drive in Tempe, and Junction Business Park, a two-building, 119,101-square-foot property at 1911-1943 Hartog Drive and 1914-1968 Junction Ave. in San Jose. A partnership between a global manager of alternative investments and Brennan Investment Group purchased The Montebello Industrial Portfolio, a 17-building, 856,013-square-foot asset in Denver, and Powerline Business Park, a 14-building, 444,120-square-foot in Pompano Beach, Fla. Jim Carpenter and Will Strong of Cushman & Wakefield’s National Industrial Advisory Group, along with IAG’s Kirk Kuller, Michael Matchett, Molly Hunt, Mike Davis, Rick Brugge, Rick Colon, Dominic Montazemi, Jeff Chiate, Rick Ellison and Matthew Leupold, in partnership with Robert Buckley, Tracey Cartledge, Scott Prosser, Steve Hermann and Jack Depuy of Cushman & Wakefield represented all parties in the transactions. Gideon Gil, …

LAS VEGAS — ABI Multifamily has negotiated the sale of a three-property multifamily portfolio in Las Vegas for a combined $8.9 million, or $121,431 per unit. The undisclosed buyer and seller are both based in Nevada. Jason Dittenber, Josh McDougall, Anthony Marinello and Bradley Gumm of ABI Multifamily represented the seller in the deal. The portfolio includes:

Anchor Point Capital Negotiates $12.2M Sale of Plaza Diamond Bar Office/Retail Campus in Los Angeles County

by Amy Works

DIAMOND BAR, CALIF. — Anchor Point Capital has arranged the sale of Plaza Diamond Bar, a two-building office and retail property in Diamond Bar, approximately 30 miles east of Los Angeles. Two separate buyers, both private investors, acquired the assets for a combined total of $12.2 million. The seller of both assets was a partnership led by Metro Properties LLC. The office building, located at 2040 S. Brea Canyon Road, sold as an all-cash deal, and the retail building, at 2020 S. Brea Canyon Road, sold with a creative seller financing structured by Anchor Point Capital. Built in 2007, the two-story, 25,000-square-foot office building was 40 percent occupied by a variety of medical and related tenants. Built in 1980 and renovated in 1992, the single-story, 8,000-square-foot, multi-tenant retail building was 50 percent leased at the time of sale. Eric Vu of Newport Beach-based Anchor Point Capital handled the transactions.

LOS ANGELES — Kennedy Wilson Brokerage, a division of Kennedy-Wilson Properties, has arranged the sale of two retail properties on the northwest and northeast corners of Melrose and Edinburgh avenues in Los Angeles. Quiet Lion LP sold the two assets, which represent three buildings on two parcels, in two separate transactions totaling $6.8 million. Oh Polly, a fashion brand, acquired a vacant, 3,355-square-foot, single-tenant building at 8001 Melrose Ave. with plans to occupy the asset. A local investor acquired the 2,442-square-foot asset at 7975-7977 Melrose Ave., which also included a 625-square-foot building at 710 N. Edinburgh Ave., with plans to operate the properties as a leased investment. MOSCOT and Vettese Studios, a clothier, occupies the property at 7975-7977 Melrose Ave., and Community Goods, a neighborhood coffee shop, occupies the building at 710 N. Edinburgh Ave. Ed Sachse, Jaysen Chiaramonte and Jack Nathan of Kennedy Wilson Brokerage represented the seller in both transactions.

PALM DESERT, CALIF. — CBRE has brokered the purchase of an apartment property located at 73435 San Gorgonio Way in the Coachella Valley city of Palm Desert. A Los Angeles-based private investor acquired the asset from an undisclosed seller for $2.2 million, or $264 per square foot, in an off-market transaction. Dan Blackwell and Andrew Boukather of CBRE represented the buyer in the deal. Built in 1988, the two-story, 8,360-square-foot building offers 10 two-bedroom apartments with a patios or balconies, a community pool and garage parking.

VERNON HILLS, ILL. — A partnership between Avgeris and Associates Inc., The Missner Group and Wylie Capital has acquired International Corporate Park, commonly known as the former American Hotel Register site, in the Chicago suburb of Vernon Hills. The venture paid $29.5 million for the site from an entity affiliated with American Hotel Register, according to Crain’s Chicago Business. Originally developed in 1996, the 70-acre site features a 257,927-square-foot warehouse, which will remain in the redevelopment, and a five-story, 202,000-square-foot office building, which will be demolished. Plans call for more than 900,000 square feet of new industrial space in up to four buildings. Redevelopment of the site is anticipated to begin later this year. The Missner Group will also serve as general contractor. American Hotel Register is a hospitality supplies distributor.

GRIMES, IOWA — Upland Real Estate Group has brokered the $1.8 million sale of an Arby’s-occupied property in Grimes, a northwest suburb of Des Moines. Arby’s has a 20-year triple net lease with 5 percent rent increases every five years. The tenant on the lease, DRM Inc., is one of the largest Arby’s franchisees and operates 109 Arby’s restaurants in seven Midwest states. Deborah Vanelli, Keith Sturm and Amanda Leathers of Upland represented the undisclosed seller.

AcquisitionsContent PartnerFeaturesLoansMidwestMultifamilyNAINortheastOfficeRetailSoutheastTexasWestern

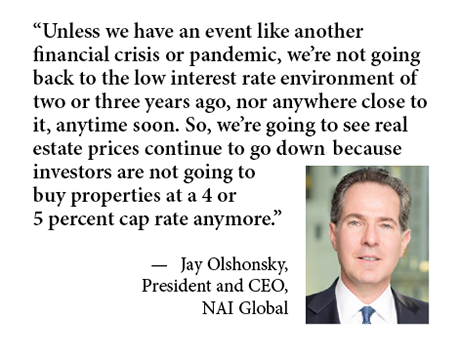

Previous Year’s Challenges Shape 2024 Outlook for Cap Rates, Investment Activity, Distressed Properties

If NAI Global president and CEO Jay Olshonsky had to use one word to sum up the 2023 commercial real estate market, it would be “inactive.” The interest rate-fueled bid-ask spread stifled investment sales of all property types, and in the office sector especially, tenants avoided making any space decisions if they didn’t have to. One month into 2024, not much has changed. From an investment sales perspective, Olshonsky still sees properties offered at capitalization rates between 4 and 5 percent while interest rates are 6 percent or higher, which is prolonging the disconnect between buyers and sellers. Meanwhile, robust job creation well beyond today’s levels is needed to create the leasing demand that will reverse the office sector’s troubles in the new era of hybrid work. But that’s not likely to happen in 2024 as the tech sector, in particular, continues to lay off workers. “I’ve been in the real estate business a long time, and this is a cycle unlike most others,” says Olshonsky. “The biggest problem we have right now is mainly record-high office vacancy just about everywhere — certainly in the large cities — which we’ve never really seen before. On the investment side, lenders cannot …