GLENWOOD SPRINGS, COLO. — NorthPeak Commercial Advisors has arranged the sale of a multifamily property located at 228 Auburn Ridge Lane in Glenwood Springs, a resort city approximately midway between Denver and the Utah border. The property traded for $8.2 million, or $171,875 per unit. The 30,376-square-foot asset features 48 apartments. Kevin Calame and Matt Lewallen of NorthPeak handled the transaction.

Acquisitions

NEW YORK CITY — The Joyce Theater Foundation has acquired a civic building located at 287 E. 10th St. in Manhattan’s East Village for $16 million. The seven-story, 58,000-square-foot building formerly housed a Boys & Girls Club facility, and the Joyce Theater plans to use the space for rehearsal, performance and administrative purposes. Paul Wolf of nonprofit advisory firm Denham Wolf Real Estate Services negotiated the sale of the building. The seller was not disclosed.

ROCKY HILL, CONN. — Locally based brokerage firm Chozick Realty has arranged the $11 million sale of Hillview Plaza, a 33,799-square-foot retail center located in Rocky Hill, roughly 10 miles south of Hartford. Tenants at the property, which was built in 1990 and was 97 percent leased at the time of sale, include Webster Bank, Salute Restaurant and Dunkin’. Tom Boyle and Jordan Pinto of Chozick Realty represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

SCHAUMBURG, ILL. — Entre Commercial Realty has brokered the sale of a 111,594-square-foot industrial building located at 933 Remington Road in the Chicago suburb of Schaumburg. The sales price was undisclosed. The property, which features modern office finishes, is located within the Woodfield Business Center. Dan Benassi, Dan Jones and Sam Deihs of Entre represented the seller, a private investor who wished to sell the building in advance of a pending lease expiration in early 2024. Phil Reiff of JLL represented the buyer, NBS Corp., which plans to relocate from its current facility in Elk Grove Village.

SIOUX FALLS AND BROOKINGS, S.D. — Upland Real Estate Group has arranged the sale of two properties net leased to Arby’s in South Dakota for an undisclosed price. The buildings are located in Sioux Falls and Brookings. Arby’s has 20-year leases with 5 percent rent increases every five years on both properties. The tenant on the leases, DRM Inc., is one of the largest Arby’s franchisees and operates 109 Arby’s locations in seven Midwest states. Deborah Vannelli, Keith Sturm and Amanda Leathers of Upland represented the undisclosed seller. Both properties sold to cash buyers completing 1031 exchanges.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has negotiated the $4.5 million sale of a 39,130-square-foot multifamily development site in the Bedford Park area of The Bronx. The site at 3165 Villa Ave. is approved for up to 57 units of residential development. Victor Sozio, Benjamin Vago, Daniel Mahfar and Jason Gold of Ariel Property Advisors brokered the deal. The buyer and seller were not disclosed.

Blackstone Acquires 20 Percent Stake in $16.8B FDIC-Run Signature Bridge Bank Portfolio

by Jeff Shaw

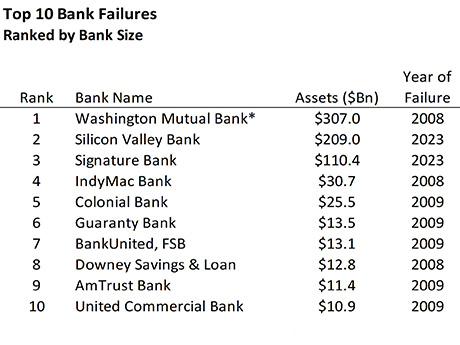

WASHINGTON, D.C. — The Federal Deposit Insurance Corp. (FDIC), as receiver of Signature Bridge Bank, has sold 20 percent of its equity stake in the defunct bank. The agency received the loan portfolio after the failure of Signature Bank in March. Hancock JV Bidco L.L.C. (Hancock), an entity indirectly controlled by Blackstone Inc. and other investors, paid $1.2 billion for a 20 percent equity interest. The portfolio consists of approximately $16.8 billion in commercial real estate loans collateralized by office, retail and market-rate multifamily assets. FDIC will retain an 80 percent equity interest in the venture. Hancock will be responsible for the management, servicing and liquidation of the venture’s assets. The entity will also be required to manage the portfolio in accordance with the terms of the transaction, subject to monitoring and oversight by FDIC. The New York State Department of Financial Services (DFS) took possession of Signature Bank on March 12. The bank failed after depositors withdrew substantial amounts of money in the wake of the collapse of Silicon Valley Bank on March 10. DFS named FDIC as receiver, and FDIC in turn transferred all deposits of Signature Bank to a new entity called Signature Bridge Bank. The bridge bank …

TSB Realty Arranges Sale of 804-Bed Student Housing Community Near Northern Arizona University in Flagstaff

by Amy Works

FLAGSTAFF, ARIZ. — TSB Realty has arranged the sale of Elara at The Sawmill, an 804-bed student housing community located near the Northern Arizona University campus in Flagstaff. TSB represented the seller, a partnership between McGrath Real Estate Partners and Kayne Anderson Real Estate, in the disposition of the property to an undisclosed buyer. TSB Capital Advisors consulted on the buyer’s joint venture partnership and secured acquisition financing for the transaction. Built in 2022, the community offers studio through four-bedroom units. Shared amenities include a resort-style swimming pool, jumbotron, grilling pavilion, fitness center, private and group study lounges, a pet wash station and an outdoor bouldering rock. “We’re proud to get this deal over the finish line before the end of the year, especially in the current market environment,” says Timothy Bradley, a principal with TSB Realty and founder of TSB Capital Advisors. “As the newest purpose-built property in a very high-barrier-to-entry market, with a top-of-the-line amenities package, 99 percent occupancy and impressive rent growth, Elara is an excellent addition to the buyer’s portfolio.”

SANTA ANA, CALIF. — Tabani Group has acquired Bristol Marketplace, a retail property located at 1351 W. 17th St. in the Orange County city of Santa Ana. An undisclosed seller sold the asset for $16.7 million. The 107,687-square-foot plaza comprises a two-story, 99,751-square-foot former Kohl’s and adjacent shop space. The buyer plans to reposition the vacant box space. Gleb Lvovich, Daniel Tyner, Geoff Tranchina and Conor Quinn of JLL Capital Markets Investment Sales Advisory represented the seller in the deal.

BELLEVUE, WASH. — Veritas Investments Los Angeles (VILA) has purchased Bellefield Major, a multifamily property located in downtown Bellevue, for $16.1 million. VILA plans to make cosmetic upgrades to the value-add property, which has already undergone extensive interior and exterior renovations over the past decade. Dan Chhan, Tim McKay, San Wayne and Matt Kemper of Cushman & Wakefield represented the seller, a local family investor, in the transaction. Located at 1830 108th Ave. SE, Bellefield Manor features 44 apartments and is situated within a half-mile of the new Sound Transit South Bellevue light rail station, which is slated to open in spring 2025.